This is Cache Part II of 'Immediate Purchases,' prompted by private meetings with The Calandra Report holdings. Also: URANIUM'S 'Cool Kids' Club. Here is Cache I of The Calandra Report (with 'untouchables' named, is here. -- Thom Calandra

Our Precious Metals Summit 4-Day Up-Load [& The Untouchables) From Rocky Mountains’ Beaver Creek

Laramide Resources LAM — Marc Henderson, a Toronto banker and nuclear energy strategist, quotes chapter and verse on a score of uranium metrics: geography, pricing, Russia, Kazakhstan, energy politics and realities and the electric utilities that will continue to thrust the element toward all-time highs.

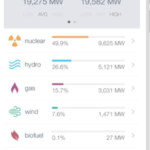

He’ s showing me GridWatch, in this instant an Ontario monitor of energy generation. There are U.K. and U.S. versions, too.

Laramide is developing USA and Australia projects, specifically New Mexico, Utah; and down under in Queensland. Marc, on the horn from Toronto and in person, has been detailing to me the be-all and end-all of BIG-PIC URANIUM DEVELOPMENTS days, weeks and months before WSJ, Sprott and other speak-easy media have.

Marc owns 10% of Laramide’s stock, a uranium equity that is up 40% or so from 2 or so years ago — yet below all-time recent highs and trailing several outpacing and worthy explorers for the U-308 fuel that heats nuclear rods. I bought LAM shares for the first time after our discussion, and after viewing this: video presentation from Beaver Creek.

The guy, age 64, is a quant, a uranium savant, an outstanding speaker and in past resource incarnations, a modest and dedicated winner. “Listen to the Cameco conference call each quarter. The executives are bragging about $50 -plus (extended) contract and spot prices. I venture to say we will get there and beyond quickly.”

The prices of spot, and of utility contracts, are a challenge to pin down: lots of private deals, zigs and zags in the language, concessions.

“The market is tight. Try buying a million pounds — you will move the spot price $5 or more,” Marc says.

Uranium pellets are packed into a reactor’s 200 or more fuel rods to generate heat at extreme temperatures, triggering a nuclear reaction.

Marc says “most nuclear utilities don’t know *%$#-all about the mining business of uranium.” (Sounds like some central banks and their knowledge of gold supply and demand — they sell low and buy high.)

The almost 3-year price run-up for physical uranium (ETF equity trusts include Yellow Cake Plc and Sprott Uranium Trust) started in January 2021. Too many metrics powering the move, Marc says. The U.S.A., U.K. and other governments, envious of miners and processors of the critically important element in Kazakhstan, China, Canada, Australia, Russia, finally are treating u308 (the triuranium octoxide compound that is yellow cake concentrate) with r-e-s-p-e-c-t. As in, funding for exploration; legislative support for the permitting of mining projects; import barriers; s dozen other measures.

Uranium, Marc says, is as critical an element as lithium, as copper, as nickel, as cobalt, as graphite, as the so-called rare-earth elements needed for much of our technology these days.

“People in First World nations will not tolerate brownouts, rolling blackouts, outrageous electricity prices,” Marc Henderson says. We will start seeing portable nuclear reactors at projects (construction, infrastructure, military, big cities, prisons, mega-factories) throughout the West, ones requiring power that just does not exist, or costs a fortune.

“Compared to even gold, uranium producing in North America is a real small club, 20 or so companies of substance: Cameco, Energy Fuels, we all know the names and see each other all the time.” For instance, a week-and-a-half ago at the powerful World Nuclear confab in London.

At that show, which drew uranium-cos, utilities and service providers the world over, large UAE and Saudi interests, Kazakh producers, North America spec-developers and mid-sized to large producers, and Africa up-and-comers, Marc Henderson, an annual attendee, as are many of his industry’s execs, noted to me:

“Electric utilities have finally (and pretty universally) acknowledged “the market has changed to a tight seller’s market and that we could also be at the sort of market inflection point we saw post Cigar Lake Flood (Canada) news in 2006. This is a dramatic turn of events from only 2 years ago. All stages of the fuel cycle are tight. Spot market is drum tight.”

'Cool kids club' and other takeaways from the London

nuke gathering two weeks ago:

"The industry is getting incrementally better at marketing itself

(and the benefits of nuclear energy). We have made progress

post-Fukushima (JAPAN meltdown) to the point where

proliferation, safety & waste concerns are no longer

consuming all of the oxygen."

Marc continues, "There is a big push on Net Zero / nuclear

and the UAE hosting a COP 28 climate conference -- a bit of a coup.

The UAE did a spectacular job quietly getting those plants built

and running and I think will turn a lot of heads. Al-Hammadi** is

a rock star and a big asset to the industry."

- As for small, portable reactors, or SMRs, "they are advancing. This is

part of the reason why the public favorability numbers for nuclear have

improved (new tech / getting into what I call the cool kids club)."

** Mohamed Ibrahim Al Hammadi, the Emirates Nuclear Energy Corp.'S CEO.

Next year, Al-Hammadi will become new Chair Elect

of the World Nuclear Association (WNA) board.

As for Laramide’s financial and asset profile, I can give you my own chapter and verse on why the $140 million USD company is 40% or more undervalued compared to its few appropriate U.S. developer peers, among them out-performing enCore Energy.

An EnCore project in New Mexico has a Laramide property, Crown Point, that is within a Nuclear Regulatory Commission source material license.

I have entered Laramide shares because of Marc, because of what he told me about looming secular and company events, and because it is cheap. If I wanted to play it safe, having been in and out of small uranium companies for 6 years, I would still own Cameco CCJ. To my chagrin, I do not. [See the other even-cheaper explorer below.]

You can glean from Laramide’s filings and presentations all you want to know, to your heart’s content, about the 115 pounds of uranium resource across four or five projects; the nitty gritty of exploration drilling in New Mexico, Utah, Australia. Also the financials.

Marc, as we reported the other day, is referencing in his video presentation “BILL,” who is William Sheriff, founder of enCore Energy’s well marketed Texas-South Dakota-Wyoming uranium project developer (and a top market-performing non-producer, thanks to “Bill’s” ‘Hollywood’ rollout of his “uranium expert” status and enCore’s proclamation as in-situ baking-soda, alkaline processor and AMERICA’s CLEAN ENERGY COMPANY).

Bill’s public webcast here at the show also is worth your 15 minutes. EnCore shares that license with Laramide in New Mexico. GEO-CEO Bill tells me, “We will be in commercial production within a matter of weeks, and 2nd plant up and running Q1 2024.” I’ll be talking to Bill in the coming week.

The other immediate uranium purchase:

Back in: For perhaps 7 years I have been in and out of CanAlaska Uranium CVV CVVUF. Always on the out with a profit. Now, with uranium spot and contract prices notching their highest prices since 2011 (at approx. $60 per pound), Cameco and Athabasca Basin geologist Cory Belyk has been running CanAlaska. In my book, CVV is perhaps the cheapest of all genuine Canada uranium explorers and vendors of Basin and the region’s properties.

Coming Tuesday: Dave Cole and proclamations about EMX Royalty‘s $30 million and growing of yearly royalty cash. It’s one of five or six immediate buys to come out of Colorado, where, coincidentally, the company is based. EMX Royalty EMX will be talking looming developments in a portfolio and with a geologic-technical team that is well above the 250-mark in generated (organic) NSRs (net-smelter returns) and outright purchases — gold, copper, nickel, silver, cobalt, etc.

EMX covers all the geographic and metallic bases, it seems, except for The Bronx and silicon, possibly. It is my third-longest holding after Ivanhoe Mines IVN IVPAF and Xtra-Gold XTG XTGRF, those two in Africa. Not to sound like a parrot recorder, as Dave Cole can strike some as strident; still, he has always delivered on his over-the-top declarations, just not always on his forecast timelines.

“We have two generational copper (with molybdenum) mines (royalties), Zijin Mining‘s Timok in Serbia and Lundin Mining‘s Caserones in Chile. When we bought into Caserones (an NSR), the mine life there was 17 years; now it’s 28 years,” he says in a closed-door session.

“Oh, not to mention the Leeville Gold Mine (Nevada Gold Mines). They are all multi-million-dollar cash fountains into our treasury.” [TCRs, any first-time dividend, even if it is pennies, will place EMX’s NYSE-AMEX shares into the large fund manager category for purchases; we’re talking Fidelity, Van Eck, T. Rowe Price.]

Also on the way this week: Heye Daun and Namibia gold project Twin Hills, amidst a multi-layered, groundbreaking financing for Osino Resources OSI OSIIF. I own it and just added more after the sit-down with Heye.

Other up-loads this week: Azimut Exploration AZM AZMTF — Québec master portfolio of gold, copper, lithium, uranium concessions and looming “news” about Elmer, the James Bay gold project headed for a first-time resource before year-end. More: Banyan Gold BYN — cheap-cheap-cheap, battered, genuing, cash-ready Yukon developer.

Plus a likely big mover this week and month, on its way to a pre-financing fair vale on AMEX-NYSE: CTGO Contango Resources. An Alaska two-part miner-explorer, Contango has that partnership with production at a mine for gold processing at Kinross Gold‘s Fort Knox Mine. Gold coming, and cash flow, by early next year.

” ‘Free’ cash flow for Contango from mining operations, once in full production, will average 67,5000 – that’s our share of average annual production at Manh Choh Mine, Rick van Nieuwenhuyse, founder, says. All-in-sustaining costs are approx. $1,116 per gold-equivalent ounce (with 5% silver); so a free flow margin of $825 an ounce at a $1,941 gold price — or yearly approx. $55 million USD. That is $5.50 per each current $19 share.”

Also ahead: Quotables about copper, lithium, gold and special situations that could bear fruit in the next 10 days.

— Thom Calandra

PayPal $229 Yearly Non-Recurring The Calandra Report

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.