GoviEx Uranium | Osino Score! | Laramide In Australia | Red Sea Attacks

“When the goddess of wealth comes to give you her blessing, you should not leave the room to wash your face.” — Hindu proverb

Expeditions that begin poorly often end well. — Said of fishing trips and bullion markets.

TCRs, Osino Resources just got bought out -- by Dundee Precious Metals.

Heye Daun's Osino OSI OSIIF is developing Twin Hills, a Namibia gold project.

"Are you happy as a shareholder?" the CEO-mining engineer asks me

today-Monday Dec. 18, 2023. [We have owned OSI for three years.]

Well, yes, I am. This is s $287 million CAD transaction, Dundee cash and shares.

See release here please. Also, see Sept. 26, 2023, The Calandra Report/TCR,

when Heye told us st Beaver Creek Precious Metals Summit, "For M&A to move up,

the whole market needs to move up." The gold price this winter appears to be doing that.

Heye has spent at least the past three years "de-rtisking" Twin Hills. He appears

to have hit a hot spot with genuine project developers being snagged by larger companies.

Dundee Precious Metals ($1.8 billion msrket value) operates a "complex copper

concentrate smelter in Namibia. -- Thom

TCRs, Yemen rebels, the Houthis, have been attacking Red Sea lane shippers this month. Friday, shares of maritime crude oil and liquid nat-gas carriers mostly rose 5 % to 7% — DHT Maritime Holdings DHT 7%. The largest so-called very-large crude carriers, VLCCs, include Teekay Corp., Euronav NV, Scorpio Tankers, Frontline Ltd. and DHT. The attacks probably will boost spot leasing rates, which are very volatile these days. Oil prices also gained as word spread of the attacks. Five shippers say they have stopped using the Red Sea.

Here is an update from The Guardian in London, worth a read: https://www.theguardian.com/world/2023/dec/17/us-to-announce-expanded-protection-force-for-red-sea-shipping. We own DHT shares and have for more than a year.

- I bought shares of GoviEx Uranium (Africa developer) for a second time in 7 years. Daniel Major, whom I have known since 2017, told me the other day the Niger military mess caught GXU unawares. The July 2023 coup pared GoviEx’s already slipping market value. “The day of the coup, we were looking at $250 million of western governments’ debt for the project out of a probable $360 million. So we had to hit the pause button.”

- Niger is good for 25% of Europe‘s uranium supplies, and so far, no interruptions there in producing mines. As for GXU’s Madaouela development there, project grooming continues, the CEO says. Mad-U, as I call it, holds something like 115 million pounds of the nuclear fuel, according to engineering studies.I think GXU GVXXF is a gift stock at a depressed (and depressing) price — market value $115 million USD, this in a three-year “up” cycle for uranium. Daniel says the country” is literally bankrupt … it is just a mess, it needs tax revenues and ECOWAS (western African coalition) needs to continue its strangulation (sanctions), otherwise we will see Mali and Burkina Faso deterioration.”

- Yemen rebels, the Houthis, have been attacking Red Sea lane shippers this month. Friday, shares of maritime crude oil and liquid nat-gas carriers mostly rose 5 % to 7% — DHT Maritime Holdings DHT 7%. The largest so-called very-large crude carriers, VLCCs, include Teekay Corp., Euronav NV, Scorpio Tankers, Frontline Ltd. and DHT. The attacks probably will boost spot leasing rates, which are very volatile these days. Oil prices also gained as word spread of the attacks. Five shippers say they have stopped using the Red Sea.

- Here is a just published update from The Guardian in London, worth a read: https://www.theguardian.com/world/2023/dec/17/us-to-announce-expanded-protection-force-for-red-sea-shipping. We own DHT shares and have for more than a year.

- Royalty books: We are seeing small roy-cos publish their asset books, detailing their NSRs, streams and other revenue and possible revenue sources. I think Vox Royalty VOXR was one of the first last year with its book. Elemental-Altus just put out its first — with 80 royalties or revenue streams. Frederick Bell at Altus-Elemental in London tells me, “In the sub-$1 billion category it is only ourselves, GROY (Gold Royalty) and VOX. The majors and mid-tiers do it with the exception of Deterra Royalties.” (Deterra, an Aussie $2.5 billion company, sports a list of its royalties/net smelter returns here.) Good to see these, as even small roy-cos have upwards of 100 or more properties from which they look to reap revenue on metals production.

GoviEx’s Uranium Projects I own shares of EMX Royalty EMX, which has a l-o-o-n-g list of properties, so long, it takes a half-minute to scroll down the list. See listhere please. I just bought back into Elemental-Altus ELE ELEMF — one that also trades in London. Elemental-Altus is a London enterprise with broad holdings, royalties in northern Africa, Morocco and Egypt.

I also own Val-d’Or Mining VZZ VDOMF, not a roy-co in its published portfolio but soon, I believe, to be valued by its numerous concessions, claims and partnered projects across Québec and Ontario. TCRs, this week I sold 15% of my VZZ to show a tax loss that can be applied to capital gains for 2023.

As for what they call organically spawned projects that can spawn royalties, re: EMX, VZZ and ELE, I could say the same about sprawling predictive modeler Azimut Exploration AZM AZMTF, whose shares I own, albeit unprofitably, for four years.

- As for other buys and sales, I have been adding to Banyan Gold BYN at depressed prices; also Victoria Gold VGCX — both of those in Yukon. Ditto, Contango Ore CTGO, next door in Alaska — its shares possibly manipulated by short-sellers or convertible investors late this past week.

- I bought back my Laramide Resources LAM after solid short-term profits (uranium). Marc Henderson, just back from Australia, where his LAM has one of its two uranium projects, pointed me to a new report. “Canaccord out earlier this week with a research note on prospects for change in Australia, which the world now really needs as a reliable uranium supplier to western utilities.” Ping me for the report please, TCRs.

- I bought yet more Western Copper & Gold WRN. I sold my Newcore Gold (Ghana) NCAU NCAUF at a small profit, and given my 14-year affair with Ghana’s Xtra-Gold Resources XTG XTGRF, which I own profitably most of that time, I have a buy order in on NCAU to get back in before year’s end. See please: Fresh and candid video Zürich interview: XTG’s James Longshore & Commodity-TV‘s Jochen Staiger.

- AS ALWAYS, I have been adding to an 81,000-share pile of long-held Africa developer, explorer and the fourth largest copper producer worldwide, Ivanhoe Mines IVN IVPAF.

- I am trying to purchase more Wyoming uranium-seekerNuclear Fuels NF NFUNF, not an easy task. I am torn about venturing into that wanna-be media/mining-co/promotive publisher, EarthLabs SPOT SPOFF — Kit Spring, a Colorado fund manager (Bonanza King Capital), also is torn but says that at half its net asset value, with cash and shares, SPOT is too attractive to ignore for a trade.Previously at The Calandra Report/TCR

Charting metals stocks: tonbo, I understand, is short in Japanese for chartists’ Dragonfly Doji, or hammer.

a sharp down day with a closing at the high. Thus, a promise of better prices to come for stocks such as Hecla Mining HL (above).

The full-steam-ahead dragonfly is known as the victory insect in Japan. It is a hunter that does not retreat.

Our Las Vegas chartist Al Marden this week was hopeful that central bankers’ interest rate musings would bring about a reversal of long-suffering stocks of gold and silver miners. Al was spot on.

Gold futures contract seen here. PLEASE VISIT OR REVISIT THE DRAGONFLY DOJI REPORT: A Foreshadowing

The so-called GDX and GDXJ stocks are hit hard by the fluctuating gold price, year-end tax selling this miserable miner stock 2023 and the perpetual strength of USD. Also, the attraction of blue-chip stocks, among other distractions, hurts what is known as the materials segment of publicly traded miners.

There is hope? Well, yes. The central banker Jerome Powell spoke this week after the U.S. central bank’s final 2023 meeting about all of the things the money-watchers track: interest rates, U.S. borrowing, inflation and jobs. [FYI: Gold, continuous futures contract, is rising $48 an ounce after the Federal Reserve kept interest rates, the Federal Funds Rate, steady. See: press conference.]

“Many/most of the precious metals miners have/or almost have made bottoms, so if what Powell says on Wednesday is friendly, we move up,” Al says. This occurred, TCRs.

Still, it is a gol-dang shame that metals and other intrepid investors have to sit at their seats’ edge, eyeing interest rates, bond yields and central bankers’ minutes and meetings and their balance sheet borrowing/machinations. One day, metals prices (and energy) will exchange hands with demand, supply-driven values. (As with globally SHORT-SUPPLY uranium prices right now. My choices: Laramide Resources; Nuclear Fuels; Canalaska Uranium; Skyharbour Resources; GoviEx Uranium.)

Here is Gold Newsletter’s Brien Lundin about the rates/yields-to-gold linkage:

“Everything, every asset class and sector, is and has been driven purely by central bank monetary policy. This phenomenon has been in effect to some degree ever since Paul Volcker started dropping rates in the early 1980s, but has been by far the predominant factor since the Great Financial Crisis of 2008.”

The Federal Reserve’s return to rate cuts (three or more now forecast for 2024) “is both inevitable and increasingly imminent, (and) it’s going to drive gold, silver and mining stocks higher over the months ahead,” Brien says.

Back to that technical read on Dragonfly: a sharp down day with a closing at the high. It is a bullish signal and not always 100% reliable.

Examples: HL Hecla Mining, a $2.9 billion market worth, is representative of pitiful mining stocks. A tip: so far HL shares are in freefall Tuesday-today., albeit with lower than usual trading volume. So that could leave the Dragonfly Drama for Wednesday.

Buenaventura Mining BVN is another example. See chart here please; if you cannot see it clearly, click on it for larger images.

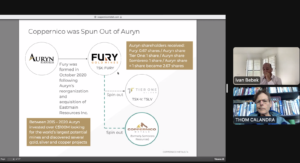

To come this week for paying subscribers: people updates from Ivan Bebek, who made me money (along with Shawn Wallace) probably 10 years ago after I visited his geologist, Dan McCoy, at Keegan Resources in Ghana. Keegan is now Asanko Gold. Ivan, a capital markets Canadian, also helped steer Cayden Resources to a $200 million-plus sale to Agnico-Eagle AEM.

Ivan, living now in Arizona, and I shared a Zoom this week. His main thing is a private Peru-explorer looking to go public by February: Coppernico Metals. That new-co transpired after Ivan and yet another company, Auryn Resources, spun out what is now Fury Gold Mines.

Copper: A supposed 2024 global copper surplus, according to forecasts, is now looking like a deficit.

Copper miner Ivanhoe Mines — revealing a $500 MILLION equity offering to investors * — sent this Bloomberg piece. The Panama government’s hasta la vista to First Quantum Minerals‘ Cobre mine is a big supply hit, along with Anglo-American‘s slimming copper output in Chile and Peru. See article here please.

So?

Copper’s price since March 2022 is down 25% — see price and chart here please.

I think that means, when China, leading the global-econ forecasts, looks hot and hunky, copper’s price rises; when China and its real estate nightmares are depressing growth (said to be a relatively tame 4.5% in 2024), all of the flag-waving copper stories about Cu being the smog killer of the galaxy will do little to boost the value of a warehouse of cathode.

Me, I see industrial copper as being a precious metal, like platinum, which, by the way, is showing strength this week of December 11. I have been adding to my Aberdeen Platinum Trust PPLT and my Ivanhoe Mines IVN IVPAF, which will be producing platinum, palladium, gold, nickel at Platreef in South Africa within a year or so.

* Finally, I stick to my take (last week) that IVN IVPAF shares will notch a new high price on the miner’s way to a $20 billion USD market value — by year-end. The shares are on their way. As in higher this week and .

And yes, granted, predictions are almost always foolish. They are, as Rudyard Kipling said in a poem about giving alms to the poor, mostly to make the giver feel generous and rarely to help the receiver. I feel good.

Ivanhoe Mines’ fresh $500 million, when heavyweight BMO Capital Markets closes the raise later this month, will go in part to pay for fresh copper exploring across Western Foreland, adjacent to the Kamoa-Kakula Copper Complex. The new stock will add about 3.6% to total outstanding shares of Ivanhoe.

TCRs, I owe you a summary of remarks by the principal behind private Coppernico Metals, Ivan Bebek, and by Maple Gold Mines‘ new CEO, Kiran Patankar. Ping me if you desire the notes.

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.