TCRs, updated May 2

Please see close of report

for RECIPROCAL GOLD/PETER PALMEDO ...

and for trading buys and sales. -- Thom Calandra

EMX | WVM | SSVR | VGCX | IMV | ATLX | AGI

IMV Inc. continues to suffer a decade-plus of spent capital by the indebted Nova Scotia immunotherapy lab.

Just announced Monday May 1 is a restructuring filing by long-suffering IMV, which has two clinical trials in Phase II: lymphoma and ovarian cancer.

For shareholders, including me (8 years running), this filing looks like yet another blow. Still, was court protection necessary for the indebted company, one albeit with a negative net worth (market cap minus debt)?

Filings show the lab was facing only about $50,000 of principal payments on loans due this year. Its chief lender, a $25 MILLION one, is Horizon Technology Finance (Nasdaq: HRZN).

Unless IMV broke a loan covenant, the lab could have continued its clinical efforts through much of this year.

One of many questions: would a court appointed trustee allow the IMV board to spend cash on hand to get to the end of September or October with a sharply reduced burn rate — for the purpose of showing definitive and promising response rates for patients in the DLBCL lymphoma trial, and possibly the ovarian trial?

Such an outcome, or pause on the debt, likely would be accompanied by an investment proposal that could provide a decent chance of the company reaching a higher value — one that would allow the lender(s) to recoup all loans, thus keeping the company running so that patients might be enrolled in two current cancer trials until an endpoint or lack of one is met.

IMV Initiates Restructuring Proceedings Full article

A COURT-APPOINTED trustee IS OBLIGED to protect patients and employees first, government tax liabilities second, creditors third and equity holders (SHAREHOLDERS) after that.

The Canada creditor protection will at some point extend to the United States as indicated in what is called a CHAPTER 15 filing.

A Chapter 15 bankruptcy is designed to coordinate U.S. and foreign courts.

Plus side: I am struggling to find one.

One large, long-holding shareholder: “IMV has a good board in place, mostly. (Finally.) The company needs to go on a starvation diet to survive long enough to bring in the (lymphoma, ovarian cancer) data.” * More below.

IMV says it intends to pursue “an outcome that will allow its DPX (cancer vaccine) delivery technology and associated lead asset, maveropepimut-S, to realize their full potential.”

The filing for indebted IMV (to the tune of approx.$25 million USD, at last look) means the cancer lab’s shares could remain halted for weeks –– “as it is anticipated that the trading thereof will continue to be halted until a review is undertaken by the TSX and NASDAQ regarding the suitability of the company for listing on the TSX and NASDAQ.”

How might such a filing, essentially court protection from demands, if any, by lender(s), benefit the cancer patients who were undergoing clinical trials (DLBCL lymphoma and ovarian cancer)?

Perhaps the trials, now pausing their enrollment of patients, says IMV, still have ahead that elusive data-set that shows overall response rates notching acceptance for expedited FDA commercial trials.

Any sale of the company would require 2/3 shareholder vote at a special EGM. Why would shareholders approve a sale when they would receive nothing?

One patient away? One arm of IMV's ongoing DLBCL lymphoma trial, with Merck's Keytruda (pembro) immununotherapy drug, is designed for 30 patients' enrollment. IMV's maveropepimut+Keytruda could -- I emphasize the conditional -- could show 9 (or 10?) patients of 30 planned enrollments with positive outcomes. Eight positives supposedly are in the bag. *

Also — as reported in April: TCRs, this spring’s IMV stock gains — microscopic market cap of $10 million USD or so — easily could fall into the category of death-spiral manipulating by asset managers who joined in the most recent financing/money raise via equity sales and are — who knows? — shorting their stock, selling their warrants, algo-deceiving-rhythmically boosting the stock price by pennies per day.

All to be followed by the crushing sale of a million or two shares that profits them and submerges individuals yet more?That was then, as in weeks ago. Before the court protection filing May 1.

Queries? CEO Andrew Hall is ahall@imv-inc.com. Pictured above.

* LYMPHOMA TRIAL: Enough patients said to already be treated in DLBCL LYMPHOMA trial (with Merck’s Keytruda) to reach a primary endpoint of success, if follow-on scans are positive. If approx. 35% of patients in the still small Phase II trial show positive responses, IMV presumably would disclose the results. See above.

Reciprocal Gold: Starting Now?

We have discussed Peter Palmedo‘s reciprocal gold musings here at The Calandra Report/TCR numerous times. Peter is an Idaho fund manager who takes large stakes in explorers and miners and then seemingly holds for ages. West Vault Mining; Vista Gold just two among many for his Sun Valley fund. (I own shares of Nevada shovel-ready West Vault Mining WVM WVMDF)

This week [May 2 right now as I write this], the quantitative notion of reciprocal gold looks sound: bank stocks, other blue chips clobbered worldwide as gold (and other precious metals) gain 1.5% and more. The equities, naturally, ar rising 2x to 3x those: small to mid-sized producers outpacing the pack, led among our TCRs by Alamos Gold AGI and Victoria Gold VGCX VITFF.

See: 30 Years Making Case For Patient Gold

‘When financial asset returns are zero or close to zero, the return on (the physical asset) gold is 20 percent on average yearly. Compound that.’ — Sun Valley Gold fund’s Palmedo

“Liquidity is a coward; it disappears at the first sign of trouble.” — the late strategist Barton Biggs

“Liquidity is a coward; it disappears at the first sign of trouble.” — the late strategist Barton Biggs

Research from Yale-trained economist Biggs and others showed a mean reversion function of the S&P 500 Index and gold. As in, financial assets (née blue chips) will boom and the value of gold (and other monetary metals but primarily gold) will sink— for as many as 10 years. Vice-versa, too.

We are I believe starting to see the vice-versa.

Trading this week and late last week: bought more Ivanhoe Mines; sold two that were lagging my expectations: Avino Silver & Gold (ASM) and CES Energy CESDF.

Sold about 15% of my stake in Group Eleven Resources (ZNG GRLVF) at break-even. I see Montreál hot-hand investor Michael Gentile is ‘maintaining’ a 19.9% stake in the Ireland zinc and polymetallic explorer. See release.

Bought more EMX ROYALTY EMX as indicated this weekend — in wake of seemingly bizarre offloading of shares we saw Friday just before the close. (See Weekend The Calandra Report/TCR)

Still marveling at Atlas Lithium‘s ATLX gains going into May: triple the price I entered less two months ago (and double the price at which I then sold.

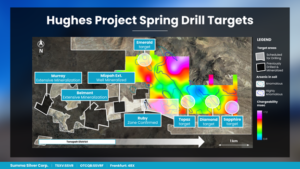

Sold half my Summa Silver SSVR SSVRF stake at break-even. Fresh drilling at the Tonopah, Nevada, camp now under way. See release. Map just here of the Hughes project (yes Howard, that HH) ; been there and likely will be back in Tonopah in June looking a third time at West Vault Mining‘s Hasbrouck gold project.

— Thom Calandra [As reported numerous times, we here at home are down more than $500,000 USD.]

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.