Gold Landscape Global Style

This gold reasoning from our banker friend, Simon Catt, in London.

Well worth the 3 minutes, and superbly worded. We last heard from Simon of Arlington Group via Saudi Arabia‘s metals and mining forum.

I am at PDAC in TORONTO. The talk of the mining show this year: Will now-$2,100 gold lift metals equities from their years-long basement levels? I think so, but then, I always do. See * at close of this report for investments C3 Metals CCCM and Osino Resources OSI.] Also Seabridge Gold SA SEA’s dilution grafik; Western Copper & Gold WRN;’s 35% share gain in a week.]

“I buy gold because I’m afraid — afraid that it will go to $7,000. To $8,000.” — Sprott founder Rick Rule at the show.

The London-global take? Read Simon Catt here please:

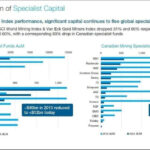

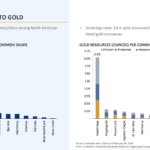

It doesn’t matter much what you and I think – we ain’t got cash. If you haven’t already seen it here is some recent research illustrating the shrinkage of UK and Canadian dedicated mining funds since 2011 down 60% and 80% respectively.

Australia is no better off, 431, over half of all listed Australian resource companies are capitalised at less than A$20 million with an average capitalisation of A$9 million and cash of less than A$2 million.

So what about the ‘big’ and the ‘smart’ money?

In February, Amazon founder Jeff Bezos sold $8.5 billion or 50 million of his shares, Bill and Melinda Gates sold 3% of their stake in Microsoft at the end of 2023 and Mark Zuckerberg founder of Meta (Facebook) made his first sale for two years selling $428 million of Meta in Q4, 2023.

Jamie Dimon, CEO of JP Morgan and the second most important banker in the world after Jerome Powell sold $150 million of shares in JP Morgan for the first time ever in February.

Nvidia insiders sold $80 million of shares after the blowout positive earnings release last week but UNLIKE my portfolio of junior mining shares this was ONLY 99,000 shares of Nvidia.

If only I could buy an oat milk cappuccino on Piccadilly if I sold 99,000 of any one of my miserable nano cap portfolio.

Thanks to the Crescat Capital February 28th newsletter https://www.crescat.net/a-macro-shift-at-hand/ we noticed Billionaire Family office Stanley Druckenmiller has been selling Microsoft, and Amazon and buying Barrick Gold.

Here is Stanley’s view from a “fireside chat with equally famous hedge fund legend Paul Tudor Jones (they are worth $14 billion between them) in October 23:

“Under a Trump administration, what I would be terrified of because he’s a big spender, he doesn’t believe in the Federal Reserve, we go back to the Arthur Burns [a previous US president who is regarded as causing the inflation of the 1970’s] model times two. So, you have fiscal recklessness, un abandon, just like he’s run his business. And on top of that, he puts a puppet into the Federal Reserve. Under that model, you have to be open minded to eight to ten percent inflation, a takeoff like you did in the 70s after probably an intermediate lull here after a year or two.”

Druckenmiller is best known for running one of the most famous macro hedge funds, The Quantum Fund with George Soros

ALL the SENSIBLE people I know have LOTS of CASH. US money market funds have over $6 trillion of cash and Japanese retail investors sit on $7 trillion.

I got 99 problems but cash ain’t one.

Commodities have not been this unloved in 15 years. Trouble ahead for Goldilocks?

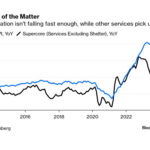

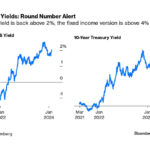

Inflation is rising and repricing risk aka the US ten year yield.

So, Trump 2 will be different to Trump 1 because in Trump 1:

[2017 during Trump’s first Presidential term] Then there were 1.3 unemployed workers for every job opening; today there are only 0.7 workers and that’s before Trump attempts to deport immigrant labour [Source: The Economist, Donald Trump is winning. Business beware, Jan 18th, 2024]

This past evening during a family dinner I had a sneaky check of my watchlist I noticed gold was up +$40/ounce. I asked two fund managers and one market commentator what I had missed and no one knew.

Perhaps the GREAT PRECIOUS METAL BULL MARKET OF THE 2020’s has started in STEALTH MODE?

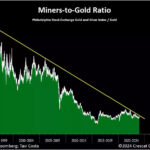

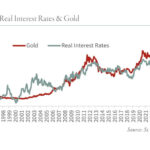

Gold bullion rallied DESPITE a 2% rise in real interest rates since 2020.

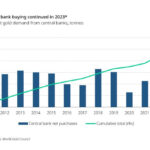

Why? Because of record and ongoing Central bank buying of bullion.

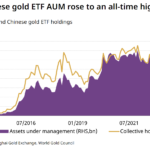

Miners on the other hand have followed ETF flows lower.

Perhaps the answer to the question as to why gold is up is as simple as: there are more eastern buyers than western sellers.

Here is what Druckenmiller says about Gold Vs Bitcoin:

On Gold: “I’m 70 years old… I own gold.” On Bitcoin: “I was surprised Bitcoin got going but it’s clear the young people see it as a store of value. 17 years, to me it’s a brand. I like gold because it’s a 5000-year-old brand, but young people have all the money. So, I like both. I don’t own any Bitcoin but I should.”

Thank you, Simon.

*Harvested from PDAC: TCRs, I am purchasing more C3 Metals CCCM, Jamaica gold-copper developer, in the wake of the Geophsyx Jamaica partnership. Jamaica’s Bobby Stewart, formerly of the tropical hotel chain Sandals Resorts, will get sunlight on the Bellas Gate explorer C3 Metals.

Ping me please for brief notes about Western Copper & Gold’s WRN 35% stock ascension in the wake of a new CEO slot and awakened interest in its Yukon deposit; Xtra-Gold Resources‘ continued exploration, alluvial and cash-at-the-ready Ghana strength XTG XTGRF.

Here: Seabridge Gold’s SA SEA partner search for the KSM copper-gold deposit in British Columbia. Spoken as a 25-year (this October) CEO from Rudi Fronk — at our yearly East Front Street PDAC pub meeting: the current gold rally puts SA SEA “just over US $1 billion, but still only valued at $6 per ounce of gold,” Rudi says.

Also here about Osino Resources OSI OSIIF and the 30% discount to the China miner Yintai’s all-cash offer for the Namibia gold mine development at Twin Hills. I have been buying more.

Osino dynamic today from CEO Heye Daun verbatim: “There may be unfounded skepticism that the deal may not close due to the Canadian regulators under the Investment Canada Act deciding that they have jurisdiction not to approve the deal. This is highly unlikely for 3 reasons 1) gold is not a critical mineral 2) our market cap is below CAD500m and 3) all of our assets and infrastructure are outside of Canada. We are comfortable the deal will close but it will take around 4 months or so to get the approvals in Namibia and China.”

Heye adds, “The sellers are all out. Osino is now around half owned by arbitrage hedge funds who need to earn around a 30 percent annual return and our discount assuming a 4 month closing period is thus warranted more or less. Just a different interpretation. We are very comfortable, we continue to advance the asset and we are working towards closing the deal.”

So yes, I have been adding more OSI here at home. As Rick Rule said at PDAC in our all-day investing forum, and I paraphrase, ‘When real assets get unfairly (whacked), buy ’em. It’s a gift that will keep giving.’

— Thom Calandra

THE CALANDRA REPORT