Platinum Group Metals | Ivanhoe Mines | Xtra-Gold Resources | C3 Metals | BeMetals | Alamos Gold | EMX Royalty

Country risk — think Africa, Peru, Chile, Argentina, South Africa; I could go on — is part and parcel of the vocabulary of mining.

Dictators, guerrillas, hothead chieftains, bankrupt currency reserves, IMF loan rescues, they scare the beans out of mining investors.

The deal-doers, not so much fear; more on-the-ground knowledge.

John McCluskey of Alamos Gold (Canada, Mexico, with a stake in a far, far, far-north nickel-gold-lithium-explorer) once told me beneath a northern lights sky show at Nunavik, Québec, that the biggest paydays in metals exploring come from going where almost no one has gone before (Orford Mining‘s concessions at Nunavilk… or sacrificing perceived ‘country risk’ for tremendous grades (gold, copper, platinum, nickel, etc.).

In the case of Alamos, John several years ago had his mid-tier Ontario and Mexico producer take a 26% stake in tiny Orford — where few, with the exception of a Canada entity mining almost obscenely profitable nickel at Glencore’s Raglan operation way up there; and a smaller, profitable and now China-owned nickel mine at Nunavik — have looked for nickel, platinum, gold.

Companies — the mining deal-execs who raise money and throw darts at maps — classify their country risks in specific vocabulary.

Peru –– permitting risk and local protest risk; Argentina — currency collapse risk; Chile — presidential edict risk; Ghana (& Nigeria, others in western Africa) — financial insolvency risk.

I could go on. South Africa — bribery, violence, power theft risk. Parts of Canada –– bureaucracy risk.

This leads to opportunities: when securities get cheap because country risk is overblown, or easing, or just wrong. For active mining investors, those who believe we are in a metals super-cycle of rising demand for gold, platinum, copper, nickel, etc., buying country risk is like seasoned bargain hunting. (One hopes. That is how I invest, TCRs. I get the timing wrong half the time.)

DRC Congo for copper-miner Ivanhoe Mines being a good example. After 15 and more years there, Ivanhoe’s people know all the ups and downs of a nation that is rich in copper, zinc, tantalum, cobalt … and diamonds. IVN IVPAF

You might say Ivanhoe’s supervisors, geologists, logisticians, mechanics, chefs, teachers are part of the fabric of the central Africa copper belt where its Kamoa-Kapula copper mine and its Kipushi soo-to-be zinc and copper mine lie.

I asked a few execs and country managers I know personally about country risk.

Dave Cole at EMX Royalty EMX has been dealing with nations and jurisdictions other than his company’s home state of Colorado to the roster tune of dozens.

EMX advertises itself (yes, I am a longtime shareholder) as getting potential royalties from 250 projects on five continents. It’s negotiating with China miner Zijin on a net smelter royalty pact in Serbia: Timok copper-gold. [Both companies look to agree to a modified royalty agreement in 2023.]

Dave tells me today, “Don’t forget social license risk; lawsuit from NGOs risk; permitting risk. Plus, many deposits in ‘stable’ countries never see the light of day. Like Pebble for example.” Pebble, that is, in Alaska’s Bristol Bay. See one NGO/non-governmental organization’s flag waving re: Pebble gold-copper — 20 years and running now.)

Frank Hallam at Platinum Group Metals PLG PTM in South Africa: “The issue in RSA these days is Eskom (the power-co) and rolling blackouts. Perhaps imperfect, the political and regulatory situation has been stable. Recent mine union contracts should provide for détente on the labor front. The general election in 2024 may cause some dynamics, but not really today.”

Geopolitical? “The issue with RSA and arms shipments to Russia is a bit of a wild card. It seems that may cool off in the days ahead, even if it does not disappear.”

Platinum (palladium, too) price? The issue currently affecting Pt prices is stage-six rolling blackouts and concern for how power shortages will affect mine production and smelting/refining. In the last quarter or two we have seen some reduction in production of all PGMs due to power shortages. The question is for how long and how bad? Most analysts see reductions in PGM output for several years. This combined with probable curtailment in production due to sanctions in Russia restricting equipment, parts and capital, will exacerbate the situation.”

Frank Hallam says analysts foresee supply side issues creating deficits in Pt supply for years. These same analysts predict continued price strength for Pd for a number of years, also due to the same supply side issues, and because the penetration of battery-EVs to the market will take longer than many predictions.

“We believe that all factors considered and allowing for price driven substitution between Pd and Pt, the price for Pt is going up, but prices for Pt and Pd are more likely to converge at modest levels rather than move to extremes.”

This material, TCRs, is as valuable as booking your own flight to Jo’burg (which I have done many times).

TCRs, as you know, I have been buying PPLT Aberdeen Platinum Trust every week now for months. Ditto for adding to my long-held Ivanoe Mines (which has a developing platinum-nickel-gold-rhodium mine at Souht Africa’s Platreef in the Bushveld Complex. I have threatened to start purchasing Platinum Group Metals, whose shares I owned on and off from 2003 to maybe 2017 or so.

James Longshore of Xtra-Gold Resources in Ghana XTG XTGRF: Ghana’s debt crisis is perennial — too much gobvt spending and dwindling tax revenue, for decades. The Ghana currency, the cedi, is a ski slope — all downhill. Stunning loss of value.

Contagion factor: South Africa’s four biggest banks likely will write off as much as $270 million of their investments in Ghana bonds. A loss of 60% or more in some issues, Bloomberg reports.

Still, 7 companies in mining plus tiny Xtra-Gold (familiar big names Anglogold Ashanti, Goldfields, Newmont, mid-size Galiano Gold), generate 35% of foreign dollars to the country. “That is a protection of a kind for mining there,” Jim says.

“It is no fun to have your country go thru an International Monetary Fund bailout. Still, it would be difficult to change the mining code (and shaft mining-cos),” he says. This is the 27th fiscal crisis in Ghana since a 1957 bailout.

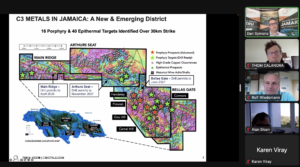

Dan Symons of C3 Metals in Peru and Jamaica (pictured above and below on an investor call): “Peru is not so much the political situation as it is the drill permitting; it can take two years after acquiring a new concession.”

Peru is the second largest copper producer in the world, after Chile. That is why C3 CCCM CUAUF is sticking with its Jasperoide property there, Dan told a small audience of investors.

TCRs, you might recall I was at C3’s Jamaica concessions: gold, copper, silver. Jamaica is all business when it comes to exploiting, or allowing explorers to exploit, their concessions. Plenty of labor; a steady mining code; stable government.

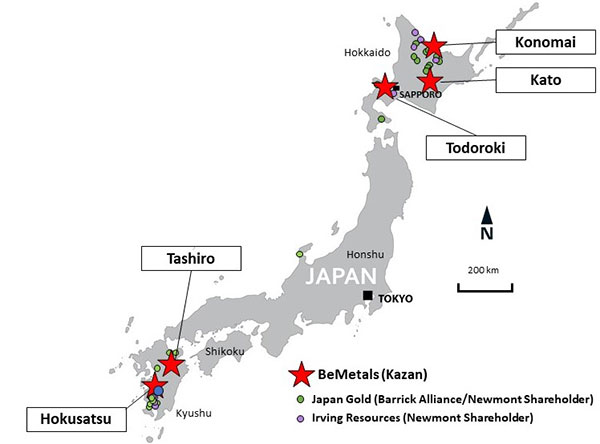

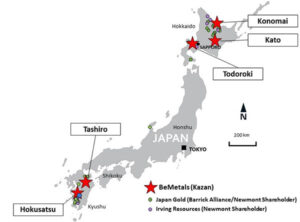

More Africa: John Wilton and Derek Iwanaka of BeMetals, which is active in Japan and Zambia. BMET BMTLF

Zambia, is one of Africa’s most stable and politically mature countries, I am told by miners. One of the few nations on Africa continent I have yet to trod.

John Wilton points out Zambia owns a long history of copper mining. “Current government has acted to promote and develop Zambia’s position as a copper producer.” BeMetals’ Pangeni copper project is “concealed” beneath shallow, sandy regions.

[TCRs, re Africa, I am a fan of Namibia, too: I own shares of Osino Resources OSI OSIIF for its gold project there, called Twin Hills.]

Japan hosts the world’s highest grade (or one of) gold mine of Hishikari.

Rules and regulatory system are well defined. Kazan is the BeMetals project, on the northern island of Hokkaido.

John and Derek point out Hokkaido is rural Japan and most of the young people have left to migrate into the major cities. “Thus far, we have found that the local communities have shown support for our exploration activities and potentially for future mining operations that would attract young people back to these rural areas with good paying jobs,” John Wilton said.

— Thom Calandra

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.