This report comes as metals prices (gold, platinum, nickel,

copper, silver) negotiate a (seemingly) omnipotent U.S. dollar.

Gold flirts with $2,000 an ounce.

|

| We stated three days ago: “Among TCR‘s abandoned stocks, if pressed to name a couple with looming events — ones that if their values were to sink even lower than they already are, we would lose them forever into a Hadestown of squid-black ink: Azimut Exploration AZM AZMTF (Elmer gold project resource in Québec before year-end); Xtra-Gold Resources XTG XTGRF (never-diluting, and on the cusp of expanded resource estimate for its Kibi gold project in Ghana).”

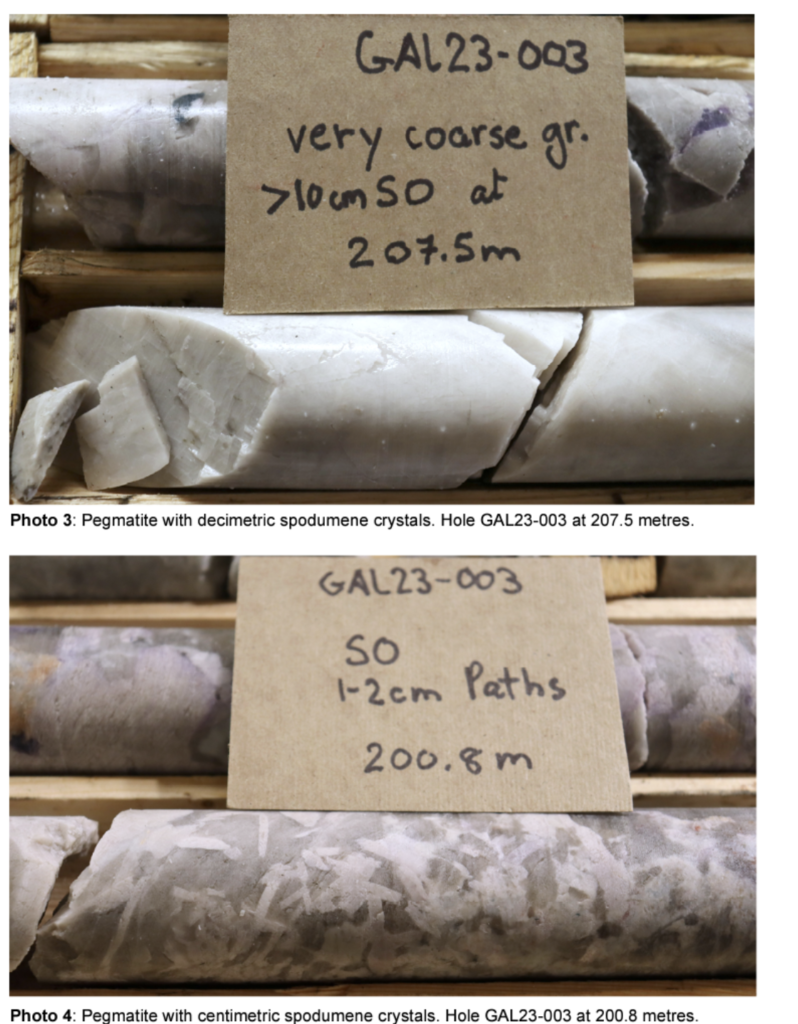

So, we had a hit Monday with an Azimut update, just not about the gold project in remote James Bay. Instead, the exploration drilling nearby pierced what investors want to see in an early stage lithium project, also at remote James Bay. That is, spodumene pegmatites.  AZM shares gained 15% in turn, albeit from a depressed (depressing?) level. I think images of the core pulled from the Soquem-Azimut project are what is moving the shares. No percentages yet, except guesses, as this is all visual assaying. Still, this looks like a boulder field. See AZM release please. If the mounds of igneous rocks hold spodumene across their interlocking crystals, (I wish I knew more about lithium hard rock-drilling) seasoned lithium investors say this field, in a province said to be rich in lithium, could be worthy, dollar wise.  Nemaska, a now-private company, is supposed to produce lithium ore from the Whabouchi mine in James Bay by 2025. Ford, the automobile maker, will take the battery metal. Sayona Mining, a pub-co with 10 billion shares outstanding, its roots in Australia, along with another Australia partner, say they are trying to raise money to mine lithium south of Whabouchi, in the area of Val-d’Or. Regarding Azimut, “It’s a strong start with obvious drilling follow-up to be conducted,” Jean-Marc Lulin, CEO-geo, tells me this morning. “The current step is dedicated to delineating the size and shape of the discovery.” Azimut and partner Soquem, which is a no-nonsense explorer-investor solely operating in Québec, are boosting the drilling to 5,000 meters from about 1,500 meters. Jean-Marc says a “mineralized boulder field” looks to be showing as much as 4% lithium oxides. More to come, I hope. Please see earlier “Redemption” reports from this month for tags and barrel-bottom reasoning re: — Banyan Gold BYN; — Newcore Gold NCAU; — and hardest hit of all, both C3 Metals CCCM and Orford Mining ORM ORMFF; three others. Orford, by the way, in a lithium hunt of its own, north of James Bay in Nunavik. Finally, that northern Spain poly-metallic prospect of zinc, lead & silver that I visited a year or so ago looks to be upgrading its exploration approvals to an underground mining permit. This is the Toral prospect that Europa Minerals EUZ, a U.K.-traded entity with Aussie roots, is in the process of optioning to Denarius Metals DSLV DNRSF. Here is that coverage please. Denarius also has a poly-metallic project farther along than this one, in southern Spain’s Iberian Pyrite Belt; and a gold-silver project that is a former mine at Zancudo/Titiribi in Colombia. Here is the Denarius release please. Previously at The Calandra Report/TCR Another Nation Draws Minerals Line In Sand China is restricting exports of EV battery material graphite. “The geopolitics of the green economy just shifted gears,” Éric Desaulniers of Québec’s Nouveau Monde Graphite said in reaction. NMG shares, which I own, are down 60% in a year and got a 40% lift Friday from the graphite development. Other graphite project developers, Brazil’s South Star Battery Metals STS for one, Ontario’s Northern Graphite NGC for another, also got lifts after a year of depressed shares. — Thom Calandra [FYI, I own C3 Metals, Azimut-Exploration, Alamos Gold, a small amount of Nouveau Monde, Orford Mining, Xtra-Gold and Newcore Gold.] PayPal $229 Yearly Non-Recurring The Calandra Report PayPal $179 Yearly: Recurring The Calandra Report Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities. |