BeMetals *| Contango Ore | CanAlaska Uranium | Platinum Group Metals

[TCRs, commodities-linked companies are catapulting, then cratering every other day -- with the trend higher for months now; along with their attendant metals. Reciprocal gold theory below. -- Thom Calandra

- TCRs, oddly justified trading this month: one day, silver, platinum, copper off as much as 2% as GOLD gains 1%, or $23. The next? Platinum and palladium hold their gains and rise as most metals decline. [Update: June 4 2024: metals values crushed, with their attendant miners.]

As for tumbling blue chips vs. metals: I think we are witnessing the halting start of reciprocating theory (Peter Palmedo, Barton Biggs, et al): that is, blue-chip non-miners — the Fortune 1000 — will weakening over an extended span as gold rises, making up for two-plus decades of lagging. [Please see most recent Reciprocate The Calandra Report of April 2024.]Essentially, long-due payback (retribution) for the 25 (some say 35) years of Fortune 1000 market dominance over bullion, including silver. In fits and starts.Zambia: Value seekers adore down days. See No. 3 + below. I am cheap-seeking shares of BeMetals this week; trading update and the discussion with BeMetals entirely updated today-Thursday. Excerpted below and in full here. I expect BMET shares to add another 10% next week as the Zambia explorer sets valuation goals with bankers and its largest investors. — Thom Calandra

- Shares of our imminent Alaska gold producer Contango Ore CTGO popped this week. I own a large amount and so do more than a few of The Calandra Report audience. See below for what CEO-Geo Rick Van Nieuwenhuyse says about why.

- Ivanhoe Mines IVN IVPAF shares continue to launch fresh assaults on a record -setting market value (currently $25 billion CAD). This in the face of large owner and quasi-state China agency CITIC Metal Africa Investments intention to sell 2% of its 314 million IVN shares.Ivanhoe’s Kamua-Kakula copper mine in DRC Congo is besting internally set schedules for just about everything. Its new and third copper concentrator (see report) puts Ivanhoe on track to 600,000 metric tons of capacity from 2024 guidance of as much as 490,000 metric tons. A new goal is 800,000 tons, the confident and forward-looking (DRC copper, zinc; South Africa gold and platinum-etc.), Ivanhoe says.

- + These The Calandra Report-tracked stocks are holding their own or rising during a largely DOWN week for metals: CanAlaska Uranium CVV CVVF (fresh assays just out); Ridgeline Minerals RDG RDGMF (Selena-silver in Nevada); Summa Silver SSVR SSVRF; Avino Silver Mines ASM; Metalla Royalties & Streaming MTA.I see that copper-developer Seabridge Gold is nearing a $1.4 billion market value. A free and hard-nosed Lobo Tiggre interview of SA SEA’S Rudi Fronk is just out. [I own all but for Mexico producer Avino; and British Columbia, NWT, Yukon and Nevada developer Seabridge.]

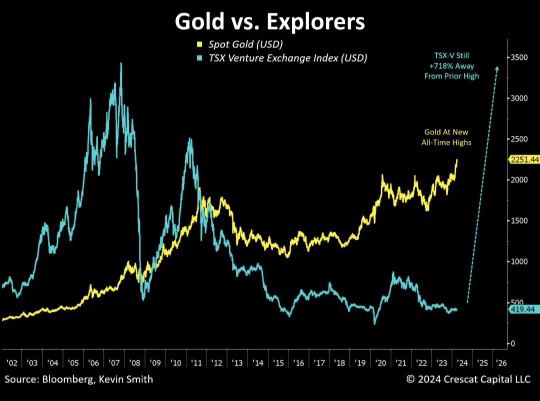

The Bloomberg-crafted grafik here contrasts shares of small metals-cos (and other Toronto-traded ‘venture’ stocks ) with the gold price — going back to the early 1990s. That is one ‘sick’ chart, and I do not mean the new-generations’ use of ‘sick.’

Platinum Group Metals PLG PTM is enjoying its best stock prices and trading volumes since January-May 2022.

Frank Hallam, CEO,:tells me today that investors are motivated by a plan to ship South Africa ore to a Saudi Arabia smelter. Shipping PGM concentrate from Waterberg to Saudi Arabia “has piqued the interest of some investors, he says Friday (updated 5-31-23).” Plus, possible North America slowing of battery electric vehicle demand could boost demand for platinum and palladium in gasoline-powered cars and trucks’ catalytic converters.

PLG’s Waterberg joint venture (with Impala Platinum and others), gives the company 50% of the project, which I have seen twice. It is a deposit of platinum, palladium and nickel on the northern side of South Africa’s Bushveld Complex. Some 19.5 million proven-probable ounces of four-metal equivalent PTMs.

Contango Ore‘s CEO-Geo Rick Van-N re: Contango shares’ CTGO “pop” to NYSE $25 this week. “Three things going on: Russell (stock index) re-balance; judge dismisses request for an Alaska (road) injunction; and scheduling of first gold pour for early July from our Manh Choh venture with Kinross Gold KGC and its Fort Knox mill.”

Rick supplies all of his conversations with tags of Contango Ore’s “hybrid royalty” approach of active partners, few employees and speedy Alaska permitting. So in the interest of my TCR informal forecast that the $24 USD shares will continue to ascend rapidly in late May and early June, I allowed Rick to go long here:

Thus: “We want projects with run-of-mine-direct-shipped-ore (ROM-DSO). Projects must be near infrastructure (Road, Rail, Water — yes, those are capitalized in Alaska — TC); they must have grade sufficient to ROM-DSO; and they must be simple ore bodies from a permitting standpoint.”

For one, Manh Choh is located on private land owned by an Alaska native tribe and the mine itself is located on top of a hill, so there is minimum water to deal with. Another Contango project, Lucky Shot, is on private land with underground already developed and permitted for mining. Also, acquisition target Highgold Mining‘s Johnson Tract contains good gold grade and a wide ore body (40 meters average width); it is above the water table on private land owned by an Alaska native corporation; it is 10 miles from the ocean.”

“We have multiple options on where to send high grade ore,” he says. Please see our The Calandra Report tagging of Coeur Mining‘s Kensington operation as a possible partner for Johnson Tract ore.

Reality, Rick says, is in numbers: “If a mining operation is processing 5 grams per ton ore and we come with 10g/t, there is a business transaction to be done. Being able to achieve production with a much shorter timeline for permitting. We are permitting a quarry operation: no mill, no tailings, no power plant, and with a lower capital outlay. Free cash flow is achieved quickly. We are more like a royalty company.”

BeMetals: Zambia

* Updated Thursday May 30, 2024 — Those promised drivers at an undervalued BeMetals BMET — active in Zambian Copper Belt and pushing out what look like mineable grades, and hopefully lengths, that are in league with producing mines Sentinel, Kansashi (FQM First Quantum Minerals) and Barrick Gold‘s Lumwana Mine in the region.

Pictured is Derek Iwanaka at BeMetals offices in Vancouver, which is part of 19.9% owner Be2gGold‘s 700-employee downtown HQ there. The second thing he told us is that the Japan copper and gold project “is on the back burner.”

Derek is if you recall a “trusted source” for me; the corp-dev exec is No. 2 to CEO-geo John Wilton in Cornwall, England.

Derek pointed to the Pangeni copper dig in Zambia. That was, naturally, the first thing he tagged in our 50-minute discussion. Pangeni means “dirt” in local dialect, and that is near where BMET shares are trading.

Update — I purchased 15,500 shares Thursday 8:45 a.m. Pacific at 8 cents use a share (BMTLF). I am seeking more before next week. The company’s John Wilton, geo-CEO, and Derek Iwanaka will meet with bankers and others to outline immediate valuation goals.

Fair warning: this implies a financing, which has a chance of diluting current shareholders — we shall see.

I sold and-or will sell before market close Thursday approx. 8% of a stake in profitable shares Ivanhoe Electric IE and in Baytex Energy BTE for the funds to start the BeMetals stake.

Let’s see how wrong I am next week, TCRs.

Tiny Midnight Sun recently started a $3.3 million equity financing and got $10 million. What catches my attention is that the “raise” drew half big investors and half ordinary folks.

Also, as discussed here this year and last, finding gold mines or at least gold reserves for the balance sheet is a slog these days for many reasons. The largest gold-etc. miners — Barrick, Newmont, BHP Group, others — are in the hunt for this industrial, global-growth metal.

I am told (Boris Cukon in Antwerp, Belgium, thank you) that microscopic Arc Minerals, active in nearby Botswana, might have closed a partnership with Anglo-American for a Zambia (earn-in) project. Not confirmed but I see this: 2-month-old boilerplate here please.

BeMetals, by the by, saw an initial 35% gain in its shares after the Pangeni copper hits disclosed last week.

“If we can hit a few more holes like this and not solitary anomalies then I think we can start waving our arms,:” Derek said.

Yes, this all sounds too good to be real. Yet there is good appetite these days for copper “deals” (I dislike d-word) — with the appetizer being Zambia, accompanied by Namibia, and possibly Botswana and Zimbabwe copper-gold exploration projects.

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.