-- Copper miner Ivanhoe Mines takeaways -- IVN IVPAF below.

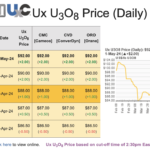

— Uranium price is ignited again with Russia import ban on U.S. president’s desk. Still, the legislation, another sanction for Russia, which is or was providing 10% or so of U.S. uranium, was in the cards. “The Russian suspend agreement already was in place that was reducing Russian sales to the U.S. considerably,” GovieEx Uranium’s Daniel Major says from London.

Wyoming uranium is tagged in news report here. See previous coverage of uranium 2023 and earlier this year — links here at Thomcalandra.com. Powder River Basin explorer Nuclear Fuels NF is in Wyoming; sister-co enCore Energy EU is in Texas; Laramide Resources LAM is in New Mexico. Ownership list here at home also includes Athabasca Basin’s F3 Uranium FUU; Africa’s GoviEx Uranium GXU; Athabasca’s Skyharbour Resources SYH and CanAlaska Uranium CVV. More uranium below at *.

IVANHOE MINES: After a quarterly update and conference call this week, at least four bank analysts or researchers upgraded their outlooks for the Africa miner’s shares.

They included BMO, RBC, Canaccord Genuity and Scotia Bank.

RBC Capital Markets: “Our view: Ivanhoe has a line of sight on producing 1 million (metric) tons a year at Kamoa-Kakula, to become the largest or second largest copper mine globally, with the lowest quartile costs and emissions that could make it the world’s best copper mine.”

Ivanhoe’s 10% share drop this week derives in part from redemption of year 2026 converts (worth $575 million), several researchers indicated about arbitraging investment firms. A weaker copper price also dragged IVN IVPAF.

Millions of IVN shares could transact in coming days after some 12 million shares changed hands in Toronto alone Tuesday-yesterday. (65-day average: 2.57 million IVN shares) This as some convertible bond owners take their equity and sell the shares, or delta-hedge them with partial short-sale positions.

Please ping me for the ways large investors (funds, banks) enter or increase stakes during spans of arbitrage.

[I added shares this morning Wednesday.]

Ivanhoe Expects Greater ‘Green’ Copper Prices

Ivanhoe Mines‘ executives in their Q1 update and investor call this week came amidst a 10% decline linked to bond-equity arbitrage, a 2% copper price drop and an overall market malaise for commodities and Fortune 1000 stocks.

Ivanhoe, set on redeeming what it called a “distorting” convertible bond issue, projects it is moving quickly toward debt-free status.

Ivanhoe’s executive chairman, CEO, CFO and COO addressed the convert-bond-related sting for the Africa copper and zinc miner after the quarter showed a non-cash loss tied to the all-high prices for shares this week and last.

Ivanhoe’s execs on the international conference call included Robert Friedland, Marna Cloete, Alex Pickard, Mark Farren and Matthew Keevil.

Ivanhoe on paper recorded a loss of $69 million linked to a non-cash loss on convertible bonds. A 26% quarterly share price increase was the reason, oddly enough. Without the converts loss so-called normalized profit came in at $70 million and adjusted EBITDA, or cash flow, tallied $126 million

Ivanhoe Mines Q1 copper and financial numbers and investor call –here are links across the board: See IVN report here please.

Ivanhoe assured investors it expects greater revenues from a $4.50 copper price vs. an average in Q1 in the mid-$3 range. Revenues for the quarter arrived at $618 million.

The world’s third or fourth largest copper producer also will boost copper recoveries from the ore it pulls from its DRC Congo mines at Kamoa-Kakula to 95% from 87% in coming quarters.

[Listen to the 58-minute call and view the slide deck and MD&A re: an Africa miner with multiple evolving and moving parts.]

Listen to Q1 call please here.

The execs said it was “perplexing” that a one-time, derivatives-linked loss ($69 million) would rattle investors.

The company says it will scrap the $575 million of converts to end “distortion” of its fiscal numbers, and it will reduce total debt to less than $150 million.

Listen to the one-hour call; read the boilerplate and filed management discussion. Often, the miner’s discussions and slides are must-viewing/listening for anyone who wants to boost their knowledge of profitable, technological and I have to add this, humane mining at a Tier 1 level.

“We have a different world at $4.50 copper,” Robert Friedland said on the call. The founder forecast Ivanhoe’s ‘taking down’ the largest two or three copper producers in an inevitable march to the top. (Currently, Codelco in Chile, Freeport-McMoRan in the U.S. and BHP are the largest.)

“We can find more copper than we can put into production,” the executive chairman said, addressing power shortage and volatility challenges in DRC CONGO. “Those are behind us.” Megawatt projections from improved Congo grid and Zambia/Mozambique electricity imports in the MDA.

|

*More Uranium: “Demand for nuclear power remains as durable as ever, while supply remains as fragile as ever.” — CG Capital Markets’ Katie Lachapelle and Canacord Genuity research team. At last look, spot uranium‘s price is $92 a pound, rising $2 Wednesday, according to UxC.com.

The Calandra Report

PayPal $179 Yearly: Recurring The Calandra Report

PayPal $229 Yearly Non-Recurring The Calandra Report

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.