TRADING NOTE ;below *

Interview: Swagger In The Basin

Watch, Read ‘Between The Lines’

[Listen to, watch the Grant Isaac interview: Triangle Investor]

Cameco, the $20 billion (USD) mostly Athabasca Basin company in Canada, will report its year end and quarterly numbers next week.

Cameco, hq’d in Saskatchewan, is not the world’s largest producer of zero-emissions uranium for nuclear reactors. That honor goes to Kazatomprom in Kazakhstan.

Yet when you add up the highest-category reserves that Cameco calls its own, 485 million pounds (as of 2023 and likely to be updated next week), its uranium output, the largest U-refinery in the world at Blind River, Ontario, and other businesses — Westinghouse-Brookfield venture’s nuclear services, small modular reactor development, fuel conversion, laser-enriched tailings and other additive operations — probably make CCJ as influential as Kazatomprom.

reserves that Cameco calls its own, 485 million pounds (as of 2023 and likely to be updated next week), its uranium output, the largest U-refinery in the world at Blind River, Ontario, and other businesses — Westinghouse-Brookfield venture’s nuclear services, small modular reactor development, fuel conversion, laser-enriched tailings and other additive operations — probably make CCJ as influential as Kazatomprom.

As for brownfield (grass roots) exploration, the company has revealed little these past three or four years.

CanAlaska Uranium’s West McArthur JV with Cameco sits 18 kilometers from the Cameco’s McArthur River mine (CVV’s Pike Zone). I own CVV shares for that reason.

Cory Belyk, CEO-geo at CanAlaska, spent 25 years with Cameco, much of it as VP of exploration, chief mine geologist and corporate development.

“There remains a serious reserve depletion issue in the NE Athabasca Basin,” Cory says. “Similar is developing in the SE Athabasca Basin for Key Lake. There is currently no identified Tier 1 asset to feed the Key Lake mill post-14 years from today, when McArthur runs out of ore.”

I am not a uranium pundit, as you TCRs know. This is why I rely on my trusted uranium sources to read between the corporate lines. They are CEOs and geologists at CanAlaska Uranium, Laramide Resources, Skyharbour Resource, F3 Uranium, enCore Energy, GoviEx Uranium and Baselode Energy.

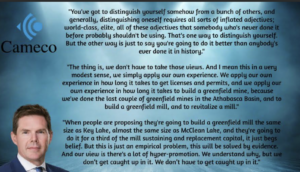

The interview flagged here, Lucijan Valcovic of Triangle Investor questioning Cameco’s executive VP and CFO, Grant Isaac, is, if you care about nuclear reactors, uranium supplies and investing in such, worth the 51 minute briefing.

Lucijan’s broad view as the investment-minded fellow asking the questions is that uranium-cos are cheap, even with a superb three-year performance on the back of a rising, and now stagnant, spot uranium price, and solid to rising multi-year contract prices with electric utilities.

Those contract prices appear to be “holding like a rock “above $80 a pound, and spot prices are holding $70 after surpassing $100 in 2024.

Grant Isaac for his part is skeptical about companies that promise to build Athabasca Basin mines and mills from scratch — “it begs belief,” he says.

He has since at least 2021 assembled a portfolio of revealing interviews and discussions with journalists, uranium aficionados and fellow industry execs.

One of those execs, after watching this latest interview, explained:

“Very aggressive stance for Cameco. I sense pressure on the Cameco marketing side coming from utilities in their negotiation process for long-term contracts with Cameco.”

Perhaps, as my trusted uranium contacts tell me, Cameco could be feeling pressure as well from new producers or “wanna-be producers,” and from successful global explorers such as the Basin’s NexGen Energy NXE.

I think with the Isaac interview, viewers get insight into how Cameco views utilities and their need for the nuclear fuel in a power-hungry, technological world.

Grant Isaac says at one point,

“There is no utility that is at their strategic inventory level … (thus a) disproportionate effect (on uranium demand).”

I am, I hope, not putting words into Cameco’s mouth here. The producer, like all producers of essential elements, is valued in part by its reserves. Cigar Lake has about 11 years left of supply, not withstanding further exploration, and McArthur River comes in at less than 15 years remaining.

Possible expanded drill program: Dawn Lake? Maybe we’ll learn more next week in the Q4 and year-end Cameco reveal. Remember, Cameco has 39 projects in the Basin. Plenty of exploration cards to play.

Britain’s Daniel Major of GoviEx Uranium GXU, an Africa explorer-developer in Zambia, is an ocean removed from Canada’s rich Athabasca Basin. Daniel’s takeaways:

- The fundamentals point to a substantial global supply deficit of uranium;

- Utilities are generally covered in the short term; but long term, utilities need guaranteed supplies so will contract out four or five years;

- The risk of projects being delayed is becoming a major risk — especially large Canada projects;

- Short term volumes available are small and this highlights the risk of potential producers promising to sell everything into the spot market.

In this report, I own shares of CanAlaska, of enCore Energy EU, and of F3 Uranium FUU. I look to purchase for a third time, shares of New Mexico and Australia developer Laramide Resources LAM.

TRADING NOTE: I HAD A GTC ORDER TO SELL 2,000 IVN at $17.25 CAD. Updated Feb 20, 2025; I CANCELED the order and resumed purchases at lower prices. See: Ivanhoe numbers, Platreef and Kazakhstan. We own approx. 78,000 shares of Ivanhoe Mines. [Conversely, I bought $2,100 USD worth of IVNV IVPAF Friday at $16.71 CAD.]

I sold approx. 1,540 shares of ITRG at a profit. We own approx $14,000 USD worth of Nevada gold producer Integra Resources.

I am selling 5,000 shares of Ridgeline Minerals RDG. We own approx. 24,000 shares. [Update: these sold Friday; RDG recently raised money to expand exploration at Nevada properties.

I added to a long-held stake in CanAlaska Uranium CVV.

I added to a small stake in Brookfield Renewable BEP. I have not covered this company and am following the advice of our daughter, Gemma Calandra, an engineer who works in the field of renewable marine energy at a government-funded lab based at University of Washington, Seattle.

Shares of Xtra-Gold Resources XTG continue their ascent. The Ghana miner says it expects to file more assays for its Kibi Gold Belt properties. We own approx. 109,000 shares.

West Vault Mining WVM shares are ascending on light volume; an Idaho fund manager controls about 45% of the outstanding shares. I own a small number of shares of the Nevada gold property developer just outside the town of Tonopah.

— Thom Calandra [Still voice to text — at least one more week in a cast; then 3 more in a brace.]

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities. The Calandra Report, in its 13th year, offers a one-price, $139 yearly fee for all newcomers. Earlier subscribers keep their original cost. Sob stories listened to. No refunds after three weeks of service. Exceptions: