Kenorland Minerals one of several mini-maxi transactions

Also cited here: Vista Gold; AMEX Exploration; Eldorado Gold; McEwen Mining; Seabridge Gold; Inomin Mines*

Canada’s Kenorland Minerals shares this week notched a 20% gain in a picky, even swampish market for mining stocks.

So far, the gain and the thickest turnover of shares in 2 months for Kenorland KLD KLDCF shares is holding.

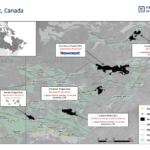

The gain comes after Kenorland swapped working interest in a Québec gold camp for a 4% royalty (net-smelter return) from now full-owner Sumitomo Metal. Details here please for Frotet Project agreement.

Is validation, a parking lot term used by mining CEOs, coming for Kenorland and dozens of other sub-$100 million mining wanna-bes? The ones, that is, forging maxi-ties to big names?

Rob McEwen of mid-tier copper-gold miner-developer McEwen Mining MUX, in, an interview, tells me this week, “The majors are reaching down into the juniors slowly. People should be buying there are bargain prices. When MUX was dragging along the floor (2012-2016), we were approached by a couple of majors.”

Yes, the top-tier miners that smell “bargain” ounces of any metal for their companies, Rob pointed out, though he need not have. [More of the Rob McEwen interview coming soon re: Argentina’s new anarchistic capitalist president; McEwen Mining‘s copper unit (Argentina’s Los Azules; Nevada) that eventually will go public as a standalone stock called McEwen Copper with approx. $400 million in the bank, at last look.]

TCRs, I see early signs of life for long-suffering, obscure explorers and passed-over precious metal (and copper) developers. Kenorland stock data here please.

More: another royalty-linked stock move, Vista Gold‘s VGZ $20 million stock-boosting agreement with Wheaton Australia, propelled volume and stock price markedly when unveiled in mid-December. Vista Gold stock data here please.

Still, Kenorland with $23 million in the bank, and some $4 million of securities, trades at a multiple of less than 2x the cash.

Vista Gold, with a guaranteed $20 million from Wheaton this year and a 9.4 million-ounce gold resource at Mt. Todd in Australia, sells for a little more than twice that.

“Minority interest in a joint venture is very tricky. We would have been required to keep up our spend of 20% of the budget while project expenditures ramp up significantly and as the minority (to Sumitomo), you are never really in control of the budgets and timeline. Exit strategy is also limited,” says Zach, with whom I have been exchanging material for approx. 7 years, even pre-Kenorland.

“With a royalty, we now have no further funding obligations and much more flexibility on how and when to monetize. Ultimately, we are exposed to a % of the total value of gold that comes out of the ground, regardless of underlying economics of any mining operation.”

Zach, who is 38, sees a “large value gap” between royalties on orphaned projects and royalties on assets that are producing or have real potential of becoming a mine.

“The real ones will command a huge premium, especially large royalties that are 2% to 3% NSR or greater, and even more so if the underlying asset is controlled by a major mining company.”

TCRs, a point to make here: I am ready to start stockpiling small companies that are getting attention from large miners. We saw the Alamos Gold-Orford Mining transaction this week; we saw the Dundee Precious Metals-Osino Resources one several weeks ago. Yes, the prices of the mini part of those mini-maxi equations are far less than they would be in a more appetizing market for unproven wanna-bes.

Yet regarding royalties, streams and outright corporate takeovers, and strategic stakes, such as $2.5 billion Eldorado Gold‘s ELD EGO $15 million CAD, or 9.9%, into Québec’s $100 million AMEX Exploration AMX AMXEF just this week, and as AMEX’s Victor Cantore in Montréal reminds me, these parking lot validations are starting to sway investors.

It is again this mini-maxi dynamic; see earlier The Calandra Report here please.

Fred Earnest of Vista Gold and I have been discussing the Mt. Todd project for 2 1/2 years now. We talked again today-Wednesday.

I do not own the shares, which amount to the thinnest market-cap of any miner-wanna-be we track here at The Calandra Report — $2.2 million.

Inomin calls Beaver-Lynx a critical minerals project. John just staked more ground. See details please.

The dig is 8 km west of Taseko’s TKO TGB copper-moly Gibraltar porphyry and mine — producing likely until 2044.

John Gomez, by the by, pores headlines and releases of large, low-grade nickel projects with “carbon-capture” features. Inomin’s feeds — see here please — are brief and real time about the business of “deals,” metals accumulation, electric vehicle and battery metrics.

Battery maker Samsung SDI this month, for one, invested in Canada Nickel. Other Canadian nickel project link-ups include Sumitomo Metal Mining, Agnico Eagle AEM and Mitsubishi Corp. “Low-grade nickel projects continue to attract major investment,:” he says.

John emphasizes, insists that Beaver-Lynx has similar Ni grades to these more advanced projects. “Of course our project has the benefit of 20% and better magnesium, which is considerably more valuable than the nickel.”

I leave it with you, TCRs.

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.