This week: Uranium shares

are trimming their

outsized gains. Latest spot

price: $95 a pound. See graf.

At $95 Spot, Buyers Will Look To Engage Again

[TCRs, trading notes, Baselode Energy and Energy Fuels* tags & commentary added.]

A summary from tracking service UxC:

- Spot activity slowed considerably as some buyers retreated from the market and others remained on the sidelines with only three reported spot transactions.

- With buying interest once again backing off, sellers have further revised offer prices down, and the spot price has slipped.

This from a trading house via GoviEx Uranium’s Daniel Major (in U.K.):

Transactional activity in the spot uranium market remained slow this week with market participants in the USA and Canada both observing holidays early in the week. The holidays, combined with higher-than-expected inflation news released by the U.S. Bureau of Labor Statistics last week, set the stage for a market noticeably absent of engaged spot market buyers.

TCRs, I am adding again to the U-stack here at home. Short-handed utilities and other uranium users were hard pressed to find supplies in November, December and January. They will be back bidding.

(As always, that does not mean you should be. I add to existing nat-resources stakes when prices drop, not gain.)

I am looking at purchasing Saskatchewan explorer Baselode Energy FIND BSEMF for the first time. See previous Baselode coverage from The Calandra Report.

Of my five U-holdings, I believe the least speculative are enCore Energy EU, a Texas producer; and Laramide Resources LAM LMXRF a New Mexico, Utah and Australia developer. In the mostly exclusive slot of actual emerging producers with profits, please see Energy Fuels EFR UUUU note * below.

Please see Uranium’s Runaway Flight Path— which lists my uranium ownership (five companies) at present.

Our trusted uranium execs are on the same page: they say they see U-turns every up-cycle since 2007.

*Uranium stocks reversed sharply and turned higher with two hours of North America trade remaining Wednesday, Feb. 21, 2024. I added to enCore Energy EU shares. See below please.

Two days later, spot-U’s price fell to $95 a pound, dinging most uranium stocks, including Energy Fuels UUUU EFR * and its near-$100 million profit report Friday Feb. 23, 2024.

(Producer Energy Fuels UUUU EFR Friday reached the near-$100 million net income mark for 2023. -- The Calandra Report. *

Cory says uranium stocks, especially explorer-developers, easily could double to ‘catch up’ with the $100 uranium spot price. [None of the execs quoted here pay me a dime; I own their stocks with my own money.]

” It simply has to snap back and junior valuations will catch up to the +$100/lb U price and surpass with what could be exponential returns. It is crazy to think that most of us junior explorers, some with credible discoveries, are priced the same as when the spot U price was $70 (or less) per pound and the long-term market was in a similar state. Crazy.” — Cory Belyk, CanAlaska Uranium

Marc Henderson at Laramide Resources LAM, which is developing properties in New Mexico, in Utah and in Australia: “Classic shake the tree correction after a little too much retail enthusiasm.” That includes financial broadcasters proclaiming their support (or hype), Marc notes.

Marc says Aussie retail “probably owned lots of lithium and nickel names and now the EV dream weavers in government everywhere are scrambling as their modeled demand turns to dust. It’s front page news Down Under — as BHP might mothball battery metal nickel altogether.”

“Near term market tightness in uranium is a reality though and cannot be wished away. Long term demand is also rock solid based on existing commitments to build new reactors and replace existing capacity, so the sector should be fine and should perform well in a more growth challenged environment– which is where we seem to be now macro-wise.” — Marc Henderson, Laramide Resources

Laramide just issued promising drill results for its Westmoreland tract in Australia. See project here please.

“This is not a ski slope,” Marc says. “The demand fundamentals are still rock solid.”

“The fundamentals are still very much in place and strong as ever,” says Jordan Trimble of Skyharbour Resources SYH SYBHF. “We have seen these pullbacks before and they have always proved to be good buy opportunities.”

Daniel Major again of GoviEx Uranium: “This is just consolidation of the price — with rapid increase of the U price since August last year the industry needed time to consider its position.”

“The fundamentals are still very positive and the equities have not even priced the uranium price move to date or anything close to it.”

I own each of these and Wyoming explorer Nuclear Fuels NF NFUNF; and sister company, Texas producer enCore Energy EU.

Cory from CanAlaska: “Patience and selective buying now will be rewarded.”

See previous uranium coverage please at The Calandra Report.

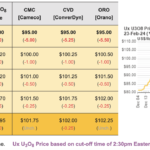

* Energy Fuels UUUU EFR gave us a rare mining profits upload this week, and a peek into contract prices from its Q4 year-end profit report:

During 2024, EFR expects to sell 200,000 to 300,000 pounds of U3O8 into its existing portfolio of long-term uranium contracts, of which 200,000 pounds were sold during Q1-2024 at a realized price of $75.13 per pound, which resulted in a gross profit of $38.29 per pound. UUUU EFR release here please.

“They are now a profitable company with a P-E ratio,” Bill Sheriff of enCore Energy and Nuclear Fuels says. “I know nobody expects or can relate to a mining company to having such things as a Price Earnings multiple, but not only do they have one but it is a good one on its own merits, even more stellar when compared to mining companies.”

— Thom Calandra

[Note — This week, as of Feb. 21, 2024, I added shares of CONTANGO ORE CTGO and BANYAN GOLD BYN BYAGF to multi-year existing stakes. I also bought more Ivanhoe Energy IE and Ivanhoe Mines IVN IVPAF. Also purchased more enCore Energy EU on Wednesday. I sold small stakes in Newcore Gold NCAU; in Val-d’Or Mining VZZ (and still own approx. 85,000 shares); and in Western Copper & Gold WRN.]

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.