Small Miners Snap Higher | Koryx Copper | Alamos Gold

[With updates Sept. 12, 2024 — gold, copper, silver, uranium-cos marking sharp gains; gold nearing $2,600 an ounce (futures contract). Small and large nat-resources companies are rising approx. 5% in various ETF indexes.]

Russia-China Uranium ‘Cornering’ | Ivanhoe Note *

Uranium: TCRs, I hinted to four or five of my uranium CEOs that I was considering lightening up on the nuclear fuel companies I have my money in.

The trade overall for me and I hope our TCRs has been largely profitable the past three years. But not this summer or autumn.

Tagged in this report: Banyan Gold; Xtra-Gold Resources; Koryx Copper; Kenorland Minerals, others below.

Well, the nuclear lions roared at me. Their response, while civil, was strident.

Outtakes:

“Hi Thom,” Bill Sheriff of enCore Energy EU (whose shares I own), said. “This is the best summary of the reality of the situation in nuclear — John Quakes (see John’s superb feed on the subject.)”

“I always say in my presentations, “It is like being offered the chance to invest in oil and gas in the 1950s. No, not every quarter or even year is going to be pleasant ,but the overall growth and profit long term is unparalleled by any other sector in terms of supply and demand.”

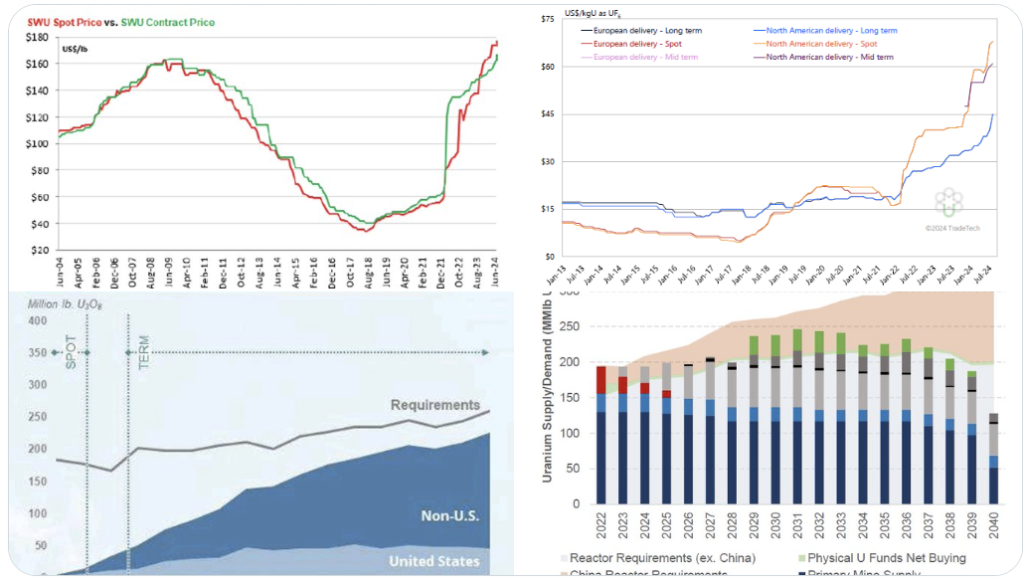

Bill and others acknowledge that small investors spend too much time looking at the spot uranium price, which has depressed to a still heady $80 or so a pound from $100 in the spring. And not enough time looking at long-term and even mid-term contract prices (3 years, 5 years, etc) negotiated by utilities and other uranium users for their power plants’ reactors, perhaps for small modular reactors (SMRs) and so on.

“Contract prices are at post 2007 highs,” Bill says. “All investors think U is down due to spot, which is headline grabbing but the term contract market hasn’t been better. Look at supply-demand figures.” (See John Quakes‘ sweeping comments on China, Kazakhstan, contract prices, kaput U-mines in Niger, in Australia … and the enormous challenges of mining uranium — here and below).

Marc Henderson at Laramide Resources LAM (whose shares I own): “The whole U sector has come off and hopefully near a turn. I think it started as a healthy correction, which allowed some new folks to get involved, but it’s a bit overdone now. The best explanation I heard last week while in London was ‘all correlations go to 1,’ which seemed about right. No place to hide (for the moment) but actually great if you want to own something instead of renting it.”

See LAM in Kazakhstan news here please.

“The World Nuclear Association‘s annual symposium just wrapped up in London. The event was sold out for the first time, making it the largest nuclear and uranium industry gathering in the WNA’s history. Meetings and presentations were focused on how to best harness the rapidly growing global support for nuclear #energy in order for the Nuclear industry and supply chains to fulfill the COP28 pledge to triple nuclear capacity by 2050.

Global decarbonization goals coupled with greater emphasis on achieving 24/7 #CarbonFree #EnergySecurity are driving a resurgence not seen since the 1970’s.” — John Quakes

“The Russia effect: when Russia decides to call in favors or restrict western uranium supplies — well, between Russia and China, they are cornering (or have cornered) the Kazakh supply. Both are starting to strongly influence the Africa continent. One has to look no further than Russian influence in the Sahel region or China’s recent (perhaps ongoing) roadshow for Xi Xinping.” — Cory Belyk

Cory, CEO-geo, adds, “The western utilities better wake up fast and start securing pounds at literally any cost, in my view.”

Updates

This week, Alamos Gold (Sept. 12, 2024 Thursday) AGI shares surpassed $20 USD for the first time since approx. 2011. I own the stock.

This week, Koryx Copper KRY added Namibia’s Heye Daun (Osino Resources) and his partner in Toronto, Alan Friedman, to its board of directors. Worth keeping an eye on — albeit still only $50 million CAD market value.

Heye is a Namibia mining engineer who sold Osino to a large China gold company this summer. He is now Koryx’s hands-on executive chairman. See release.

Small metals miners’ shares such as Koryx Copper, Ridgeline Minerals RDG RDGMF (Nevada), and roy-cos such as EMX Royalty EMX, have languished in 2024, and 2023. This week, the GDXJ and other small-co mining indexes (ETFs) are rebounding.

These and others that are tiny yet showing fresh highs are worth monitoring; they include Koryx, Ridgeline, Xtra-Gold Resources XTG XTGRF (Ghana), Kenorland Minerals KLD. and Banyan Gold BYN BYAGF, the Yukon operator’s shares crushed.

I own all except Koryx.

* More on taxes, trusts and so on for subscribers:

The yearly New Orleans show, a favorite of mine, rolls along in two months.

Brien Lundin, writer, organizer, says the 50th edition of the show will have a few surprises.

Brien scheduled it three weeks past the usual timing — “the Nov 5 U.S. election will be a competing factor, and let’s hope there is no turmoil attached to that,” he says.

The line-up looks pretty strong: check it out here.

I will moderate the opening Precious Metals Panel.

Please click here for a super discount on entry fees — https://neworleansconference.com/calandra/. Thank you.

Family Offices Must Show Their Hands In Mining Investments

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.