Banyan Gold | Contango Ore | I-80 Gold | C-3 Metals

Look at that USD go. See: DXY currency basket. “So it goes” (Kurt Vonnenegut).

Please see relevant non-The Calandra Report/TCR commentary below — no, not the Slaughterhouse Five author. Instead, Fred Hickey, a 34-year newsletter writer, talking gold futures (or lack of?). *Below.

Most investments, and our preferred metals-cos, are getting the beans kicked out of them. Strong dollar = weaker commodities.

Exceptions? Banyan Gold just in with a fresh 6.2 million-ounce gold resource at AurMac in Yukon. BYN BYAGF shares up smartly. I own a fair whack and seen the spread three times.

“Large companies,” CEO-geo Tara Christie tells me just now, “are looking for long-life assets. Some companies will look at this as heap leach at lower grade, and some will increase the cut and look at a mill with CIL (carbon-in-leach) scenario.”Baynan is the one with Victoria Gold’s Eagle gold mine, going into year 3 of producing, down the road. Own a whack of that one, too — VGCX VITFF.

“When they drilled out Eagle (and surrounding concessions), “the gold is there and when they mined it the gold came out.” Tara says. Her Banyan resource statement.

Index Decks

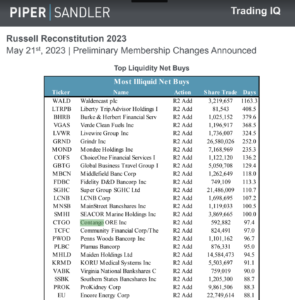

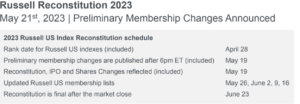

The yearly Russell (and other) index shuffles in June will shuttle volume into some metals-co shares; that is, the ones with small share counts likely will see price benefits.

I have two Russell additions on our The Calandra Report/TCR screen (and own both).

I-80 Gold is not a miner with a modest share count; it is a mid-tier explorer-producer in Nevada with 275 million shares and approacing a $700 million market value.

I-80 Gold is not a miner with a modest share count; it is a mid-tier explorer-producer in Nevada with 275 million shares and approacing a $700 million market value.

I-80 will go into the “broad-market” Russell 3000 and tighter Russell Microcap indexes after the market opens on June 26. IAU IAUX

Professional investors, funds, “benchmark” something like $12 trillion USD against Russell’s U.S. indexes. I-80’s summary here is a worthy explainer of the Russell process.

Contango Ore CTGO is the tiny-share count addition to Mr. Russell. The Alaska explorer and soon-to-be gold producer ‘s 7.6 million shares give Contango a $210 million market worth.

When I started getting into Contango, and 6 or 9 months later visited the Alaska operation (summer 2022), the NYSE-listed CTGO was about half that value.

Here is a Piper Sandler recon report: note Contango as what is called a “net illiquidity” candidate once metals funds and others need to recon their own baskets with CTGO.

* Fred Hickey has The High-Tech Strategist, a monthly since 1990 or so.

Past decade: three major gold bottoms: end of 2015, summer of ’18 and autumn ’22. “At each of those bottoms, Managed Money (i.e., hedge funds and CTAs) long gold futures contracts sunk to approx. 80,000. “Managed Money longs are now 139,000.”

Still, since about 7 days ago, futures open interest lost 41,000 contracts — a combination of long dumping and added shorts, Hickey says. Fresh futures data (COT report) used in this Friday’s commitment of traders round-up. Thus, Managed Money longs could be near 100,000, “and fast closing in on 80,000.”

Gold down yet again Wednesday-today: $1,964 continuous gold contract. “All fits,” says Fred, with a “very brief gold” decline, driven, he says by “hot money. Potentially sets up mid-June bottom (classic seasonality) or earlier.” He notes a weird gold money inflow into GLD ETF as gold’s price declined: in his words.

Oh, those 3 major gold bottoms – end of 2015, summer of ’18 and autumn ’22 occurred with gold at $1,050, $1,180 and $1,610 respectively. This means (potentially) “a rally would blow through the old highs (and likely way beyond). Exciting!” (His word and exclamation point.)

Peru: Yes, I know. Peru inhales wind these days for miners and explorers. Still, this nation with interminable permitting processes at every level is the world’s No.2 copper producer (copper price as you know getting pounded this month, and with it shares of my Ivanhoe Mines).

C3 Metals just in with a decently sized “maiden” resource at its Jasperoide copper and gold project in southern Peru. Worth a look as CCC CUAUF shares getting creamed.

Some 560 million pounds of contained copper and 320,000 gold ounces. See: Jasperoide press release.

C3 is on The Calandra Report/TCR screen because I went to see the Jamaica gold, copper, silver, lead-etc. concessions there in November.

Deflation: my protege Barbara Kollmeyer in Madrid at Dow Jones MarketWatch explored this with a “quant” fund manager. Worth a look.

— Thom Calandra