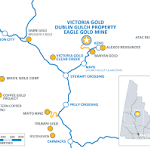

Victoria Gold Mines, Western Copper & Gold, Others U-turn For Fierce Gains

Friday update: Victoria Gold shares

were rebounding 9% after the Eagle

Gold Mine operator announced

a normal-course issuer

bid for 5% of its own shares.

Others, too. *

Victoria Gold VCGX VITFF shares this week are (or were) getting rumbled, perhaps unfairly, after its Q4 report.

In a rough-and-tumble-week for Victoria Gold, (and for many small to mid-sized gold, copper and select other miners), at conclusion Friday we saw shares bounce back vibrantly. (See GDXJ index please.)

Gold’s price regained the $2,050 level; copper’s price was flat, yet copper miners’ shares rose in some cases. (See: Western Copper & Gold‘s WRN 16% bounce-back for one. *)

The broad midday reversal, as a fund manager told me 30 minutes ago, looks like a wake-up call for sidelined investors. Will it last? is the query.

* WRN is putting Sandeep Singh, formerly of Osisko Gold Royalties, in the CEO slot. Paul West-Sells will remain as president. WRN, with backing from Rio Tinto and others, is on our The Calandra Report list of probable (maxi-mini) takeovers.

Maxi-mini list of candidate at close of report please.

As for Yukon’s Victoria Gold, the stock a day ago was at or below where the Eagle Gold Mine‘s execs were buying shares in the open market in 2023. I bought more Thursday at a 52-week low of $3.88 USD. Friday, the shares were up 9% at $4.26 USD.

VGCX VITFF shares still were below where they started the week.

[Below: Radisson Mining | Goldshore Resources]

Regarding Eagle Gold Mine, yes, there are worry flags.

Investors were expecting $50 to $80 lower than the low end of $1,450 to $1,650 an ounce all-in sustaining cost guidance. See financials here please.

Also, 2024 guidance of 165,000 to 185,000 ounces is lower than analysts’ consensus of 188,000 ounces for this year.

My reasons for further purchases are basic:

— I think production this year will come in at the high end toward 185,000 oz, thanks in part to greater stockpiling of ore, albeit lower-than-average-grade rock.

— I believe debt is under control; inflated AISC will ease slightly with lower fuel costs, as indicated in the conference call, and just maybe, more reasonable Yukon labor costs.

— The Brewery Creek mine and mill purchase last year will prove to be a boost to the company’s gold-ounce resource, but I do not know when.

— I always love when a company states on the record: ” Read our lips — ‘no new financings.’ ”

Other reasons, too.

From the VGCX Q4 update call:

CFO Marty Rendall in response to questions remarked, “We do want to pay back some debt. But once we get a little bit of debt paid back, there are other options with free cash flow, including buying back shares. And certainly, we’re not happy with our current share price, and we think they’re on sale. So it

seems like it might be a good time.”

CEO John McConnell added, “We did make a small acquisition last year of the (Yukon) Brewery Creek and Gold Dome assets, where we used $8.5 million in cash for those assets. So we’re open

to doing that. But our priority is to pay down debt, and we continue to look at acquisition opportunities in

the Yukon and throughout North America.”

Robert Sinn, an independent mining writer (Florida), accompanied me on one of my three tours of Eagle Gold Mine.

“The reality is that gold producers should be swimming in profits at $2,000 gold and they really aren’t. Victoria is doing OK, but they have definitely been placed in the penalty box. Remember when they were talking about 250,000 ounces of annual production as being possible? (Plan 200K I believe it was called.) Seems a long way away.”

I close this SEGMENT with Mark Ayranto, chief operating officer, who knows hands down Eagle’s leach pad, which sometimes requires repair, and the exploration at the Raven project nearby.

“Q2 and Q3 are certainly the quarters where we can really maximize area under leach, take opportunities, side slope leaching and do a few other things that allow us to get a lot more tonnes to the pad, typically and bring ounces forward.”

I hope this take does not sound hopeful and sunnyside-up. It is just that there are slim pickings for relatively new gold mines in Canada. This one, VGCX and VITFF, demonstrates shares that outpace the pack during up and down spans.

The ‘leaper-VGCX VITFF charting we saw and heard in a Florian Grummes technical analysis in Zürich in November. (Superstar producer Alamos Gold AGI also is in that thick percentage ups-and-downs slot.) See that The Calandra Report please here.

This is a down span, and that is when I make most of my purchases. Trying to catch the falling blade, is how the cliché goes.

Plus, macro-wise, well, I believe the gold price will pace higher this year into 2026. That is a cash-flow ‘bump.’ A good one.

Switching CEO Posts: A Blunt Explainer

Brett Richards is dropping his role as CEO at Goldshore Resources GSHR (Ontario) and taking the slot at Radisson Mining (Québec’s Cadillac Break). See release here please.

Brett had some rough going in 2023 at Goldshore after a draft of a Moss Lake resource report (43-101) looked to have some explicit directions to its independent engineers from Goldshore. A version became public in what he told me was “a cluster mess.”

The stock got clocked: May-June 2023. I owned GSHR briefly, well before that storm, and made a small profit after meeting Brett at the New Orleans conference.

(I happen to think Radisson’s O’Brien Mine project, high grade and underground, needs a further string of high-grade, shallow hits to convince investors RDS RMRDF deserves to be trading at twice its price. That will take another half-year. A Radisson assay article here.)

I do not own RDS shares. A couple of the shareholders, Eric Sprott and Michel Gentile, both Canadians, were moving mining stocks with their choices in 2022 and part of 2023.

The follow-on effect has all but evaporated for most mining stocks.

Radisson, meantime, is at the extreme high end of gold grades in the Abitibi Greenstone Belt.

The old O’Brien mine is said to have been the highest-grade gold producer at 15.25 grams a metric ton for 587,121 ounces through 1957 from the mid-20s. The current cut-off grade for the 10.2-gram-average modern resource (here — 500,000 ounces indicated slot) is 4.5 grams a metric ton.

I asked him why the switch to Radisson?

“Look, we (GSHR GSHRF) are trading at less than $4 oz and it costs us $10-$15/oz discovery cost, so why invest $15 to get $4 in return? Makes no sense.”

He continues, ” Goldshore has a $25 million market cap and needs a $75 million one to even consider raising funds for drilling.”

Brett is blunt without being rude to his investors, in my own experience — but he seems to wear the truth on his open-collar work-vest.

Brett Richards, with about 30 years of capital markets experience running mining companies, 14 of them, we understand, admits, “There is not much I can do to help the story but continue to be its ambassador.”

One independent analyst, Eric Lemieux in Québec, notes a Goldshore PEA stutter some time ago.

“No degree of advertising / marketing / letter writing / influencer content / speaking engagements or conference attending will make any difference in this market. It just burns through capital.”

“The problem in junior mining is structural in nature and it going to take a geo-political or macro-economic event to change it for pools of capital to return to natural resources.”

Neither Brett nor Radisson nor anyone else pays me to air their views. His is blunt.

“I am Goldshore’s 4th largest shareholder – controlling 9 million shares – and we wait for the gold run we are all expecting.”

As for Radisson RDS RMRDF, which I have tracked for 7 years now but do not own, Brett notes,

“I am excited to help (chairman, interim CEO) Denis LaChance and move O’Brien up the food chain towards cash flow visibility. Grade is top decile in the space, and there are very few projects that are this special. It might not have the size of GSHR at Moss Lake, but Radisson makes up for it in grade.”

Please see the latest uranium reasoning this week. (Producer Energy Fuels UUUU EFR Friday reached the near-$100 million net income mark for 2023. -- The Calandra Report.

Our maxi-mini candidates (big miners buying smaller ones):

- Vista Gold (developer of an Australia gold project — VGZ on NYSE; I do not on the shares.

- Banyan Gold BYN BYAGF — Yukon and yes, I own the shares and look to purchase more this month.

- Western Copper & Gold WRN in Yukon; yes, I own shares.

- West Vault Mining WVM WVMDF in Nevada.

- Xtra-Gold XTG XTGRF in Ghana; I own shares.

- Anglogold Ashanti-backed G2 Goldfields GTWO GUYGF in Guyana; I do not own shares.

- Arizona Sonoran Copper ASCU ASCUF; I do not own shares. ASCU is just out with its Cactus copper project’s economics, scale, cap-ex projections — 110 million pounds copper cathode yearly over 21 years yet a 6.8-year payback. See report please.

— Thom Calandra

PayPal $179 Yearly: Recurring The Calandra Report

PayPal $229 Yearly Non-Recurring The Calandra Report

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.