DHT Maritime | enCore Energy | GoviEx Uranium | Banyan Gold | Seabridge Gold

TCRs, each of the headlined names here shows trading signs they will be ‘breaking good’ in coming days. All have current or looming developments. Â

BANYAN GOLD BYN BYAGF: At $13 per ounce

in the ground, Yukon's 7-million-ounce

(inferred) Banyan Gold will see a

valuation catapult, I believe.

See below please.

Catapults:

— Very large crude carrier DHT Maritime in with a solid quarter of European shipping profits and a 22-cent dividend. This from our Greece shipping aficionado, Avraam Gabrielidis. The stock DHT on NYSE eclipsed $11 Wednesday. I bought more to bring the stake to $22,000 USD.

Nutshell, Avraam says, “For me the very positive news comes at page 3 of the results. ‘Thus far in the first quarter of 2024, 78% of the available VLCC spot days have been booked at an average rate of $55,900 per day on a discharge-to-discharge basis. 83% of the available VLCC days, combined spot and time charter days, have been booked at an average rate of $50,800 per day.‘”

TCRs, for yr-to-yr comps, Q1 2023 saw 66% of the available VLCC spot days booked at an average rate of $56,400 per day on a discharge-to-discharge basis. Some 75% of the available VLCC days, combined spot and time charter days, were booked at an average rate of $48,400 per day.

Avraam adds,

“Also consider that the daily profit and loss break–even for spot rates per day is $300 less this year, so maybe it does not make a huge difference, but it proves the level of professionalism of the management team that reflects positively to the shareholder.”Â

Slam-dunk new highs ahead for DHT Maritime, as I see it. The stock goes ex-dividend later this month of February 2024. Quarter numbers here please.

— Uranium: The southern Texas new producer enCore Energy EU on NYSE cut the ribbon at Rosita, the processing plant and uranium fields. Please see photos here, courtesy of Janet and Bill Sheriff. Please see posting. Or the video.

External coverage here please.Â

EU shares are at all-time highs. [This is updated Friday Feb. 9, 2024.]

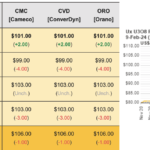

Spot uranium Friday Feb. 9, 2024, at $101 an ounce, some $6 beneath its best price of the past week.

Cameco, world’s second largest uranium miner with two production facilities in Canada’s Athabasca Basin, updated investors this week. Please see the guidance especially about long-term contracting of its sales and references to modular nuclear developer Westinghouse purchase. CCJ’s update, guidance and boilerplate here please.

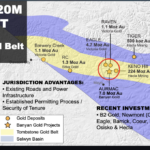

— Banyan Gold BYN BYAGF is now a 7 million-ounce resource, most of it in the inferred slot.

Will a buyer of AurMac Gold Project, essentially Airstrip and Powerline deposits in Yukon, insist on measured and-or indicated category ounces of the shallow, pit-constrained deposits?

“We haven’t announced our drill plans yet. We are working on various scenarios, three of them,” CEO Tara Christie says today in a phone call with me. “We’ll look at where we would actually mine in different scenarios.”

The three scenarios, heap leach, mill with flotation and mill with conventional CIP/CIL (cyanide, carbon in leach; carbon in pulp — I simplify this), can be seen in the new deck. Deck here please.Â

Boilerplate: AurMac is adjacent to Victoria Gold’s Eagle Mine and Hecla Mining’s Keno Hill silver mine. $7 million CAD in cash. Banyan is trading at $13 per ounce CAD in the ground vs. peers that trade at $13 to $72 an ounce.

AurMac uses a 0.3 gram cutoff for an average 0.63 gram a metric ton of grade. One part of the project, Airstrip, is 845,000 ounces inferred at 0.75 grams a ton.

“Can I imagine that we have 2 million ounces at 1 gram? We have focused on Powerline … so it is about time to look at Airstrip’s grades,” she says.

Neither Banyan Gold nor any other company or individual pays me or The Calandra Report for coverage, for sponsorships. We just get simple subscriptions, which folks keep for years (or not) at their original price, if recurring. Thank you and you and you.

Victoria Gold VGCX, with its Eagle Gold Mine up the gravel, power-lined road some 50 km or 60 km, owns 11.2% or so of Banyan.

I believe a Yukon (or Alaska) miner will buy the entire company at some point; I have owned BYN on and off and on for five years. See resource upgrade please.

This 11-minute video take Tara did with Kai Hoffman, a Germany newsletter writer and conference organizer, is here. Please see the video.

Collateral: that deck from Banyan just released. Note references/maps to surrounding mines in the district. Map to left here.

Tara Christie and team are (at last) dialing up the outreach. This after a half-year or more of fieldwork, exploration drilling, metallurgical testing and site grooming. She tells me Banyan for the first time received a presentation slot at the annual BMO metals investor conference in Florida — for fund managers.

A live gig, staged by Adelaide Capital, for us ordinary folks, is Thursday Feb. 15. I look to be on it.

Also this audio for those who just want words without faces: it’s quite concise. It is on X, formerly Twitter.

— A brand-new board member at Bill Sheriff‘s Wyoming explorer, Nuclear Fuels NF NFUNF, gives us a read on uranium: Richard Munson. Rich (and Bill) are l-o-o-o-n-g time subscriber to these reports.

Rich is a uranium aficionado, public policy strategist and former uranium-exec whom I first met in Guyana at Toroparu 12 years ago at John Adams‘ Sandspring Resources.

Rich tells me today, “Uranium has some legs right now. I still talk with Jerry Grandey – ex-Energy Fuels and of course ex-Cameco CEO , and he sees a real difference in this run up and, for me, what Bill Sheriff and some others are saying about the market makes sense. In-situ (ISR extraction) was just coming together when John Adams, Jerry and I were at the original Energy Fuels, but it is truly the game changer for production — unless you already have a conventional mill up and running – like the ‘new’ Energy Fuels — and are nimble enough to see how to participate in the new U.S. programs

for critically needed elements.”

— EMX Royalty: Poorly performing EMX is getting a welcome share lift. EMX is buying back shares. See release please. I hope to see a first-time dividend declared, but I have no timing. See please a decade of earlier The Calandra Report coverage. First off of many, this one: The Calandra Report subscribers here please.

I have owned EMX almost as long as the two Africa companies in the fold here at home: Ivanhoe Mines IVN IVPAF (2003) and Xtra-Gold Resources XTG XTGRF (2009).

* — Seabridge Gold SA SEA is in with a fresh KSM resource estimate at Iron Cap and Kerr — gold, copper — in British Columbia. What next? Why, partners of course.

This from Rudi Fronk, CEO. Â See updated resource report here please.

RBC, the investment bank (Royal Bank of Canada), is running a formal joint-venture process that is expected to conclude in the next 6 months.

Hannah Ritchie’s “Not The End Of The World” — I am reading the sunny-side-of-the-egg Scottish data scientist’s just-published book. Her latest newsletter — about energy in the year 2050 — is here for free. Her book chapter on climate change is mining-specific.

Miners as a rule, the ones I talk to, beg to differ regarding Hannah Ritchie’s view, for instance, that clean energy will sweep out all ther carbon cobwebs by 2050.

“But what if, in 2050, we need less energy than we currently do? That’s a real possibility. Not because the world will get poorer, or the population will shrink. But because a decarbonised energy system needs less energy than one running on fossil fuels.”

“A cleaner environment and electrifying the world is the right long-term move, but we need to do it sanely and not so the super rich get richer and on the backs of the rest of us. I do NOT agree that windmills and solar are the answer. They work in certain specific places, but not all. I am all for nuclear and more hydro and I think coal and natural gas still will play a major role, albeit with carbon capture/re-injection required – and still far more competitive than wind and solar.”

— Thom Calandra

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.