The January post-tax-selling metals equities rebound is happening early to select explorers and developers.

Witness: 35% and greater gains in two weeks for the hardest of the hard-hit, including Banyan Gold BYN BYAGF (a takeout candidate — see earlier reports please; Western Copper & Gold WRN; Group Eleven Resources ZNG GRLVF; and fledgling uranium prospector Nuclear Fuels NF (see below); Denarius Metals DSLV; two or three others in the The Calandra Report fold. Winners this December 2023.

In here: Developer Stocks Activated

Platinum Shipping: Saudi Arabia

Also: Ghana Gold

A Lithium Note

Alas, sigh, nothing doing, yet, with shares of Azimut Exploration AZM AZMTF, nor Orford Mining ORM ORMFF, nor Ridgeline Minerals RDG RDGMF, nor Contango Ore CTGO; nor Val-d’Or Mining VZZ VDOMF; nor Western Alaska Minerals WAM WAMFF. Nor Summa Silver SSVR SSVRF.

Nor Maple Gold Mines MGM MGMLF; perspective from new CEO Kiran Patankar about developments at the Québec gold project developer coming soon. Those non-winners are suffering share wise from a combination of investor fatigue, year-end tax-linked selling with a week to go … and possible short selling.

Allow me to be casual — as this is probably the last report you will receive before the winter (Christmas, etc.) holiday. (Buon Natale, all of you.)

As a sliding USD improves a vibrant gold (silver, platinum, copper, oil, etc.) price, the outtakes below are just in from principals of Newcore Gold, Platinum Group Metals, Xtra-Gold and Osino Resources.

Platinum Group Metals’ PTM PLG parlay with a Saudi Arabia metals smelter looks noteworthy. See news please.

I just bought Platinum Group Metals shares for the first time (not counting a May 2023 miniscule and profitable foray into the stock) since viewing 7 years ago the Waterberg Project, for a second time with Frank Hallam, now CEO, and previous CEO R. Michael Jones. I also own Aberdeen Platinum Trust PPLT, a metal, along with zinc, and copper, that is beyond most reason depressed and ready for better prices.

Non sequitur, sort of, the per-pound copper price looks to be benefiting from the firming belief, after a decade of hopes, that the world in coming years will bear much higher prices for the industrial (and I believe, precious for growth) metal from far fewer active mines.

Copper’s continuous contract at $3.91 a pound is getting the attention of multibillion-dollar investment fund managers, several news agencies, analysts and trade groups report. See price here please. [Copper producer Ivanhoe Mines in Africa, its IVN IVPAF shares approaching an all-time high, is our largest resources holding here at home.)

They all are from Africa, figure that, and all — excepting $287 million Osino Resources takeover by Dundee Precious Metals — are poised for what the trade calls stock re-ratings.

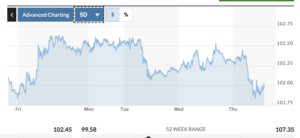

The dollar, a reverse denominating (sic) factor in most commodity prices, is on a 5-day slide vs. the global DXY currency basket. Cheaper dollar over time improves the value of dollar-denominated metals and other commodities.

Also, see a technical read on USD here — 2-year chart at left.

Platinum Group Metals

I pinged CEO Frank Hallam today about the Saudi smelter discussion he’s been having — and a so-called tradeoff study of possible energy savings that PLG PTM might benefit from if it were to ship to an offtake partner with a metals processor in Saudi Arabia.

Remember, South Africa, where Waterberg Platinum Project is located, is notorious for power outages, choppy prices, energy theft and so on.

“Ignoring all other factors, the cheaper energy and water costs in Saudi Arabia substantially offset the additional shipping costs,” Frank tells me. “So, if all else remained the same, you would be indifferent to process in RSA (South Africa) vs. Saudi Arabia. However, if you factor in financial, tax, infrastructure and other incentives, there becomes a compelling case for processing in Saudi Arabia.”

Frank says he has been working on this for a year; I know that because I track his Heathrow-Jo’burg flights — at least three in the past five months.

“We and Ajlan (the Waudi group) have both completed due diligence trips and studies. Our initial thoughts were that the shipping and handling costs would kill the concept. Once we and our external engineers studied the facts, including shipping, power and water rates in Saudi Arabia, we learned that the cost for power is about 33% of what it is in RSA. Water from desalination is also available at cheap rates. There are of course other issues to consider. The financial, tax and logistical incentives in Saudi Arabia also (look) favorable.”

Xtra-Gold Resources

As reported this week, my Ghana gold project developer, self-financed Xtra-Gold XTG XTGRF looks to be on the threshold of a groundbreaking Boomerang ‘deep’ (400 meters) zone shoot — “one that might not pinch out,” CEO James Longshore tells me.

Jim, with whom I spent 5 days at Precious Metals Summit in Zürich, is shooting for selling his company in the next two years, but not unless he gets $100 an ounce for the gold in the ground. “We think to get that kind of price, we need to show that the Kibi (Gold Belt) that we control has at least 2 million ounces, and any producer will figure on extended life of mine and maybe twice that number.”

A shoot, by the way, that does not “pinch out” can add a half-million or more ounces to a deposit.

My tempered opinion, after owning XTG and seeing Kibi 5 times since 2009: a mid-tier will purchase the entire kit-and-kaboodle when the resource, currently about 830,000 ounces, surpasses 1.6 million ounces — and perhaps pay a price of $80 an ounce. That is 4.5 times the current market value for the entirely self-financed, alluvial-income Xtra-Gold.

See XTG assays release please.

James Longshore also is country manager and founder-major shareholder; Jim in rural Ontario is forgoing a three-week holiday break to return to Ghana right after Jan. 1, 2024. See our The Calandra Report/TCR about this from earlier this week please.

The Boomerang Deep ‘headline hole’ just reported is 9 meters at 9.29 grams per metric ton gold — a cross-plunge of the lower main shoot. “How big this can get? We only have 1 drill hole in Boomerang Deep, so too early to tell the shape yet but it was 9 meters thick so that is positive. I believe the structure will hold, but the question is what will future drill grades be as we step out? I have no idea.”

At this price, I say, perhaps recklessly, XTG XTGRF as a genuine gold mine developer is a gift at $44 million USD, and with a $28 million enterprise value. (Xtra-Gold sells alluvial gold from Kibi each month and books $2 million to $3 million a year in profits, and has for a decade. So, plenty of cash, about $11 million USD right now.)

See our Developer List below please.

Newcore Gold

The other Ghana developer I track (and today-Thursday Dec. 21, 2023, I re-purchased my profitably sold shares from the autumn) is Luke Alexander & Doug Forster‘s Newcore Gold NCAU NCAUF.

Luke tells me today that lots of Africa wanna-be gold producers are scanning the Osino-Dundee transaction.

“There is a lot of room for Newcore to rerate from current valuation of $8-oz to the $75-oz Osino Resources take-out valuation. We are looking to start closing the gap as we put out our updated PEA sometime next year and continue to de-risk the project to a construction decision.” [I just today-Thursday Dec. 21, 2023, bought back my Newcore shares, sold several weeks ago profitably.]

I own most of these companies’ shares, but not Denarius Metals and not Ashanti Goldfields.

Developer Candidates

Other developers, genuine ones, that are in our The Calandra Report fold: Western Copper & Gold WRN in Yukon (just bought more); West Vault Mining WVM WVMDF in Nevada; Xtra-Gold XTG XTGRF in Ghana (just bought more); Newcore Gold NCAU in Ghana; Banyan Gold BYN BYGAF in Yukon; Anglogold Ashanti-backed G2 Goldfields GTWO GUYGF in Guyana (I have not purchased it yet; shares up neatly in wake of Anglogold Ashanti investment.)

Keeping An Eye On: Banyan Gold BYN (Yukon) — shares were depressed and now are rising 35% in 2 weeks.

Keeping An Eye On: Contango Ore CTGO (Alaska) — NYSE-AMEX shares all over the place, mostly down, and appears to be a bloodsucking arbitrage related to convertible securities; CEO Rick Van Nieuwenhuyse tells me today my guess is as good as his — “but at least no one can complain about liquidity.” I purchased more CTGO earlier in the week

Note: Too good to pass up, I sold approx 20% of my Nuclear Fuels NF stake for a hefty two-month profit. NF is uranium exploration in Wyoming’s Powder River Basin. Thank yiu, Michael Collins and Bill and Janet Sheriff.

Osino Resources

Heye Daun shares a thought about his just-sold Osino Resources (closing of the Dundee Precious Metals purchase will come by February — with half Dundee shares and half cash, thus upside, as they call it, for Osino shareholders, including us here at home.)

The CEO and mining engineer in Namibia says, “It is a pity the market was so weak the past few years. In a different market our share price would have been double. But I think shareholders will do better with Dundee DPM shares than with Osino shares, and we have to recognize that whether we like it or not.”

A telling remark here from Heye today to me: “I have always said it, that Canadian equity market is so momentum driven and chases every next-best-thing and does not know how to figure proper fundamental value. Anyhow, now onto new horizons, after a bit of a break.”

Lithium: The craze of 2023, 2022 and 2021 — lithium concentrate prices catapulting, plateauing, sliding and recovering — looks set to continue. Many companies are still going public, raising money or flat out exploring for the world’s most common in the ground element.

Nevada, Chile, Argentina, Bolivia lead what U.S. geological stats show as approx. 100 million metric tons of documented lithium resources worldwide — some 55% or so in the “lithium triangle” of Bolivia, Chile and Argentina. Tough to keep track of them all, and my only lithium holdings are in Québec via gold and nickel explorers Azimut Exploration and Orford Mining.

Still, the $30 million market caps of some of the newbies are worth a scan. Gabriel Rubacha in Argentina dialed in with his NOA Lithium Brines’ work in the southern hemisphere. NOAL shares in Canada have been trading since March 2023. NOA’s “triangle” projects are in the mining province of Salta.

The flagship project is called Rio Grande. Drilling in brine targets are showing what the industry calls lithium-brine-saturated units starting st 3 meters and down to approx. 500 meters. Let’s see what happens when drilling assays arrive in the next two or three weeks. I do not own NOA shares.

— Thom Calandra

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.