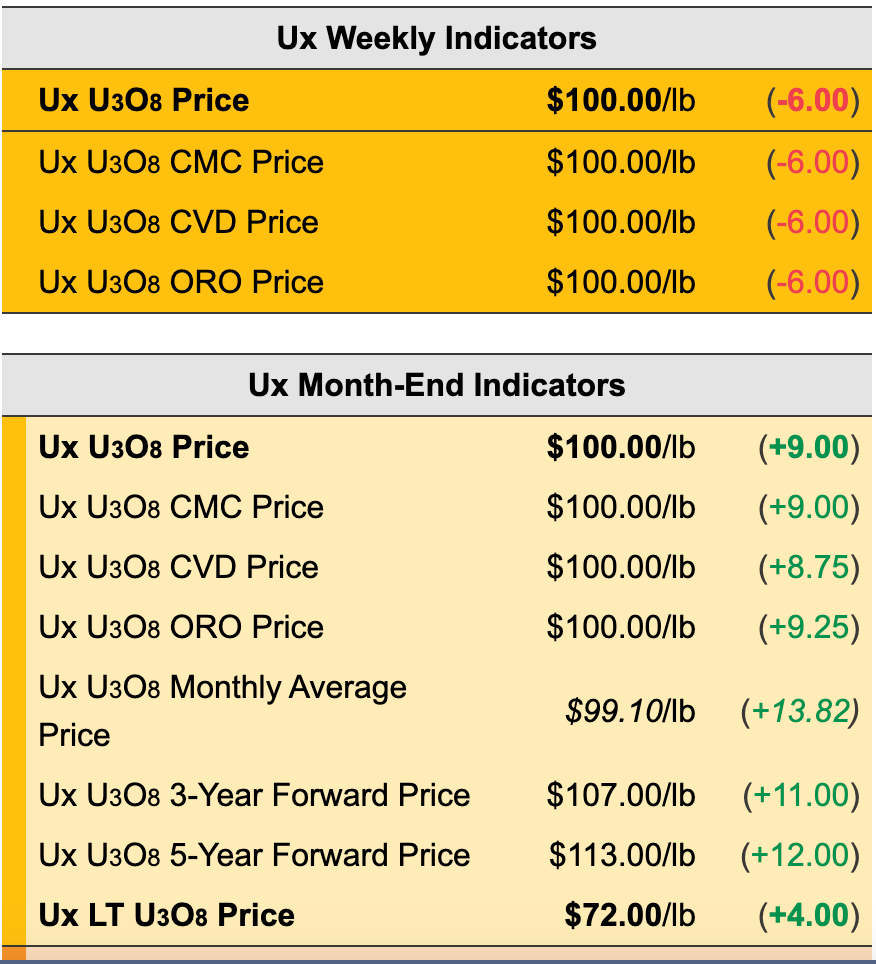

17-year spot price high; contract prices ascending

Also: NiCan | C3 Metals | Arizona Sonoran Copper | Ivanhoe Electric | Western Copper & Gold

Good price days for the nuclear fuel are stretching to weeks, months and years.

“It is climbing. See what the next days bring,” says Cory Belyk, CEO at CanAlaska Uranium CVV CVVUF. [Update: Thursday, Feb. 1, brought yet higher prices for uranium equities and spot uranium oxide prices.]

Utilities and other buyers of the nuclear fuel go into the spot market in crisis — caught shorthanded for projected electricity generation at nuke power plants, for one.Â

Below: Hope For Microscopic Explorers -- NiCan NICN gains 250%: Manitoba nickel-copper results.*

All steady buyers of uranium oxide must negotiate 3-year and 5-year contracts, or somewhere in those spans. Note 5-year contract term here in chart.

“Long-term contracting support is the KEY, and it has built support recently with upward trends abound. Spot-uranium (approx. $100 a pound) will be above this handily at some point,” Cory, a trusted source, says.

A price of $105 a pound the other day is the most expensive price since 2007 or so.

CanAlaska, an explorer and property developer-groomer-seller in Athabasca Basin, saw its shares “break out” to their highest price since April 2011. CVV CVVUF Tuesday rose 8%. I own the shares.

Skyharbour Resources SYH SYBHF (whose shares I do not own) also logged an 8% day.

Another I am well familiar with and used to own, Mega Uranium MGA MGAFF, with ownership of Canada uranium super-power NexGen Energy NXE, IsoEnergy ISO and other U-explorers/royalty-cos, heralds shares that have more than doubled since July 2023.

Most uranium stocks took a breather Wednesday. Prospect spawner and explorer Skyharbour, perhaps playing catch-up, continued to gain — up another 3% on outsized volume.

Many of uranium’s explorers, developers and producers, and the uranium physical trusts, continue to see sharp stock-market ascents. The spot per-pound uranium oxide price is in the $100 to $105 range.

Cory at CanAlaska Uranium CVV CVVUF is looking for yet more equity gains, and spot-price gains, ahead of Canada’s Cameco CCJ call and quarterly update Feb. 8. Also a production update coming from Kazakhstan’s National Atomic Power KZAP on LSE.

“Expect new highs ahead of us,” he said today-Wednesday. See second UxC chart please above.

There is plenty of The Calandra Report uranium material mid-2023 to present. Uranium supplies worldwide are strained. Governments are looking to lock in suppliers for non-carbon power, for weapons, for research. Production cutbacks regularly at the few producing mines in the world. Restrictions or taboos on Russia’s so-called enriched uranium.

Naturally, most of us will wind up paying higher prices for our wattage, if we aren’t already.

I am fortunate to have heeded advice (Cory Belyk; Marc Henderson of Laramide Resources; Bill Sheriff of Nuclear Fuels/enCore Energy; Daniel Major of GoviEx Uranium; Jordan Trimble of Skyharbour Resources) in late summer 2023 to re-enter 4 of my preferred uraniums and still coveting a fifth. (Skyharbour on my pending list.)

The outsized gains today led me to shed 30% of two of the holdings, Nuclear Fuels NF NFUNF, whose Wyoming drilling is updated today – see release please; and GoviEx GXU GVXXF. I still own enough of each and the others to make a difference.

Once again, uranium spot price data and the more meaningful contract prices (5-year pacts) are hard to pin down.

All the indicators, led by uranium trusts (Yellow Cake Plc YLLKF; Sprott Physical Uranium Trust U.UT SRUUF) that accumulate the nuclear fuel, fortify what has been an almost 90% rise in U308’s price since the start of 2023 a year ago.

In this TCR (Jan. 10, 2024), I name those preferred uranium equities, most of them explorers that continue to see higher prices each week of this 2024 new year. I own four of these: Laramide | GoviEx | CanAlaska | Nuclear Fuels. See The Calandra Report report here please.

Hope For The Obscure

*NiCan NICN shares were rising 255% at last look after reporting one drill hole of 31.5 meters, averaging 1.90% copper and 1.92% nickel at its camp near Snow Lake, Manitoba.

Intercept widths, as I understand it from a trusted source, MJG Capital fund manager Matt Geiger, look “phenomenal for nickel sulphide.” [MJG does not own NICN shares.]

The 31.5-meter intercept was “the greatest length of continuous mineralization intersected to date,” the company said. See results please.

Still, the turnover for a now-$9 million market-cap explorer Wednesday, even with almost 17 million shares changing hands at last look, amounts to just $2 million CAD or so of share worth.

Yes, there is pent-up demand for exploration drilling success stories among the most obscure of explorers — worldwide. Nickel is somewhat disparaged thus far this first month of 2024. Yet copper, attempting to ladder to within reach of $4 a pound, is on the gotta-have map for majors such as Rio Tinto seeking copper-gold properties, especially in North America.

I just got off the horn (Zoom) with Dan Symons of C3 Metals CCCM CUAUF, a gold-copper explorer of Jamaica porphyrys (and Peru copper tracts). He says, “There are a lot of precious metals producers, I mean a lot, looking for copper or copper-gold properties.”

I confirm. [More to come from C3’s Dan Symons — I own CCCM shares.]

Good example: Barrick ABX upped its Hercules Silver stake to 15% a couple of months ago once it became clear Hercules BIG in Idaho was onto a copper system. See that one please.

See earlier The Calandra Report this week regarding other examples — Rio Tinto-backed Arizona Sonoran Copper ASCU; Rio Tinto and Mitsubishi Materials backed Western Copper & Gold WRN.

Regarding this NiCan, I know little; the CEO, Brad Humphrey, is former big-bank Wall Street resources analyst. The camp, says the company, is a possible Lynn Lake comparable.

I’ll have more about the copper-gold search re: Western Copper & Gold and its Casino project in Yukon in coming days.

Right now, here at home, with an outsized stake in Africa copper miner Ivanhoe Mines IVN IVPAF (82,000 shares), and a building Ivanhoe Electric stake, and a small number of WRN shares (Casino); I am copper vigilant.

I like the idea that with Ivanhoe Electric IE, its market value approx. $1 billion, a shareholder gets Arizona activity (Santa Cruz); Utah (Tintic); Kingdom of Saudi Arabia exploration; and exploration and battery technologies: Typhoon and VRB Energy.

I bought yet more IE Wednesday in what has been an 11% slide of Ivanhoe Electric shares in the past 5 trading days.

Later this week — more thoughts. Please shoot us your copper-gold ideas, sub-$150 million or so property price tags, even if theoretical. North America only, ex-Mexico, please. Copper-gold only, please. A challenging assignment, I know.

— Thom Calandra

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.