Gains For Select Mini-Memes: IMV Attempts Recovery — Shares Face NASDAQ Delisting

LODE, IMV, ATLX, Others: their commonality this month is (mostly) a lack of fundamental news.

TCRs, this report published Apr 24, 2023 @ 12:27 Pacific Time and updated 5 times Tuesday April 25.

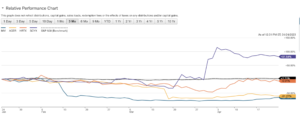

pBrowse revisioPLEASE POf relevance to our active investors: we are seeing sharp and rapid gains for a group of our small The Calandra Report/TCR titles, ones that since the meme-flare days starting 2020 (see graphic), have caught fire for no detectable reason whatsoever.

No business reason. But yes, here in April 2023, the minēma again are benefiting greatly from Internet-orchestrated buying and selling. Via algorithms, hooligan robotics, manipulative trading platforms, Reddit (etcetera) discussion groups.

Please digest the following primer on what appears to be happening this month in select mini-meme stocks. Focus: Nova Scotia lab IMV.

(See cancer lab IMV featured here below: April 14, 2023: 55 cents USD; after hours today-Monday April 24, $1.07.)

Also see IMV footnote about the cancer lab’s blocking of The Calandra Report/TCR access to one of its media feeds. Shame!

Remember our The Calandra Report/TCR coverage of adolescent buffalo 2020 to 2022? Pick one: Precipio PRPO, Urban-Gro UGRO, Innovation Pharma IPIX, IMV, Comstock Mining (now COMSTOCK INC.) LODE.

Meme stocks: shares that benefit from cultish behavior -- passed from one individual to another.

Meme derives from Greek mimēma, 'something imitated.'

Investment timing required for making meme money.

GameStop probably was the first meme stock -- in 2020.

Now, there are ETFs and indexes

(See VanEck Social Sentiment ETF BUZZ, others)

that track memes and themed stocks.

Some of the mini-memes here are worthy. Comstock Inc., a silver concession holder at the Comstock LODE in Nevada, is one I have tracked, visited and invested in since 2008 or so. LODE is now into industrial real estate, metals recovery and recycling, biomass generation and artificial-intel-guided calibration testing of ‘critical’ metals. The shareholder letter just out summarizes the tiny mining-co’s transforming activities. See letter.I own a small number of shares.

Atlas Lithium ATLX, the Brazil concessions holder, notched an all-time high just now. (I do not own ATLX shares but did earlier this year and made money.)

Lithium investors, it appears, now dismiss next-door Chile’s nationalization scare of late last week — see ALBEMARLE ALB shares today as they erase about a third of their freefall losses. Below: trading note.*

At any rate, today and most days this month, small and even smaller, obscure names have seen 30% to 60% gains, albeit from their trashed valuations. None more than … I know, shoot me … Nova Scotia immunotherapy lab IMV.

I sent a TCR note this weekend past to 75 subscribers who likely were infected with my IMV enthusiasm for 8 years running this month. (Hooligan behavior, me? Maybe.)

The note tries to explain what might be happening with IMV‘s woeful stock this recovery month. The shares are now at $1.07 after-market today Monday April 24, having risen 95% in 6 trading days.

We here at home own about 34,000 post-suicidal 10-for-1 consolidated shares. There is no extended periscope in existence that breaks the surface for us (approx. minus-$500,00 USD, much of it in retirement accounts). Unless IMV’s pioneering cancer treatments, all still pre-commercial and awaiting definitive data-evidence of having met primary endpoints, see a buyer cash out the now-$12 million stock for 10 times that number. More, actually.

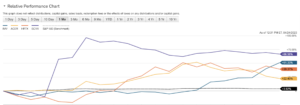

The note I sent floats a notion entirely devoid of common sense, devoid of cancer science, pharma licenses and clinical primary endpoints: that IMV’s NASDAQ AND TORONTO SHARES might be prepped to rise that 10x, or more, in a span of 6 weeks. (Charts below compare IMV stock with other recovering small biomed stocks.)

Why? Possibly because of the immunotherapy lab’s long-in-the-tooth yet effective DPX-delivery ‘platform’ and accompanying patents; possibly due to IMV’s several cancer trials with maveropepimut-S; maybe a transaction given IMV’s relationship with Keytruda combo-therapy supplier Merck; or possibly for no functional reason at all. Just an $11 million USD penny stock — now $12 million — that could see renewed interest from stock traders who value momentum rather than chemistry. Or from cunning stock trading by price-rigging professionals (likely already happening; hooligan robotics, etc.)

An aside: we have seen a good score of crushed biotech stocks pack in recovery gains since the start of April 2023. So let’s not get too wild here.

See: HERON THERAPEUTICS HRTX, ACER THERAPEUTICS ACER, SCYNEXIS SCYX charts here.

Still, for the one-week, one-month time spans, IMV takes the (robotics again?) profits cake. The stock continues its leap today-Monday, up another 18% and then another 20% atop that in the after-market. Thick volumes on NASDAQ.

Big-pic: cancer vaccines are getting press this spring of 2023. Bing the Moderna-Merck melanoma buzz. Not all positive. As a dozen of you point out to me, there are shortcomings, health risks, genetic alterations for some of these experimental vaccines.

Plus, the economics: some of the treatments (CAR-T-cell) that MIGHT extend life for cancer sufferers can run $400,000 USD or more per regiment. Are horrible to endure. Do not always extend life and sometimes end life prematurely.

As you know, with a $12 million market-cap biomedical stock, any whisper of plus or minus events sends the stock price way, way up, and way, way down. We will I GATHER discover more soon about the lymphoma and ovarian cancer clinical trials BEING STAGED BY THE COMPANY at various sites.

As indicated, I just added marginally to a stake that once was 225,000 shares and now, after that devastating 10-1 share consolidation, is approx. 34,000 IMV shares.. Again, I am down after 8 years by more than $490,000 USD.

Further thoughts

TCRs, the 2-week IMV stock gain (see chart again) easily could fall into the category of death-spriral manipulating by asset managers who joined in the most recent financing/money raise via equity sales and are — who knows? — shorting their stock, selling their warrants, algo-deceiving-rhythmically boosting the stock price by pennies per day. To be followed by the crushing sale of a million or two shares that profits them and submerges individuals yet more.

I have not even looked at the U.S.-traded options contracts on the NASDAQ shares. Are there any IMV options contracts even traded these days in the United States?

So, a cash buyer with pharma interests I suppose could pay IMV $200 million (plus assumes the debt and existing royalty payment to Merck AG — Germany and not U.S. Merck) for all of IMV, lock stock and barrel ($10 a share fully diluted?); or IMV could transact a licensing agreement for maveropepimut-S in specific indications; or the lab gets an upfront royalty payment from a buyer who envisions eventual commercial sales for an indication (ovarian, lymphoma, advanced bladder cancer, other).

That is a pittance of a price. Somehow, even if a takeover were to result in a 500% premium, or more given the current 77 cent stock price, few long-range holders (including here at home) would be able to breathe profitable air. Some would threaten legal action.

A NASDAQ delisting compliance period is under way for a minimum $1 stock price across 10 days. HERE IS THE NOTICE. A delisting could occur in September 2023.

IMV shares on NASDAQ AT LAST LOOK ARE 83 CENTS. [Closed at 91 cents USD MONDAY and in post-market $1.07 MONDAY APRIL 24, 2023.]

I bought yet more Monday. Good money after bad?

There. I got through that and did not even mention ‘infectious disease.’

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.