C3 Metals | Vista Gold | Orecap Investment

TCRs,

C3 Metals has assays coming for three projects later this summer and autumn 2025. No formal press release but for this CEO.ca notice. The drilling plans and assay releases’ timing are starting to circulate among investors.

This month of April 2025, I have been buying shares of an Australia mine developer seeking a strategic partner, merger or sale of a scaled-down, $400 million cap-ex project, Vista Gold VGZ; and these two high-risk miners, the aforementioned gold and copper explorer that will fill its news wire with assays from three projects in Jamaica and in Peru, C3 Metals CCCM; and a holding-co with stakes in a bunch of gold, copper and uranium explorers, Orecap Investment OCI.

I discussed Jamaica and Peru with C3’s CEO, Dan Symons.

C3 has Freeport McMoRanFCX as a $75 million earn-in (for 75%) Bellas Gate partner in Jamaica, which I have seen.

“We have the financial firepower to understand Bellas Gate (copper and gold); it suggests a large hydrothermal system.”

The Super Block Project is a 50/50 Joint Venture between C3 Metals and Geophysx Jamaica Ltd., the largest mineral tenure holder in Jamaica. The Pennants gold mine produced 16,000 gold ounces between 2002 and 2004.

What also gets my attention is the 1-for-13 reverse split that Dan engineered in December 2023. “Any time you do a reverse, it rarely does well out of the gate.” This one has. “We have been able to attract more institutional ownership (63% of the company) … so I’m making 10 calls instead of 100 (to raise money),” Dan Symons says.

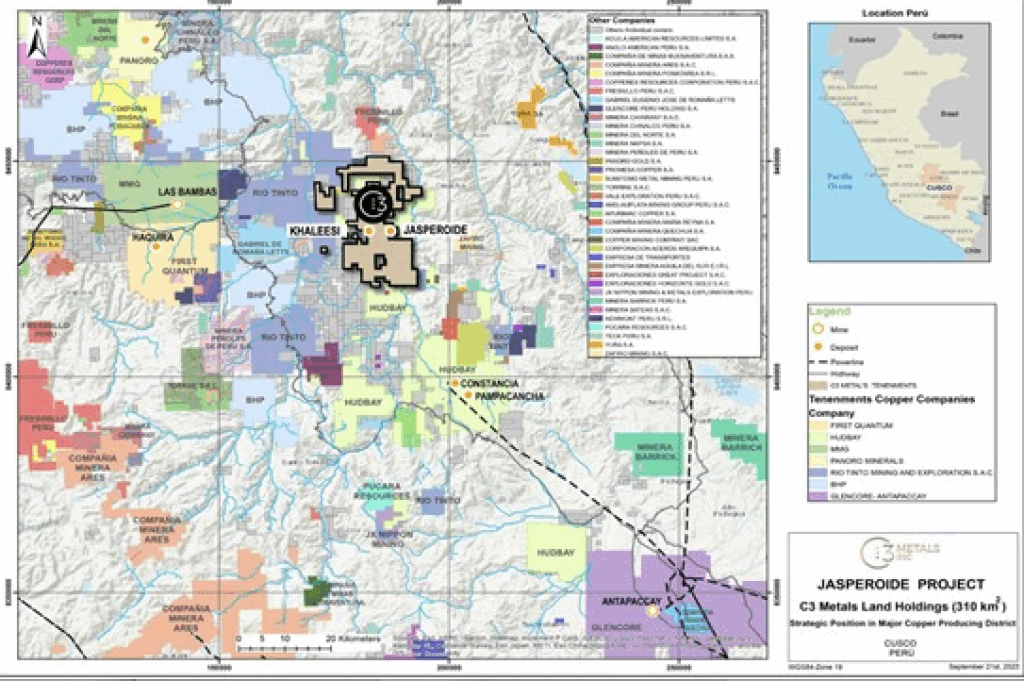

As for Peru, Dan, and a trusted source outside of C3, compare the tracts the company has groomed the past 2 1/2 years similar to Filo‘s holdings in Argentina — acquired by Lundin Mining and BHP.

Peru, as you know, is copper central, along with Chile and Argentina. “We believe if our Khaleesi (outcropping skarn, other indicators) comes together, it is worth multiple billions and we own 25% of it.”

Gold, molybdenum show in the outcrop, with credits of 0.3% to 0.6% copper.

“Our theory is that we have a porphyry system on either side … similar to the big mines operating around us.”

Soils testing shows as much as 1,260 (copper) parts per million across a 400×470-meter zone; a metric ton has 1 million PPM.

“We typically get excited when we see 300 ppm or higher for copper. We also have a 1,900 x 650m zone where we suspect the associated porphyry system — where the northern part averages 650 ppm and the southern portion averages 950 ppm. This project has the potential to be a new discovery along a very well known, world-class copper producing belt.”

Dan says Khaleesi “looks like it has serious scale potential.” The company looks to complete the permitting process (water use) by June, then a July-to-December 6,500 meter program for tracts that have never been drilled.

At another series of skarns, Montaña de Cobre in what is called Jasperoide came in with a first-time measured and indicated mineral resource of 51.9 million metric tons at 0.5% total copper and 0.20 g/t gold. That’s about 570 million pounds of copper and 327,000 ounces of gold. MCZ is one of 13 skarn prospects identified by C3 Metals at Jasperoide.

That is 8 km east of Khaleesi.

“All of this is truckable … ore to a facility to turn it into concentrate — as is done at Las Bambas and Costancia,” two of the largest copper mines in South America, if not the world.

Dan and team have forged community pacts with residents — always a concern in Peru. Let’s see what C3 delivers later this year. The CUAUF OTC stock in the U.S. trades sporadically.

TCRs, here is more on Vista Gold’s build-ready Mt Todd gold wanna-be in Australia.

Vista has been grooming Mt Todd for a decade. It is ready for mining and seeks a partner, a buyer or a contract miner.

The strategy has been to Increase the reserve grade to 1 g Au/t using a higher cut-off grade, thus reducing initial capex.

Boilerplate:

Vista’s Mt Todd feasibility study initiated in December 2024 looks to reduce initial capex by 60% to $400 million and estimates average annual gold production of 150,000 to 200,000 ounces for as many as 30 years.

“We think the market appreciates grade over ounces,” Pamela says.

I think the new study will be out to investors by June or so this year. The stock is running higher in advance of its release. We’ll see.

I’d like to buy more VGZ in May. Sun Valley Gold, a natural resources fund run by quantitative analyst (reciprocal gold theory) Peter Palmedo, owns 16% of the shares. Sun Valley also owns 44% of West Vault Mining WVM, a Nevada developer of another build-ready gold mine.

Also: my reasoning for adding more OreCap OCI is published here at thomcalandra.com and already sent to you: Copper Booming | Strategist’s Rules | Tiny OCI.

This week, OCI said it will ‘spin out,’ create subsidiaries for many of its Kirkland Lake properties. In the past, Orecap’s Stephen Stewart has executed with this strategy for American Eagle Gold & Silver, Awalé, Mistango and others. The move I think will move (higher) the stock of OCI, which trades at rock-bottom book value of its portfolio. See: Orecap strategy

AGNICO-EAGLE: Many of our TCRs own Agnico-Eagle AEM.

This piece by Denver Gold Group Mining Forum‘s Kristie Batten shows how large producers are ‘spreading their bets’ with equity stakes in small explorers.

Agnico Near Net Cash, Vows to Maintain Discipline

Agnico was also active on the business development front, making a record number of investments in junior explorers: Rupert Resources (TSX: RUP), Collective Mining (TSX: CNL), Cartier Resources (TSXV: ECR), Ongold Resources (TSXV: ONAU) and ATEX Resources (TSXV: ATX).

Trading: In addition to C3, Vista and Orecap, recent purchases include adding more Avino Silver & Gold ASM, whose The Big Print author, gold historian and money manager Larry Lepard sees as a top pick; and I purchased more of currently outperforming EMX Royalty. See: Review of The Big Print

I intend, as stated numerous times here, to divest some of the 78,000 shares of Ivanhoe Mines we have here at home — for both family trust allocation and diversification. I am, I hope not paradoxically, expecting Ivanhoe in early May to state potent copper (and zinc) production figures from Kamoa-Kakula in DRC Congo.

Ivanhoe will issue its Q1 2025 financial results April 30 — this week. Co-Executive Chairman and founder Robert Friedland will address the Bank of America Metals, Mining & Steel Conference in Barcelona Spain May 13-14.

See:Reciprocating With Fury [Gold & Bitcoin]

Thank you.

— Thom Calandra

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities. The Calandra Report, in its 13th year, offers a one-price, $139 yearly fee for all newcomers. Earlier subscribers keep their original cost. Sob stories listened to. No refunds after three weeks of service. Exceptions: