Dollar Weaponizing Looks To Be Backfiring | BRICS Nations

“Gold‘s increase in price is being driven by continued Central Bank buying as a reserve currency. Central Banks do not buy silver as a reserve currency.” Rudi Fronk, Seabridge Gold SA SEA

Sprott Gold & Silver Trust | Summa Silver | Alamos Gold | Aberdeen Platinum Trust | EMX Royalty | Avino Silver

A ton of feedback is coming into The Calandra Report regarding gold's March march, silver's tardy rebound ... and the gold-BRICS dynamic. Thank you, TCRs.

Gold at $2,254 (futures contract) is staging a landmark day, month and 2024 year.

Silver at $25.10 might be starting a stealth rally — regaining $25 an ounce.

Gold’s 1.9% rise the other day to a new high exceeds big-bank analysts’ forecasts. As my money manager friend up the street says at times like these, “You gotta respect a move like that.”

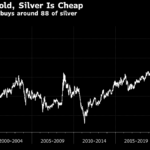

Regarding silver: at a gold-silver price multiple of 88-to-1, gold is enriching bullion believers, especially those outside the U.S. dollar’s forte realm who own gold in weaker currencies. Australia gold costs $3,448 AUD and closer-to-home Canada gold costs $3,025 CAD an ounce. (Correction: gold in South Africa‘s rand, one of the weakest currencies vs. USD, runs 41,900 ZAR. Apologies for the error, TCRs.).

A report next week will look at what I believe are ‘unfair’ market values for three or four gold, copper miners, explorers and roy-cos.

(Example: EMX Royalty EMX, whose shares were weakened by SSR Mining‘s $8.9 million advertised sale of its stake in December 2023; I added this week to approximately a decade of EMX ownership here at home.)

Still, many of the smallest miners, sub-$1 billion, have packed on 25% to 35% gains this spring of 2024.

First off, for us gold geeks, comments about a building international protest against America’s dollar-centric banking requirements and towards gold-backed trade transactions.

“The scary thing is that the U.S. has weaponized the dollar to control the banking system … unsustainable,” EMX Royalty CEO Dave Cole in Colorado tells me. “Lack of intelligence of our leaders.”

And this:

“The U.S. is using the world’s established medium of exchange to achieve political ends. The mechanism is to exclude the banks from certain countries, as decided by the U.S. Treasury, from the Society for Worldwide Interbank Financial Telecommunications (SWIFT), which is run by the Treasury.” — Former Seabridge Gold Chairman Jim Anthony tells me.

[Gold-copper project developer Seabridge, its shares leaping this week, runs a real-time gold commentary and an even more real-time X (Twitter) feed about gold, global flows and central-bank shifts. I do not own SA SEA shares.]

Brien Lundin at Gold Newsletter (image here) today-Friday March 29, 2024, tells me:

“I doubt that the dollar will be replaced as the global reserve currency any time soon. However, the latest example of dollar weaponization after Russia’s invasion of Ukraine prompted a wide array of central banks, most notably the People’s Bank of China, to begin aggressively building their gold reserves. They largely exchanged their dollars (U.S. Treasurys) to accomplish this.”

The reality is that a shift away from U.S. dollars, while already occurring as China, Poland, Turkey, Russia and others sell their U.S. paper and accumulate gold, will take another four or five years to gain steam. Besides, the United States is said to own more gold than all of the BRICS nations together.

Tim Wood, a South Africa transplant to America in his 13th year as executive director of the 125-plus member (I lost count) trade association Denver Gold Group, says,

“Gold is reflecting a persistently rising risk premium for US-domiciled and dollar-denominated assets. It’s a classic example of Franco Nevada’s Pierre Lassonde and his famous words about ‘gold climbing the wall of worry. There are multiple points of pressure across all the capital markets, but especially for the U.S., as it is confronted with paying an incredible and growing percentage of its receipts in interest (Treasurys).”

The Denver Gold Group‘s next trade show, Gold Forum Europe, will be in Zurich April 9-10.

OK, back to the blow-by-blow. (Next week, I look to deliver a little more financial context for why gold’s gains likely will keep exceeding banks’ targets. More importantly, as stated, the several worthy miners, explorers, developers and roy-cos I believe are lagging the stealth rally of metals equities this month and year. And no, I do not own all of ’em.

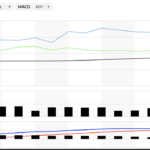

So, silver. Yes, the precious and industrial metal silver (blue here) the past 30 days slimmed the gold–silver gap, it is true. See chart please.

Still, the one-year chart comparing the two precious (to some) metals shows the wreckage. (Silver is still the blue one here, in more ways than color.) See chart please.

It is good to see gold get credit (if that is the right word) for fiscal worries, a Middle East scrum, Red Sea attacks, Russia rattling, China-Taiwan tensions, the possibility of greater price inflation worldwide ahead of us … and so on.

Yet that gold-silver ratio of 88 is said to average 67 across a 30-year span. Imagine if silver fired up to get the multiple to 75; I know silver investors who happily would take physical silver or the futures contracts at $28 an ounce vs. its current $25.10.

This commentary via Bloomberg is worthy. Good stats. See piece here please.

I have little deep-seated analysis to offer you in this gold-silver inequity. You all likely know my choices for precious metals are gold, platinum … and the global glue of copper.

Platinum and copper are meandering just like silver is (or was) this year and most of 2023. Copper and platinum (and silver) have a lot to answer for this decade and much of the 2010s. [I own Aberdeen Platinum Trust PPLT-NYSE — a choppy years-long trip for me.]

Imagine if Rick Rule, instead of saying the other day,

“I own gold because I’m afraid it will go to $5,000; go to $7,000,” he instead had said, “I own silver because I’m afraid it will go to $28.”

Maybe not the same punch? See our The Calandra Report coverage please for the early March 2024 PDAC investment panels that featured Rick Rule and other bankers/investors.

“Silver always follows, then catapults higher on a performance basis. Gold at least is easy to read. Silver breakout will happen when gold goes through $2,200 with volume and bitcoin goes south. Just watch, it will be magical.” — John Anderson, Chairman, Triumph Gold (Yukon) TIG (I do not own TIG shares.)

My only squib to offer silver believers is that I hold silver in physical form (a hundred or more pounds of junk silver 92.5%); numismatic collectibles — as in coins; jewelry; a dozen or two silver “rounds” from a dozen or two silver mines I have toured since 2002; and the Sprott Gold & Silver Trust CEF-NYSE, which I use as a money market in a fashion. (See trading note below please.)

I believe CEF is 43% silver and the rest gold; it trades at a 4% discount to its net asset value — see boilerplate here please.

Of course, I own several silver and-or gold-silver explorers and miners in Nevada, Arizona, Mexico, New Mexico. The ones with gold production and M&A action are ego and portfolio boosters and have been for a few years now, led by Alamos Gold AGI.

[Alamos this week says it will buy Argonaut Gold for its Ontario Magino Mine, next to Alamos’s Island gold mine. See analyst report here please.]

In the smallest of the silver explorers, we are seeing a stealth rally: one I own, Summa Silver SSVR SSVRF, has shares rising to 30 cents USD from 20 cents a month ago, albeit scant volume. (The mid-sized silver producers are engaging fresh interest, ever-so-s-l-o-w-l-y, too — MAG Silver MAG-NYSE for one; Avino Silver & Gold Mines ASM, as its execs show me today, up 40% from where Coeur Mining CDE sold its 14 million shares in 2023. (I do not own MAG, Avino or Coeur.)

I am sure I’ll hear from yet more silver aficionados and dollar hand-wringers after this is out.

Oh yes, one more thing, anecdotal: I went through a phase (2005 to 2013 approx.) where I handed out silver coins as a gift or as a reminder of bullion value — to the kids at $6 and $8 and $10 an ounce; to my accountant (8 years later it is still on his desk); to friends; etc.

Not sure any of them got too excited — even as some of the coins’ designs were striking, both the sovereigns and the miners’ rounds.

A telling comment, from at the time our 13-year-old: “Buy it back at $10 — I can get a used XBOX 360 NBA2K13 disc.”

Trading note: this week or next, we will be selling approx. $5,000 of our children’s DHT Maritime Holdings DHT for a profit to cover family taxes and their IRA contributions. (Partially accomplished late Thursday March 29, 2024) In total we own approx. $23,000 USD of DHT, much of it held three-plus years.

For the same reason, we also will be selling approx. $3,000 or so, at a profit: a sliver of our SPROTT GOLD & Silver Trust CEF; some of CEF we have owned since the original Central Fund CEF CEF.A in the early 2000s. (Mission accomplished.)

I look to raise another $3,500 USD or so for taxes by selling more DHT Maritime.

As stated above, I added approx. $2,400 EMX Royalty to our accounts at $1.75 a share USD. I think there is a case to be made that the holder of producing gold-copper-etc royalties in Serbia and in Chile, among other nations, will regain its $2.15 mark of one year ago, April 5, 2023, in the coming month. We’ll see. More about this next week from a conversation I had with EMX’s Dave Cole.

Important: no executives, promoters, asset managers, companies pay me for any coverage in The Calandra Report. We merely offer what we think are reasonably priced subscriptions — links below.

Buona (Cattolica) Pasqua. I am told by my Greece ag-equipment and shipping aficionado, Avraam Gabrielidis, that Greek Orthodox Easter — as in the Catholic Church a celebration of the Resurrection –will take place May 5 this year. Learn why here please.

Worth a view: “Resurrecting Meme Stocks — Cash Trasher” from boutique banker Simon Catt in London. At The Calandra Report here please

— Thom Calandra

PayPal $179 Yearly: Recurring The Calandra Report

PayPal $229 Yearly Non-Recurring The Calandra Report

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.