As Miners Get Whipped, Ghana ‘Shoot’ Bears Promise

The New Orleans Tapes: Fresh From Brien Lundin -- below and here. The cute banner below got a lot of guffaws from the crowd.

TCRs,

Xtra-Gold Resources XTG XTGRF: the longstanding (since 2008) exploration team at Ghana’s Kibi Gold Belt has fresh drill core from what could be (emphasize could be) a lengthy gold shoot within sedimentary rock.

In addition, the self-financing explorer, from its alluvial gold sales, buys its shares back and retires ’em regularly. See the SEDI insiders filings via Canada for this.

Regular buyback and retiring of shares by Xtra-Gold Resources.

See the online report for subscribers here please.

In markets this week, (Monday Dec. 9, 2024), miners‘s depressed shares are rising sharply (5% or so as a group) — this following investors’ outflows from mining ETFs, led by Van Eck’s GDXJ – see price.

Year-end selling for capital gains losses weakened most metals miners into wheree we are today Dec. 9.

Bitcoin and other alternatives to precious metals, and copper, were hurting mining shares, too — as you know.

TCRs, I am a platinum believer; the metal is undervalued, under-explored and a necessary element for cleaner air.

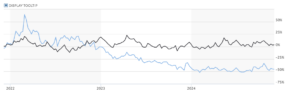

Platinum is active for hybrid vehicles as a catalytic cleaning agent. How it stacks up against once mighty (and necessary) palladium, used in combustion engines and whose $2,900 price in February 2022 is now about the same as platinum, is worth a look.

It’s a convergence that could lead to an outpacing by platinum. I own and buy Aberdeen‘s pure platinum trust PPLT (on NYSE) about as often these days as I buy the gold-silver Sprott trust CEF CEF.A.

I asked Frank Hallam, Canadian CEO of South Africa developer Platinum Group Metals PLG PTM, for his view of fundamentals.

PLG PTM toils in the shadow of South Africa mine developer Ivanhoe Mines IVN IVPAF, whose Platreef (see map), heading into production soon, I first saw in 2003.

I have known Frank about as long as I have known and occasionally owned PLG PTM — since 2003, when Mike Jones operated the Waterberg miner.

“We have said previously that over time we expect the price of platinum and palladium to converge. That doesn’t mean they will be equal, just that it is unlikely one goes to say $3,000 and the other to $500.”

Frank, speaking to me via e-mail from South Africa, sees enough interchangeability in autocatalysis “that over time if one price goes to a high that metal will be thrifted out versus the other.”

Palladium, he says, will be influenced by internal combustion engine (ICE) demand. Supply constraints might shift the market balance as well.

“Lower prices for prolonged periods will cause shaft closures and slow down recycling,” Frank forecasts.

Platinum Group Metals is the company that has Saudi Arabia in the mix as a smelter location when bulk mining site Waterberg starts production. When is that? See below. I have seen Waterberg twice.

The boilerplate: 246.2 million metric tons at 2.96 g/t of so-called 4E equivalent (platinum, palladium, other metals*) — 23.41 million ounces 4E on a 100% project basis. PLG PTM owns about 50% of Waterberg and other platinum companies, Japan Oil and empowerment groups own the rest.

Platinum is expected to see growing demand from the “hydrogen economy” at a time when deep shafts in RSA are likely to close, reducing some supply, Frank Hallam says.

“This would support prices. We’ll see.”

Frank Hallam is an accountant by trade and co-founder and director of Platinum Group Metals and other miners.

He ‘articled’ in the mining practice of Coopers & Lybrand (now PwC). “When I left public practice in the mid 90s I went right into listed exploration companies and got my hands dirty all over North America and Africa.”

He continues, “Our partners in Japan and Saudi Arabia believe that battery electric vehicle (BEV) market share will continue to underperform. They see ICE demand, including hybrids, being stronger for longer than current estimates.”

The Saudi Arabians, pushing for more metals in their own land and elsewhere, also see concentrate feeds from Waterberg as a resource upon which they could establish a platinum group metals (with copper and nickel) processing hub in Saudi Arabia.

“Ivanhoe’s Platreef project is moving along. Maybe a little slower than expected. The main driver for their value is actually in the Congo – not at Platreef. Their market visibility does not hurt us, but it doesn’t really help us either. Both Waterberg and Platreef are seen as the future of the industry in RSA South Africa. The question is, how far out is that future?”

Other influencers: “Trump is a plus-minus situation. His fossil fuel and ICE views are good for demand. His shoot from the lip trade policies are very suspect. His geopolitics are destabilizing as well, at least for now. It will take some time to tell.”

As for Grasberg‘s timeline:

“If we start work tomorrow it would take about 2.5 years to stand in the ore body. Then another 1.5 years to start the plant and then 3 years to commercial production, so about 7 years all in. Note that we won’t take a construction decision without concentrate offtake – hence the reason we are focused on that,” he says.

Thank you Frank.

*The six platinum group metals sharing similar properties: ruthenium, rhodium, palladium, osmium, iridium and platinum. The three elements above the platinum group in the periodic table are iron, nickel and cobalt.

Xtra-Gold Resources XTG XTGRF: the longstanding (since 2008) exploration team has fresh drill core from what could be (emphasize could be) a lengthy gold shoot within sedimentary rock.

“The gold shoot (called ‘Lone Tree’ by VP of Exploration Yves Clement) runs right below our maiden (Kibi Gold Belt) resource, and this drill hole had 30 meters-plus of gold-bearing material. If it grades anything close to 1 g/t (one-gram per ton), we may have our next significant gold shoot. We know this structure runs no less than 4.5 km,” James Longshore, CEO and country manager, says.

This “Zone 1” of the new target is called Gold Mountain, right below “Zone 2,” where the maiden resource was. XTG XTGRF has 1.2 million ounces of gold filed in all categories.

See: Earlier this week — Ghana Gold-Co at 13-Year High Share Price

Trading: In the past week or so, I have been buying shares of Xtra-Gold; shares of the Aberdeen platinum trust; and shares of Alamos Gold AGI.

As reported, I sold a couple hundred shares of Contango Ore late last week near $14 USD, for a loss, after the press release of higher Alaska mining costs. I hold the rest, approximately $4,000, a longstanding stake going back 3 or more years. CTGO shares look to be in recovery mode at $12.10 USD right now (Wednesday December 4, 2024).

On Thursday 11 AM PST Dec. 5 2024 and Monday Dec. 9 2024 11:55 AM: we sold 1,341 shares of Ivanhoe Mines. As reported many times, we are selling some of the 31,000-odd shares that we hold in one of our taxable accounts and — for family living trust purposes — shuttling proceeds when we can into those trusts. All told, we now hold approx. 81,000 shares of Ivanhoe.

Our largest resources stakes here at home are Ivanhoe Mines, Xtra-Gold Resources, Alamos Gold and EMX Royalty EMX.

— Thom Calandra

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.