Obscure and way, way oversold candidates with real-life assets (all of which we own here at home): Summa Silver SSVR; Banyan Gold BYN; Contango Ore CTGO; C3 Metals CCCM; Victoria Gold VGCX; Val-d'Or Mining VZZ; others (you know 'em).

Plus: C3 Metals Jamaica | PDAC Leaders

TCRs,

Yes, Happy Gold Friday.

Weekend safe-haven buying by central banks (Gaza; Ukraine; Red Sea) is one driver for the near-$2,100 gold price today March 1, 2024.

This is the best read — from ING in Netherlands — dissecting the spurt Friday.

“Strong central bank buying has offset ETF outflows. Central bank demand maintained momentum. Annual net demand amounts to 1,037 tonnes – just short of the record set in 2022 of 1,082 tonnes – as reserve diversification and geopolitical concerns pushed central banks to increase their allocation towards safe assets. The People’s Bank of China and National Bank of Poland were the driving forces.”

A Happy Gold Friday, that is, for the futures contracts, the physical holding trusts (CEF is my preferred one, Sprott Physical Gold & Silver Trust); and the coins, bars and nuggets in the hamper or safe-box.

By some estimates, metals equities — most of ’em (barring uranium, oil explorer-producers, select copper producers) — are in the aggregate 40% below any fair value ratio of equity value pegged to the gold price.

Let me present this as a real question from an overseas subscriber:

“It is really very hard for me to understand what is happening with metal

stocks. Gold is at all time highs. Silver is about 8% lower (for 12 months). Copper is about 10% lower from 12 month highs and more or less up from the lows the same percentage.”

“On the other hand most metal stocks are at 12 month lows (most of them at multi-years lows). Big ones Franco Nevada, Barrick Gold -40% to -50% lower. Medium caps are down 50% from 12 month highs at least. Smaller ones — royalty companies such as EMX (which just recorded $14 million of revenue in Q4 — see report) — are near their 52-week lows. There are some exceptions — like Ivanhoe Mines (all time highs) IVN IVPAF.”

Our overseas (western Europe) investor asks, “What do you think about this strange situation?”

My response: when gold closes above $2,100 spot for a week or two then seeks $2,200 an ounce, the migration by ordinary folks who do not own it, or need it in their long-short hedge funds and traditional mutual funds, will turn the stocks higher almost instantly.

(Friday is actually a good start for some of the best depressed candidates, explorers, producers, and battered stocks of royalty-cos such as EMX Royalty and developers.)

Let me give you our trusted trading source, banker and investor Simon Catt at Arlington Group Asset Management in London.

Simon’s take in brief:

Simon Catt: I think we are very close to a breakout above all time highs for gold and silver will follow — within weeks but I have been hoping/waiting for months now…

Simon Catt: Asian demand is the bull case — we just need U.S. ETF supply (see ING article please) to stop. Equities will catch up very quickly when physical moves to new highs, within weeks I think.

Some already are ‘catching up.’ McEwen Mining‘s profit report Friday lifted MUX shares 11.5%.

Net for 2023 included profits from several mines (MEXICO, NEVADA) and a $224 million accounting gain linked to partially owned McEwen Copper, an Argentina miner that plans to go public. See MUX release please.

Enough for now — off to Toronto for the yearly PDAC, see below please.

C3 Metals In Jamaica Sandals

Jamaica (former) hotel operator Bobby Stewart is dipping his sandals into what he says is a “new and exciting industry” for the island.

Bobby in Kingston hails from the large Stewart family, which runs the Sandals group. Robert Stewart, eldest of seven of the founder’s children, is using his minerals exploration-co to take 5% of C3 Metals CCCM CCAUF, whose shares I own and whose Jamaica projects I visited.

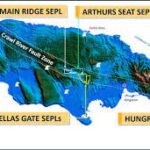

The particulars of what is a land-sharing partnership are here for C3’s Main Ridge Super Block Project.

Bobby’s Geophysx Jamaica controls land adjacent to Main Ridge. Dan Symons, CEO of C3, tells me Bobby was $2.8 million CAD of $8.05 million C3 raised via equity and a reverse consolidation of shares in November 2023.

“We agreed to an initial work program and budget of $475,000 USD per party, which we can agree to increase or decrease together,” Dan tells me from Toronto.

“We wanted to continue to hold a 100% interest in Bellas Gate and the majority of Arthurs Seat (copper-gold). The clear synergies geologically were around the past producing Pennants mine and our Main Ridge concession.”

TCRs, I think Bellas Gate, as we saw at the site, is attracting suitors in part because of a hydrothermal system “based on the geophysical and geochemical footprint,” Dan confirms.

C3 is an approximate $33 million CAD market value.

CanAlaska Uranium

See: CVV CVVUF coverage this week — another Athabasca Arrow possible with hesdy grades rarely seen. Early success at CanAlaska and Cameco‘s West McArthur project are boosting CVV shares as much as 60% in extreme trading this week. I added to the pile here at home.

Toronto Panel: Global Take On Metals

PDAC: the annual Toronto metals investors, prospectors and developers conference arrives in 2 weeks.

My panel’s details: Investment Leaders Forum: March 3 3:35 p.m.

Hall E, on the Investors Exchange show floor, 800 level.

Kai Hoffman of Frankfurt, an investor, speaker and conference organizer, is moderating the panel.

Panel title: The global economy vs. the resource sector: Finding a win-win situation

I hope some of our TCRs can make it. Matt Geiger, trusted source and SF fund manager (MJG Capital), is also on a panel there in the morning.

Note: I lost track of Benchmark Metals (with Lawyers development in British Columbia). Execs at the newly merged Thesis Gold TAU THSGF set me right. GEO-CEO Ewan Webster is still in charge — a $69 million CAD market value. Exploration at Ranch and Lawyers gold projects is ongoing. See boilerplate please.

— Thom Calandra

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.