Plus: That Lithium Stock In Brazil & Not -- Whew! -- In Chile Recovering Platinum Price Ivanhoe Mines | Vox Royalty | Atlas Lithium | Vision Lithium

[Latest: platinum’s price at $1,140 logs yet more gains — futures contract. See below for a South African geologist who has worked PGM mines in that nation. *]

What it takes to be ‘thick’ in a press release of exploration gold drilling?

I asked David Christie at Orford Mining ORM ORMFF after his Abitibi Belt, Québec. gold seeker (and yet farther north, nickel, lithium camps) used the adjective in a drilling update just now (Thursday April 20, 2023)

“I believe when we are talking close to surface (potentially open pit) and good strike, with grades over 2 grams gold (per metric ton) that anything around 15 meters or better is getting ‘thick’ from an economic point of view.”

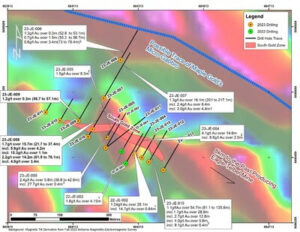

So 2.2 grams over 14.2 meters is thick in the geo-CEO’s book. The stock, whose shares I have owned for 4 years, is moving toward its all-time high today yet remains obscure at $33 million USD market value. Alamos Gold owns about 25% of Orford’s shares. [Robo-analytics: ORM appears to be in a strong bullish trend. Its 200-day moving average is upwards sloping and the MACD histogram is above 0.]

David plans an internal review when additional exploration assays — the bulk of them from this 14-hole spring 2023 program at Joutel Eagle — are returned from testing lab(s). In terms of comparables, or look-alikes, Orford’s project sits next door to Agnico-Eagle’s original gold mine of Eagle -Telbel — which is on the main road to the Québec mining capital of Val d’Or.

— Atlas Lithium ATLX, a Brazil explorer, is seeing its shares post all-time highs this week, even amid a lithium cooling span for the battery component’s industry: way too many explorers and not enough actual producers.

Latest boost to Brazil (and Québec and Nevada) lithium projects: Chile is on the nationalizing war path. See: lithium grab by revenue-seeking government. Also: related article.

Albemarle ALB, Sociedad Quimica y Minera de Chile SA SQM — two Chile-centric lithium producers — Friday April 21 are seeing their market values thinned by 8% to 21%.

Brazil’s Atlas, run by California/Brazil transplant Marc Fogassa, recently logged what it calls its best hole yet.

That was 2 weeks ago. Atlas, or shall I say alas? Alas, this was one The Calandra Report/TCR tagged three months ago at half the price, and whose NASDAQ stock I purchased, then sold for a rapid, 50% profit. Still tiny but no longer obscure at $140 million USD. It’s a 120% gainer now this spring 2023. Atlas is near a Sigma Lithium project in Brazil.

My only lithium holdings are indirect via Orford Mining (Qiqavik/West Raglan in Nunavik) and Azimut Exploration AZM AZMTF in James Bay, Québec.

One that is still obscure at $25 million USD: Vision Lithium VLI ABEPF — Sirmac project in northern Québec. Montreál’s Victor Cantore, a trusted gold/lithium/nickel source for me, runs Vision and Amex Exploration, also in Québec. I just bought VLI ABEPF shares for the first time Friday 12:40 p.m. Pacific time — approx. 15,000 shares.

— Summa Silver: decent grades in New Mexico out today SSVR SSVRF: I own Summa shares; the company will need to release at least four or five more holes at its Mogollon spread soonest to get the stock ignited, I believe.

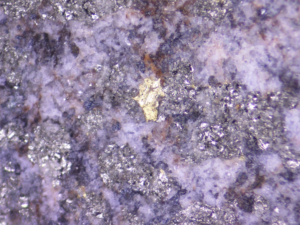

— Goldshore Resources GSHR GSHRF — Brett Richards at the Ontario gold project developer is striving to see his 4-million-ounce resource get closer to 6 million ounces in a coming resource upgrade. Latest assays are promising — 2.17 grams gold over 50.35 meters is the headline there. Some gold flake there (pictured). Hard to believe GSHR trades at a $25 million USD value with even just 4 million ounces of resource.

Wesdome Mining owns about 22% of GSHR shares.

Trading: I bit my lip. clenched my teeth and added again to my languishing yet mildy recovering, deeply underwater biomedical (cancer — ovarian, lymphoma, breast, bladder) lab’s stock, IMV Inc. Please see earlier The Calandra Report/TCR this week for two probable reasons why IMV’s $6 million USD of soon-to-be-booted-from NASDAQ shares are up 26% in a week.

Trading: I sold profitably my small stake in VGZ Vista Gold as I await more partnering developments for its Mt Todd project in northern Australia. I met with Fred Earnest, CEO, in Zürich last week. One large and 10-year-plus shareholder, Peter Palmedo at a Sun Valley equity fund in Idaho, could be taking an activist stance. Peter’s reciprocal gold theory says WHEN GLOBAL BLUE CHIPS DIVE DEEP, DEEP, DEEPER, DEEPEST, GOLD THE COMMODITY WILL RISE SPLENDIDLY TO VERTIGO HIGHS.

Peter controls the largest stake in West Vault Mining, a Tonopah, Nevada, owner of a small, shovel-ready, heap-leach gold mine WVM WVMDF whose shares I own.

Trading: Ivanhoe Mines with its Platreef development in South Africa stands to benefit from the platinum catch-up in price this week, month and year. [I just added more to a stake going on 20 years.]

Platinum‘s price, the continuous futures contract, continues its march toward $1,200 an ounce.

* I asked Vox Royalty VOXR for context. Vox has a royalty asset, Limpopo, in South Africa. Riaan Esterhuizen, exec VP and a geo, now in Australia, worked in many of the PGM mines in South Africa.

“Whilst the expected gradual reduction in demand for platinum, palladium and rhodium in the gasoline-powered vehicle economy is well known, research indicates that this will be more than offset by growing demand for these metals as part of the distribution and consumption in the hydrogen economy value chain. The relatively high concentrations of green economy copper and nickel by-products in this asset relative to projects on the Western Bushveld, makes it a compelling development opportunity for Limpopo controlled Sibanye-Stillwater, in our opinion.”

Earlier at The Calandra Report/TCR

Platinum and its attendant physical trusts (Aberdeen Platinum Trust PPLT) are withstanding interest-rate blows from precious metals investors this week, month and year (2023).

One industrial reason: the subbing of cheaper platinum in place of palladium as a catalytic converter element in gasoline-fueled vehicles. [Boilerplate: global platinum supplies probably will experience a 556,000-ounce deficit this year, after supply surpluses in 2022 and 2021, World Platinum Investment Council says in a quarterly report.

TCRs, many other reasons: South Africa power outages and shortages that will trim output at mines there; the Russia mess; possible platinum use in hydrogen-cell vehicles way down the road.

Our task (at The Calandra Report/TCR) is to give you the early heads-up (as I think we did several times this year and from mid-2022 onward).

I boosted our holdings in Ivanhoe Mines (Platreef project), although I had been doing that for the DRC Congo copper; and I started going big into Aberdeen Platinum Trust — PPLT on NYSE. The trust is up 20% this month of April.

When I was in Zürich last week, I met one-one with Frank Hallam and Kris Begic of Platinum Group Metals PLG PTM, an up-again, down-again, up-again developer of Waterberg (63% palladium, 29% platinum, with rhodium and gold). I have seen (several times) to Platinum Group Metals ‘operation, and to Ivanhoe’s Platreef, both of those in different sections of South Africa’s Bushveld Complex.

The two execs talked about protonic membrane fuel cells, about platinum-neccessary hydrolyzing for fuel cells, and about nickel, (an electric vehicle metal that Ivanhoe’s Platreef has in abundance).

Still, said Frank Hallam, CEO of Platinum Group Metals, “Demand for diesel engines and combustion engines will remain strong for a lot longer than people think.”

Platinum Group Metals is shooting for transacting a gold stream and possibly what is called a gray powder concentrate of concentrated sulfides (platinum, palladium, some copper and nickel) to harvest fresh capital.

Frank Hallam acknowledges the challenges of conducting business in South Africa. The sale of Platinum Group Metals’ costly Maseve Mine on the western limb of the Bushveld put that cash-draining mess behind the company, but only after legal wrangling that concluded four years after the $74 million sale — in 2022. See: legal ruling 2022.

“We blew our brains out on Maseve,” Frank said.

— Thom Calandra

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.