TCRs: New URANIUM material here. Also: Ghana gold explorer-producer GATA.org reminder: Wiki gold leak Trading this week

“Apparently, sell in May and go away has been adopted by a whole new generation of investors.” — Marc Henderson, Laramide Resources LAM

Weekend June 29-30 update

— A 5-photo-look at this week’s Ghana gold exploration by Xtra-Gold Resources. XTG XTGRF

— What else did we learn about China and gold from the 2011 Wiki-leaked diplomatic cables? Thanks, Chris Powell of GATA.org, for the reminder, pegged to Julian Assange‘s release. See: below and GATA here.

— Uranium updates from our trusted execs in the subdued June trading market for spot uranium and 5-year, 10-year contracts with utilities.F3 Uranium‘s FUU Dev Randhawa says, “I thought we would see better action on Athabasca Basin stocks this week with the proposed ($1.14 billion CAD) Paladin Energy takeover of Fission Uranium FCU.”

F3’s flagship holding in the basin, Patterson Lake North, originally spun itself out from Fission and is 12 miles from the Fission project, which is called Patterson Lake South.

— Jordan Trimble of Skyharbour Resources SYH, largely in the Athabasca Basin: “There has been weakness in the equities across the entire sector — probably due to the slight pullback in the spot price and seasonality. We have seen softness in the uranium equities the last few summers but that can quickly reverse later in the summer as we approach the WNA (World Nuclear Association) conference and typically a more robust fall season.”

Jordan sees a “new base” above $80/lb for spot, with long term contract prices continuing to tick higher.”Needless to say, most uranium execs are looking to developments at or before the WNA Symposium September 4-6. More execs talking uranium below.

Also: see uranium notes please from The Calandra Report.

— Trading: I have this week, with abandon, been buying additional Ivanhoe Mines IV IVPAF shares (now 82,000 total). Sales to pay for the purchases, as discussed, along with on-hand cash), come from Metalla Royalty & Streaming MTA, and also from partial stake sales of Ridgeline Minerals RDG, DHT Maritime, Skyharbour Resources SYH, Nuclear Fuels NF and Azimut Exploration AZM. Below, more detail. *

I also have been adding to my crushed Yukon producer and an explorer in the wake of the Eagle Gold Mine heap-leach containment rupture — Victoria Gold VGCX and Banyan Gold BYN BYAGF — see this week’s update please.

Also, see please Simplifying Trading update from The Calandra Report.

Suppressed Gold Price: China Road

Chris Powell of Gold Anti-Trust Action Committee reminds us this week, “While it did not get much attention outside monetary metals circles, that “classified information” — the famous Wiki Leaks cables, dispatches taken from U.S. government computers by a disgruntled soldier Bradley (now Chelsea) Manning, and made public in 2011 — included information about U.S. gold price suppression policy.”

Some of those cables came from the U.S. embassy in Beijing, were sent to the State Department in Washington and included English translations of commentaries from Chinese government-controlled news organizations about U.S. gold price suppression policy.

The U.S. embassy cable’s summary of the commentary reads:

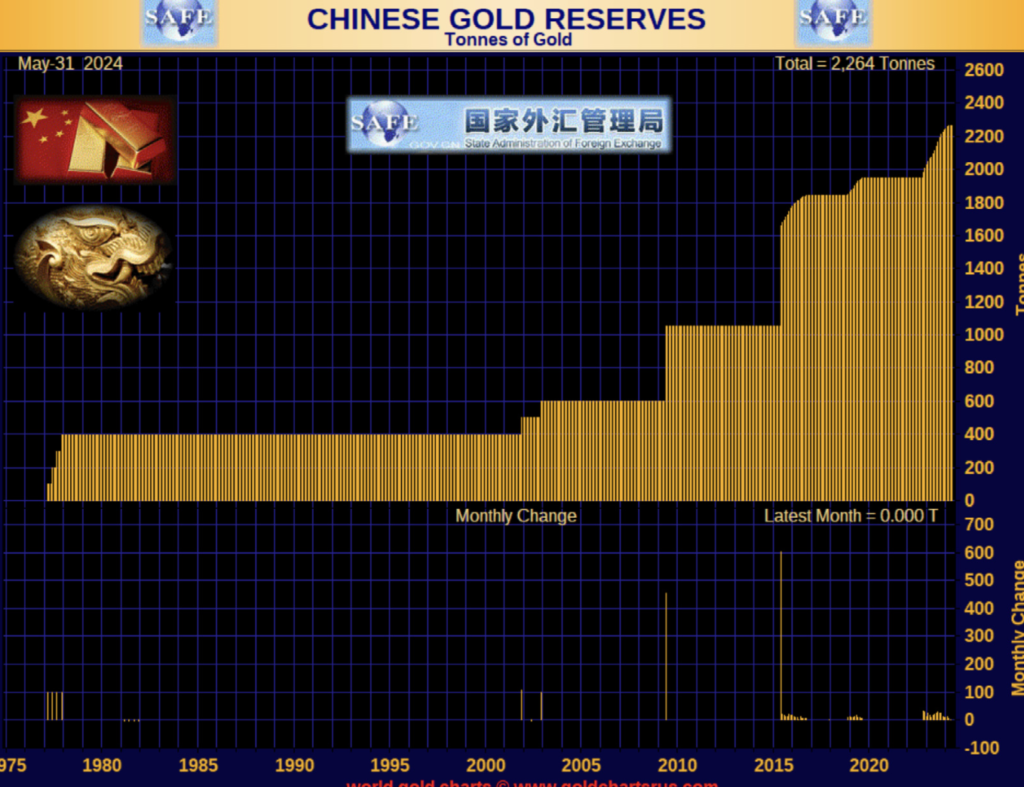

“According to China’s National Foreign Exchange Administration, China’s gold reserves have recently increased. Currently, the majority of its gold reserves have been located in the United States and European countries.

“The U.S. and Europe have always suppressed the rising price of gold. They intend to weaken gold’s function as an international reserve currency. They don’t want to see other countries turning to gold reserves instead of the U.S. dollar or euro. Therefore, suppressing the price of gold is very beneficial for the U.S. in maintaining the U.S. dollar’s role as the international reserve currency.

“China’s increased gold reserves will thus act as a model and lead other countries toward reserving more gold. Large gold reserves are also beneficial in promoting the internationalization of the renminbi (yuan).”

“The Wikileaks cables have plenty more like that,” Chris says. See:

https://www.gata.org/node/10380

https://www.gata.org/node/10416

Thanks again for the reminder, Chris Powell, who reported on the gold reserve info as early as 2011.

Xtra-Gold Resources, Ghana

The entirely self-funded Xtra-Gold XTG XTGRF I believe has a decent chance to notch a doubling of its current gold resource to 1.5 million ounces from its Kibi gold sites.

Xtra-Gold operates 5 concessions in west Africa’s Ghana and has been in country, regularly drilling, building roads and harvesting, then selling what amounts to approx. $15 million USD net of alluvial gold for more than a decade.

TCRs, I think the race is on: one of three or four possible buyers will I hope one day purchase Xtra-Gold at $75 or more per ounce in the ground — 3 times its current $65 million CAD market worth. (I have owned XTG since 2009 and visited Apapam and its concessions four or five times.)

Xtra-Gold uses a mounting $13 million USD cash and its held gold and securities to retire shares, buy all equipment, pay concession feeds and salaries. This has been going on for more than a decade.

Several of those held securities, including a nickel explorer and two energy-cos, at last look, I believe are accelerating in price.

“Our 100,000 meters of drilling at current prices would cost $30 million in Ghana. We have financed the majority of these drilling costs with our alluvial mining project, for which we are getting zero value in our share price. Shareholders have had no dilution to their share ownership.” — James Longshore, CEO, founder, Xtra-Gold Resources

All Xtra-Gold photos are courtesy of James Longshore and Ghana staff. Please click on photos for larger size, clarity.

More Uranium Views

* Nearly all of the stake sales above were small amounts, $1,000 or less. [Exception, half of quite profitable DHT Maritime stake, as discussed.]

In the case of Metalla, I intend to re-purchase, one hopes, at lower prices. Ditto, Ridgeline and ditto Skyharbour, whose Russell and Moore projects have 8,000 meters of drill results to come, and another 8,000 meters to be drilled.

— Thom Calandra

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.