Plus: Ivory Coast Stunner — Awalé’s Odienné Gold ‘Hits’

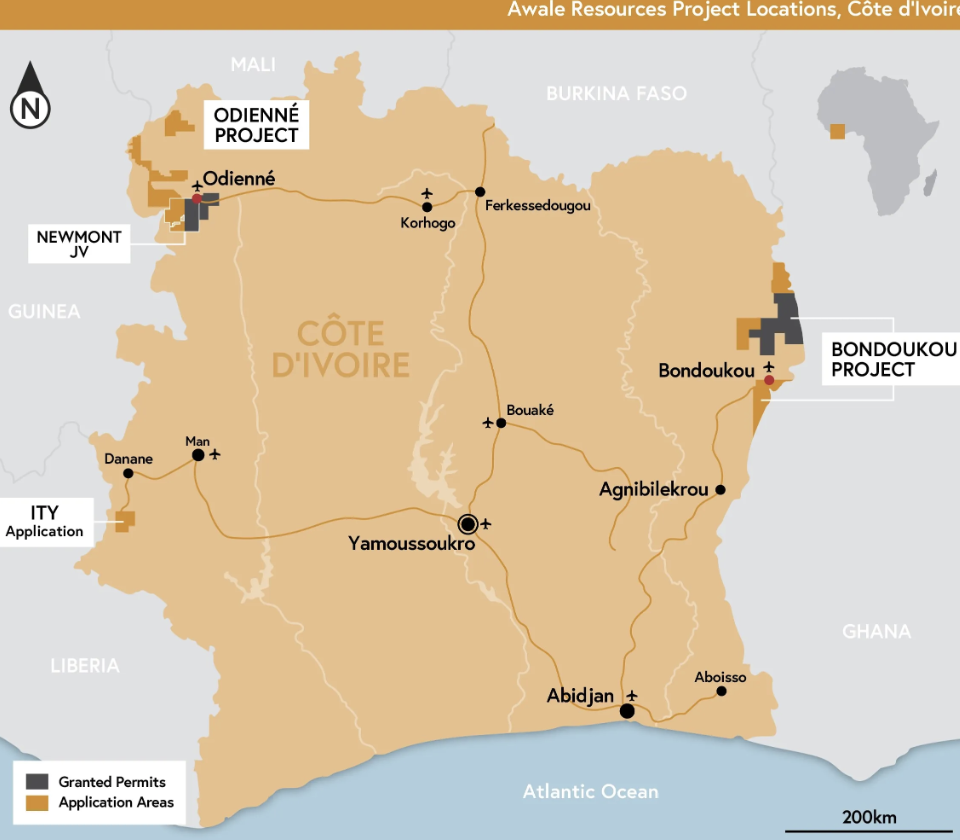

Alert: Awalé Resources AWLRF ARIC (shares Monday in Canada rising 97%) is out with another potent gold exploration hole — Odienné in the northwestern corner of AFRICA’S Ivory Coast.

More below on what portfolio owner Orecap Investment‘s Stephen Stewart is calling “one of the best holes of the past decade.” Scroll to close of report please. *

[See trade note at close please.**]

First, TCRs, this from banker Simon Catt, our money flows tracker at Arlington Capital in London, is talking high-risk and metals:

If you’re sitting on any spare cash for gods sake BUY SOMETHING RISKY. Meme stock chat forum Reddit closed up by almost half on its market debut this week a day after AI proxy Astera Labs surged 72% from its IPO price raising $713 million on Nasdaq.

The Fed says it’s OK if inflation is “bumpy,” which is code for not going back to its pretend “2% supercore” blah blah target. Does anyone actually believe prices are only increasing at 2, 3 or even 5% a year? I mean for starters you may have noticed your mortgage cost has more than doubled in three years and housing makes up ~ 30% of the CPI inflation calculation.

The labour unions in your city interrupting your train journey or holiday flights seem to understand that they need +10% annual wage growth to keep up with the cost of living.

All U.S. Federal Reserve governors now agree 75 basis points of interest rate cuts are coming.

Rather than taking the punch bowl away, the Fed is pouring in MORE JUICE. Stock (and some bond) markets worldwide love it; too the U.S dollar vs. most currencies.

Also big gainers this first quarter of 2024: bitcoin, other crypto currencies, cocoa and cocoa powder (thanks to climate change and endangered shipping lanes), Argentina bonds … and voilá, resources: uranium, copper, gold, even platinum, all perking up.

The Fed’s challenge, says Simon, who reported back to us in January on the KSA Saudi Arabia Minerals Forum — “More Than Just An Oil Well,” is that a gravely indebted 10% of America’s population (voters) earning less than $25,000 a year and highly levered companies ARE experiencing a HARD LANDING.

So the Fed, members of which are appointed by politicians in an election year has to choose between blowing bubbles and helping out the poorest 10% of the United States. Let’s party like it’s 1999?

Commodity prices have caught a bid. (See CRB Index below.)

Apart from Nvidia, Bitcoin and Argentine Bonds, how about a little DIVINE INSPIRATION for Easter? Specifically:

Helix Exploration https://www.helixexploration.com/home is a hot IPO. The company was looking for £5 million and came back with £23 million of demand — of which it took £8 million on the London LSE. (Simon Catt discloses he is a “small investor” in pre-public Helix.)

At its 10 pence IPO price, Helix will have a value of approx. £13 million, which is about one sixth of fellow US helium explorer Pulsar Helium (PLSR on the TSX) — up 400% since its August 2023 IPO.

Helix’ is scheduled for its IPO on London’s AIM market April 9.

HELIUM; the inert noble gas and second lightest element after Hydrogen is up ~ 10X in ten years and Exxon will charge you ~ $600/Mcf on long term contract about 200 times for valuable than natural gas.

Helium is rare, inert (can’t be burned) and has the lowest boiling temperature of any element on our planet. Demand is driven by semiconductor manufacture – helium is used to sterilise and cool the manufacture of computer chips and to cool the jets of rockets as they take off.

Helix Exploration is exploring for helium in the U.S. state of Montana, which Simon says is a much better place to find the rare gas than say Tanzania — because the United States is the world’s largest consumer of helium and has the oil and gas infrastructure to capture, process, store and transport helium to its end demand at NASA or an Intel fab.

Helix Exploration is run by ‘Mr Helium’ Bo Sears, who wrote “Helium: The Disappearing Element.”

Thank you, Simon Catt at Arlington Capital Management.

Buona Pasqua.

Awalé’s Odienné in Cote’d’Ivoire *

Just out: Awalé Resources’ Charger targets at Odienné show 45.7 g/t gold over 32 meters. “It is one of the best gold grade/thickness intercepts of the past decade. Furthermore, the intercept is shallow, with continuous gold mineralization throughout,” says Stephen Stewart of Orecap Investment OCI ORFDF, an ARIC AWLRF Awalé share owner. Orecap stock and those of Awalé, both small market caps, are rising on strong volume in early trading Monday.

Stephen Stewart chairs Awalé and several other companies (below) in his Orecap Investment portfolio.

TCRs, this is a follow-up to Awale’s BBM target hits announced last week — one that lifted the tiny explorer’s shares. “The stock was 11 cents in February; it’s $85 cents now,” says Robert Sinn, who tracks small gold, copper and silver explorers at CEO Technician. “Subsequent drilling , a 25,000-meter program, will determine its longer-term value.”

A public company, Orecap Investment, owns approx. 13.5% of Awale, with another Stewart-founded entity, private Ore Group, having affiliates who put the Awalé ownership closer to 18%. Newmont Mining owns 15% via an earn-in pact with Awalé as operator. I own shares of Orecap as indicated last week here — see The Calandra Report please.

- LAST WEEK’S Cote d’Ivoire gold drilling update tallied 2.4 grams at 75 meters of intercept at BBM target: Awalé Resources ARIC OCI. See release please. This is an approx. $50 million market cap with the stock rise Monday … and please, do not chase. I think we can expect to see a share placement to raise money at higher prices, which sometimes dampens enthusiasm, albeit in this case at so-called ‘accretive value’ level, a higher stock price.

- Orecap OCI ORFDF’s perennial new-co-maker Stephen Stewart via his Orecap Invest owns sizable takes in ARIC and several others: American Eagle Gold AE; QC Copper & Gold QCU QCUFF; Mistango River Resources MIS, Baselode Energy FIND.

STEPHEN STEWART AT PDAC I own Orecap (as of last week) because of its principals’ first-hand stewarding of these investments; and because its paltry $14 million market value (rising with the Awalé hits) is about half cash and the value of its securities on the books.

Today, I intend to add to our approx. $1,400 USD ORFDF with another small purchase, $1000 worth ORFDF — made after I sell a partial stake, Monday pre-close, in perennially profitable Alamos Gold AGI. (Selling about 10% of our AGI holdings that have been held for years.) Fait accompli at 3:39p.m.ET re: both sale and purchase.

The results last week from BBM targets were enough to convince me to take a small stake in Awalé. See news releases by Awalé please.

Stephen Stewart, merchant bank Orecap CEO and sole owner of private Ore Group, this morning from Toronto about the Awalè hit:

“Andrew Chubb is a top notch geologist who saw something no one else did. He then convinced Newmont (which has the right to acquire 65% of Odienné) andOre Group of his vision, which is now being followed through upon with our recent series of news releases – highlighted by the best drill hole of my career announced this morning. OCI … made this investment at 12 cents, which gives us 8.3M shares and 4.2M warrants exercisable at 20 cents.” (Awalé shares Monday at 80 cents CAD.)

Stephen, with whom I spent time at PDAC earlier in March, has been selecting stakes for Oregroup/Orecap based on intensive reviews, with attention to price and pathways to becoming something rare in mining: a producer. OCI portfolio here please.

Orecap/Ore Group affiliates own stakes in American Eagle (10% of AE) and of QC Copper. He and his Oregroup partners recently staked to Cuprum, Ontario’s largest copper resource, “out of a distressed situation with a low valuation.” Bios, background here please.

** Trade note: Thursday March 28, 2024 — this week or next, we will be selling approx. $5,000 of our children’s DHT Maritime DHT for a profit to cover taxes and IRA contributions. In total we own approx. $23,000 USD of DHT, much of it held three-plus years. For the same reason, we also will be selling approx. $3,000 of our SPROTT GOLD & Silver Trust CEF, some of which we have owned since the original Central Fund CEF CEF.A in the early 2000s.

— Thom Calandra

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.