enCore Energy | Ivanhoe Electric | Amex Exploration

[See trading note below please. *]

UPDATE: Platinum Group Metals PLG PTM shares appearing to notch higher at (HOPEFULLY) sustained levels — a beneficiary likely of its ongoing Saudi Arabia (KSA) partnership for platinum metals smelting of South Africa ore. I own PLG shares, a small stake.

EARLIER IN THE WEEK: most metals’ spot and futures prices were gaining markedly (before a week-ending sell-off of gold, copper, platinum). Silver had started behaving itself and is 21-cents below a 4-month high. OUTPACERS this week: enCore Energy EU; McEwen Mining MUX; Amex Exploration AMX; Seabridge Gold SA; Lavras Gold LGC; Awalé Resources ARIC; Coeur Mining CDE.

** In this video interview, the Bill

and Janet Sheriff uranium co.

I reference, and own,

is south Texas producer

enCore Energy. EU. Apologies

for that. (Minutes 10 to 12 approx.)

[View here at INN’s YouTube channel or here at our The Calandra Report Video Library.]

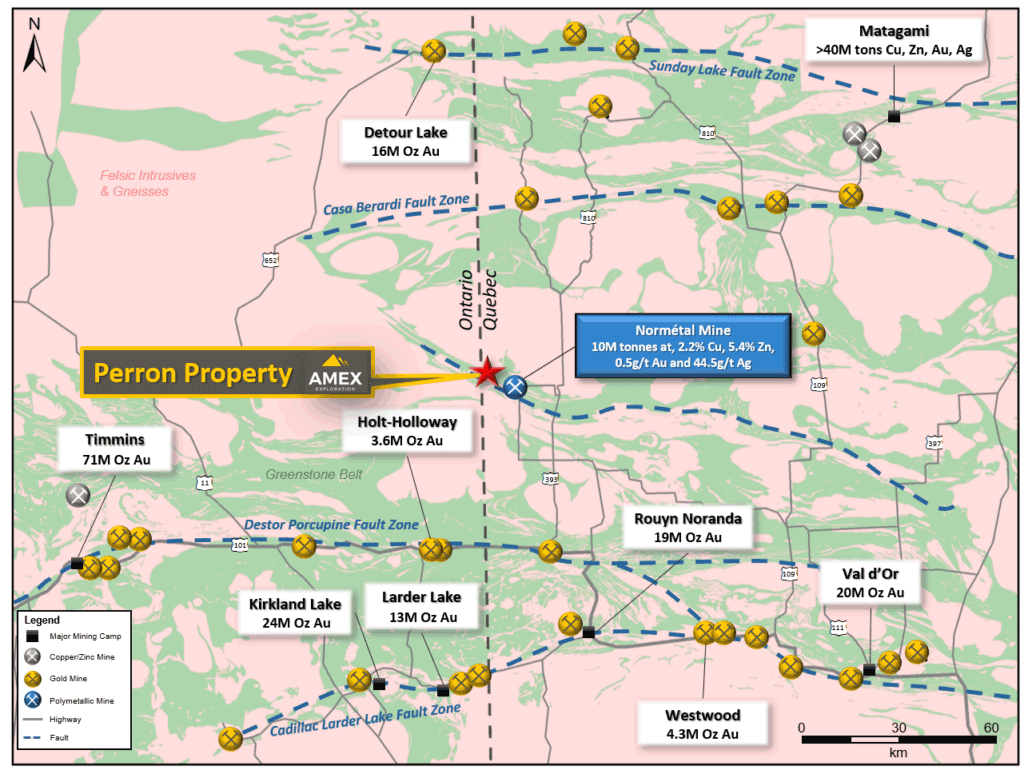

I saw Amex Exploration‘s early GOLD (AND COPPER) exploration at its Perron Project in the northern Abitibi gold belt of Québec three years ago. Amex is at last stating a resource — in a few weeks I see it coming. The project’s rich grades and expanse scribbled on the proverbial back-side of the envelope could put the filing at 3 million ounces; average grade is anyone’s guess, but likely 1.5-gram plus.I have been talking to CEO Victor Cantore, as I do every other month.

- This past week, Amex AMX AMXEF is reporting 3.43% copper with silver, zinc and gold. It is right on line with the Normétal Mine trend next door. The adjacent Perron gold project is known for its rich gold strikes in hundreds of thousands of meters of drilling. I no longer own AMEX but made money with it during a two-year span.Perron covers 4,560 hectares. Amex owns it kit and kaboodle, and as Victor notes, “We have money we can only spend on exploration, and that is what we do.” Also what the company has been doing for four years: oodles of flow-through exploration cash spent; lot of holes drilled. I understand a prelim-econ study will follow a compliant resource statement — the first-time resource due in by late April or in May.

We’ll see. It is rare that a new resource, heralded by the company, moves the shares dramatically, either way. In Amex’s case, we’ll see all categories, including I think indicated gold. Probable booster: forest fires at the project meant tree clearing and road building paid for by provincial government — result, more holes tight meter-spreads. Note: I RESTARTED a small AMX AMXEF stake again (Friday). Please see maps.

Added Thursday March 26, 2024 — Another high-grade strike at Perron’s Gratien zone for Amex Exploration: 76 G/T gold over 3.50 meters. See release please.

- ORFORD MINING ORM ORMFF, Québec gold-nickel explorer, expects its shareholder vote for the Alamos Gold AGI transaction in a week, March 27, 2024. See the details here please, I own ORM and AGI.

- Shares of DHT MARITIME HOLDINGS DHT, a large crude-oil carrier-vessel in Europe and the Middle East, look to be headed back to a 12-year high mark. The shares, up 2% today on NYSE, are volatile in the rebel-assaulted Red Sea and vicinity. I own the shares for the dividend and the drastically higher spot leasing and contract rates notched in the past 15 months.

As promised:

- Gold target of $2,800 an ounce seen in chartist’s cup and handle calculation. See chart here please. “Whatever the height of the cup is, add it to the breakout point of the handle. That figure is the price target,” says Las Vegas chartist and The Calandra Report subscriber Al Marden.Thus, $1,900 + $900 = $2,800. When? The current price, $2,160 an ounce, will stand active producers in good stead with their mining shareholders. A sustained price run above $2,200 an ounce will stand mining-co shareholders, long suffering, in good stead.

- A Cote d’Ivoire gold drilling update (2.4 grams at 75 meters of intercept) just in for an obscure-co: Awalé Resources ARIC OCI. See release please. I tag ORECAP OCI ORFDF because perennial new-co-maker Stephen Stewart via his Orecap Invest owns sizable takes in ARIC and several others — American Eagle Gold AE; QC Copper & Gold QCU QCUFF; Mistango River Resources MIS. I own Orecap because of its principals’ first-hand stewarding of these investments; and because its pitiful $11 million market value is half cash on the books.

- I bought more shares of Orecap OCI ORFDF, microscopic holder of four or five gold, copper and uranium stocks — run from Toronto. Outpacers include assay-moving Awalé Resources (Cote d’Ivoire) ARIC; American Eagle Gold EA; and Mistango River Resources MIS; and Baselode Energy FIND. Trading volume earlier in the week for OCI ORFDF is about 12 or 13 times the usual. It is an $11 million CAD company. OCI portfolio here please.

- CanAlaska Uranium is optioning yet another Athabasca Basin property to a pub-co, this one Nexus Uranium NEXU. At the rate it has been distributing its basin uranium prospects to companies in exchange for stock and cash, CVV CVVUF shareholders will see a new name pop into their brokerage accounts twice or three times a year. CanAlaska is good about that — see: Core Nickel CORE spinoff please. And Nexus release.

- GoviEx Uranium GXU going all in on its Niger uranium project, Madaouela, in the coup-queasy nation. (Exchange country risk for rich grades, I happen to believe). I own shares. See release please.

- *There are 571 drill holes into Alta Mesa now for enCore Energy in Texas. Investors appear to support the just-released well-graded uranium holes. See the release please.

Note: Xtra-Gold Resources XTG XTGRF CEO James Longshore is out explaining the Ghana explorer-producer’s singular strategy for shareholder returns. The strategy, that is, of no-dilute, own-all-equipment, pay all salaries and don’t raise money with stock placements. While preparing the expanding Kibi gold project for sale in west Africa.

Earlier: Copper cathode at The Calandra Report

— Thom Calandra

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.