Offer (From Asia?) A Third Better Than Dundee’s Bid

Now: A fresh and richer bidder’s offer for Osino’s Twin Hills, a vibrant gold project in central Namibia, is in, pushing Dundee DPM aside.[Osino press release here please.]

The offer, I believe, is from Asia, and most likely is an already Africa-active gold miner based in China. The new bid is one of what will be, I believe, a 2024-’25 rush of big-miner offers for small gold (and copper) developers trading below fair value.

See: the original $287 million offer in December 2023. See first The Calandra Report on the transaction. Please see close of this report for my maxi-mini nominees. *Also: Uranium lull or opportunity?

The mining engineer in Namibia said, “It is a pity the market was so weak the past few years. In a different market our share price would have been double. But I think shareholders will do better with Dundee DPM shares than with Osino shares, and we have to recognize that whether we like it or not.”

A telling remark here from Heye: “I have always said it, that the Canadian equity market is so momentum driven and chases every next-best-thing and does not know how to figure proper fundamental value. Anyhow, now onto new horizons, after a bit of a break.”

Well, no break yet for Heye Daun.

Maxi-mini bids: The Calandra Report

My own candidates for opportunistic bids in the coming year?

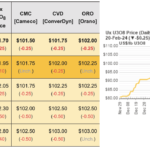

- Vista Gold (developer of an Australia gold project — VGZ on NYSE; I do not on the shares.

- Banyan Gold BYN BYAGF — Yukon and yes, I own the shares and look to purchase more this month.

- Western Copper & Gold WRN in Yukon; yes, I own shares.

- West Vault Mining WVM WVMDF in Nevada.

- Xtra-Gold XTG XTGRF in Ghana; I own shares.

- Anglogold Ashanti-backed G2 GoldfieldsGTWO GUYGF in Guyana; I do not own shares.

- Arizona Sonoran Copper ASCU ASCUF; I do not own shares. ASCU is just in with a cost study of its flagship project near Casa Grande, Arizona, Cactus — a proposed heap-leach mine with a 21-year-mine life, according to the study.

Uranium shares are (finally)

trimming their gains.

‘Shake The Tree’ For Uranium

Latest summary from tracking service UxC:

- Last week, spot activity slowed considerably as some buyers retreated from the market and others remained on the sidelines with only three reported spot transactions.

- With buying interest once again backing off, sellers have further revised offer prices down, and the spot price has slipped nearly every day since last Monday.

Our trusted uranium execs:

Marc Henderson at Laramide Resources LAM, which is developing properties in New Mexico, in Utah and in Australia: “Classic shake the tree correction after a little too much retail enthusiasm.” That includes financial broadcasters proclaiming their support (or hype), Marc notes.

Marc says Aussie retail “probably owned lots of lithium and nickel names and now the EV dream weavers in government everywhere are scrambling as their modeled demand turns to dust. It’s front page news Down Under — as BHP might mothball battery metal nickel altogether.”

“Near term market tightness in uranium is a reality though and cannot be wished away. Long term demand is also rock solid based on existing commitments to build new reactors and replace existing capacity, so the sector should be fine and should perform well in a more growth challenged environment– which is where we seem to be now macro-wise.” — Marc Henderson

Laraide just issued promising drill results for its Westmoreland tract in Australia. See project here please.

“The fundamentals are still very much in place and strong as ever,” says Jordan Trimble of Skyharbour Resources SYH SYBHF. “We have seen these pullbacks before and they have always proved to be good buy opportunities.”

Daniel Major of GoviEx Uranium: “This is just consolidation of the price — with rapid increase of the U price since August last year the industry needed time to consider its position.”

“The fundamentals are still very positive and the equities have not even priced the uranium price move to date or anything close to it.”

I own each of these and Nuclear Fuels NF NFUNF; enCore Energy EU.

See previous ursnium coverage please at The Calandra Report.

— Thom Calandra

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.