DOE’s 20% Solution | Execs — Laramide | GoviEx | CanAlaska | Nuclear Fuels

Uranium’s ‘spot’ price just got a boost from a U.S. Department of Energy notice it will seek sources of 20% enriched uranium for nuclear reactors.

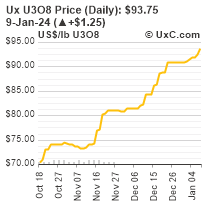

Wednesday’s spot price for uranium oxide at (update: $104) appears headed to $100 a pound. The price surpassed $100 in 2007 and again after Japan’s Fukushima shutdown in 2011. Spot uranium has almost doubled from $50 a pound in a year. *

The DOE seeks so-called HALEU uranium, high-assay low-enriched uranium to the tune of 20% vs. current 5% for North America product. See Reuters article and DOE notice for requests-for-proposals.

[Uranium stocks, explorers and producers, and physical trusts (Yellow Cake, Sprott) for the fuel, are gaining sharply Wednesday. See below.]

The politics of the DOE development are thick, among the drivers: White House ‘green energy’ initiatives; and safeguards for Western countries if Russia restricts exports of its enriched uranium. The largest ‘spot’ driver, as one of our execs below notes: “For the first time in the history of uranium, demand has surpassed supply.”

TCRs, here are thoughts in real time from top execs of the four uranium explorers I own:

Marc Henderson of Laramide Resources LAM LMRXF (New Mexico’s Churcrock project; Australia properties): “Patience rewarded.” Laramide shares, among North America explorers, are one of two (here at home) whose shares have doubled in price in six months’ time. Marc’s regular material for our TCRs in 2023 have been accurate and self-fulfilling– see here please: Exex Verbatim: Laramide.

Marc, naturally, cautions about price swings. He points to economics: “This really brings the higher cost curve projects squarely into the mix now and I also expect to have a greenfield exploration cycle as investors realize you have around 15 years of known global U reserves but you keep turning on assets that have 60 years of demand in front of them.”

See please: Laramide’s just-released New Mexico project’s economic engineering report (PEA). Headline for the preliminary econ assessment is 31.2 million pounds of uranium produced over 31 years.

Cory Belyk of CanAlaska Uranium CVV CVVUF: I think we can say all of these CEOs have provided substantive views and shared their two decades of uranium experience with us. Cory’s CanAlaksa is a Canada explorer of Athabasca Basin properties.

“It is flying,” Cory says today. “I expect it to continue to rise, perhaps moving toward exponential, as the market continues to tighten. I equate it to a coil spring that is being compressed to an extreme – at some point the recoil will happen. Perhaps a stretching rubber band is better … at some point it snaps back.”

Cory’s perspective continues:

“If you look at data from the last cycle (circa 2006) the exact same thing happened. The producers and near-to producers climbed while the junior explorers lagged. Then it shifted dramatically over about a quarter (3 months) and the juniors climbed significantly faster and further (by % gain) than the producers did. This cycle by comparison thus far is even more extreme due in large part to market (investor) apathy and sitting on the sidelines or in the ‘safe’ money. That will change the same way as in 2006 BUT the big difference is the fundamentals that underpin the change are rock solid this time.”

As for Athabasca Basin (Canada) metrics: “As Cigar Lake (maximum 11 years remaining) and McArthur (15 years remaining) production wanes, the uranium world is in for a shock. NexGen Energy NXE will undoubtedly fill some of this but not all.”

Daniel Major of GoviEx Uranium GVU GVXXF (Africa) “Expect prices to go higher still. However, note there are very few trades actually being done at these levels. Believe there was one today to justify the price.”

In the uranium oxide spot market, buyers generally need the fuel to fill a pressing need, say for electric utilities. Contract pricing that goes out years is the preferred avenue for buyers.

William Sheriff of Nuclear Fuels NF (Wyoming explorer) and enCore Energy EU (South Texas producer as of November 2023): “Note there are seldom many trades in the spot market but it is actively bid and offered and a guide to contracting. (So) $100 is in the bag. I actually think the Bank of America projections for 24 and 25 are quite reasonable.”

Some months ago, BofA forecast as much as a 40% price improvement for uranium and nuclear power after a decade of relatively parched investment in U.S. production and exploration.

Bill notes, “Bank of America initiated on Boss Energy BOE (Aussie company) today and raised uranium price expectations to $105/lb in 2024 and $115/lb in 2025. I think we all remember when the big banks got involved in the last cycle. Things got crazy quick.”

Boss Energy bought a 30% stake in enCore’s South Texas Alta Mesa project for proceeds of $70 million — announced in December 2023.

Bill Sheriff’s outlooks here and on LinkedIn state what he calls “Nuclear Facts” — most recently, that 28 U.S. states have one or more nuclear reactors.

Another view from Jordan Trimble, one of a small handful of uranium execs I rely on. Jordan’s Skyharbour Resources SYH SYHBF largely is in Athabasca Basin.

“It’s a confluence of positive factors pushing the price higher as we enter a seasonally strong period for the commodity and uranium equities. The lack of mobile secondary supply is squeezing the market higher, exacerbated by the Russian uranium import ban that is looming. The DOE’s request for uranium enrichment RFP’s is adding fuel to the fire this week and further illustrates the growing need and demand for nuclear fuel in the West, where there just isn’t the domestic supply to keep up currently,” Jordan says today-Wednesday-Jan. 10, 2024.

In North America, Cameco CCJ, Energy Fuels UUUU, Uranium Energy Corp. UEC and Denison DNN have the largest market values.

Australia has some large-cos, led by Paladin Energy PDN, Boss Energy BOE and Deep Yellow DYN.

* Thank you CanAlaska Uranium’s CVV Cory Belyk,

Laramide Resources’ LAM Marc Henderson, GoviEx

Uranium’s GXU Daniel Major, enCore Energy EU

& Nuclear Fuels’ NF Bill Sheriff and Skyharbour

Resources‘ SYH Jordan Trimble for timely updates

of contract and spot uranium prices

and of current nuclear, government,

production and electric utility developments

driving now-triple-digit prices. I own all

but Skyharbour.

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.