* Trading note below:

Ivanhoe Mines | Ivanhoe Electric |

Alamos Gold | Aberdeen Platinum Trust

Updates: Ivanhoe Mines Q1 copper and financial numbers and investor call just out Tuesday April 30. See IVN report here please. [Listen to the 55-minute call and view the slide deck and MD&A re: an Africa miner with evolving and moving parts.]

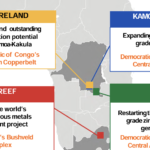

BHP‘s $40 BILLION USD offer for Anglo-American is back in BHP’s court after an Anglo-American rejection. The rejection continues to lift copper futures prices by another 2% to their best price since April 2022. Shares of DRC Congo copper miner IVANHOE MINES IVN IVPAF are ‘en fuego,’ as our Spanish speakers say.

The theme: a copper scrum as global smelters scramble for concentrate to produce sheets of cathode. How desirable are Ivanhoe’s copper and zinc mines to probable suitors? Also, how much will IVN benefit from a copper (and zinc) sector lift?

Ivanhoe Mines ** is our largest and longest-held nat-resources stake here at home. (80,000 shares, much of it since Ivanplats South Africa 2003. IVN climbed another 6% Friday to its best-ever price, $20.36 CAD and a $25.9 billion CAD market value. Number of shares traded: 3.1 times the 65-day average daily amount. More below **.)

Plus: A Swan’s Dive | Reciprocating Gold-Silver

Gold’s price, says a multiverse of researchers, analysts and brokers in the western world, is at “all-time, historic highs.”

Time to point out again that the inflation-adjusted high for the gold price occurred in 1980-’81 at a level that today equates to $3,100 an ounce.

The gold price, after futures contracts shaved $100 off the price this week, is $2,336. In North America, Europe, Toronto, Geneva.

In Shanghai, Singapore, Hong Kong and points east, gold’s price, spot gold’s price, is closer to $2,400 an ounce. See: Shanghai prices for gold, silver here please.

Overnight, “professional” takeaways about the “disconnects” running through gold, silver, bond, interest rate and ETF markets this month are the rage. Here is one (one that I respect, unlike some of these insta-expert bullion scans):

“Treasury yields have historically trended inversely to the gold price. When real yields are high there is a move away from gold to invest in government backed securities and assuming a zero-risk trade that pays over inflation. There is a desire today to hold both gold and bonds due to geopolitical and economic tensions across the globe, hence gold breaking with recent trends. This desire is confirmed by the strong buying desire from speculators.” — Erika Harrington, Auramet researcher

Erika, in New Jersey with international bullion trader/metals services provider Auramet, notes that all sorts of traditional gold-to-you-name-it relationships are gone with the wind this spring of 2024. Gold-silver ETF holdings are trending lower and lower but bullion prices keep rising, for one.

TCRs, the No. 1 takeaway from several missives of the erstwhile worthy research (as opposed to insta-analyst rubbish), is probably this one, again from Erika.

“”We see that total open interest on the exchange is being managed by speculators and non commercial participants, again lending to the theory that gold is being traded more as a currency than as a commodity.” — Erika Harrington

As discussed in our reports two weeks ago (see please The Calandra Report listings), only 25% at best of North America gold futures contracts conclude with delivery. Paper is paper — it is speculating, hedging, trading; it is rarely gold (and silver) ownership.

Here is another worthy piece, this one an interview with VanEck portfolio runner Imaru Casanova, and worth a 2-minute scan, by my former colleagues at MarketWatch.com: See Q-A here please

Reciprocating: Payback?

Imaru includes the reciprocal blue-chips to gold thesis. See below please. [This week and last, reciprocating “payback” for decades of Fortune 1000 market gains started — blue chips declining steadily as gold, silver (copper) gain. Let’s see where it goes.]

Imaru tags inflation, central bank buying, and she is bold enough to foreshadow what could be a “black swan” event that boosts gold’s price to $2,600 an ounce.

“One reason we are so positive is because the historical driver of prices has been absent. Geopolitical risk is increasing, the Fed is still expected to cut rates, and Western investors are going to start looking to hedge their portfolios. When investors look to add protection and diversification, we expect gold and gold equities to benefit. That makes me really bullish.” – Imaru Casanova, VanEck

What Idaho quant and gold fund manager Peter Palmedo and I have been discussing for almost three years now also is on Imaru’s tag list: reciprocal gold-blue chips theory. Also known as western payback into gold coupled with withdrawals from most perpetually rising Fortune 1000 equities.

“How high do (gold) prices have to get? We have seen markets pay more attention (of late), but it’s going to take a real pullback in the broader equity market to drive investors to gold. We need to see investors feel the pain of lacking diversification,” Imaru Casanova says.

TCRs, see trading note below.*

I have the 2-minute, graphic Auramet piece for those who wish to read it.

I also have a deep read into copper prices, smelter cuts, merger-acquisition talk, supply-demand for industrial metals, silver in Mexico … and even skepticism about AI-generated energy needs this decade (something that copper and uranium producers/explorers often cite for further price gains in their elements). Merely ping me.

* Trading notes: this week and last, as discussed, I added shares of Elemental-Altus Royalties ELE, EMX Royalty EMX, Metalla Royalty MTA to the piles here at home.

** Ivanhoe(s): Ivanhoe Mines next week April 30 pre-market will publish its Q1 income statement; I expect insight into the higher copper prices that March and April have delivered; also perhaps sotto-voce talk that a partner will emerge soon for Ivanhoe’s Western Foreland copper discovery near the producing Kamoa-Kakula copper mine; plus Kipushi zinc-copper and Platreef platinum-nickel-gold-etc mine (South Africa). Ivanhoe is our largest resources holding.

Ivanhoe Mines’ forward price-earnings ratio of 47 per share likely will shrink as projected earnings rise — perhaps after income and margin numbers and (maybe) revised guidance are revealed next week.

I have been purchasing this week and last more of explorer Ivanhoe Electric IE’s shares. The explorer (Arizona, Utah, Montana, Saudi Arabia) with Typhoon drilling technology is part of the Ivanhoe Capital family. IE shares on NYSE rose 10% Friday.

We own approx. $1.4 million of the two, 95% of that Ivanhoe Mines, much of it held since 2003 when the miner was Ivanplats in South Africa. See IVPAF chart here please.

I also have been adding to our Alamos Gold AGI, which in my book is the performance winner of 2024, 2023 and 2022 and now, with mergers and a looming purchase of most of Argonaut Gold, now a $6 billion market value on NYSE.

I have been adding to our platinum via Aberdeen Platinum Trust PPLT; and to our gold-silver holdings via Sprott closed-end Gold & Silver Trust CEF.

— Thom Calandra

TCRs, boost metals watchdog GATA.org and get The Calandra Report at a discount — tell your gold-believing friends, family, partners and wanna-bes. Here please.

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.