TCRs, please see Dollar Section at close. USD is (finally?) reaching down to the 100 DXY Level. We have not seen that 100-basket low since April 2022.

Also: outside coverage about TWO MINERS I track and own.

BOTH of these profiles are from The Northern Miner.

He makes just about the same points as we did here at The Calandra Report/TCR in our four-part Tonopah review.

I think his lede paragraph “stands out.”

Henry writes, “WVM stands out among the wave of gold, silver and lithium explorers sinking exploration dollars into the Tonopah Silver District in that it is content to bide its time and do nothing.”Â

More here and thank you Henry, and Sandy McVey. See: https://www.northernminer.com/news/site-visit-west-vault-mining-likens-its-hasbrouck-project-to-gold-in-a-secure-vault/1003856584/

Azimut-Exploration, the Québec predictive modeler, gets the lithium treatment — again, from Henry Lazenby.

This Rio Tinto $115 million CAD option-in pact just happened, as you know from our own The Calandra Report/TCR coverage Monday; and across the past four years.

The article, mostly a retelling of the press release, is worth a read for the background on the lithium flap Azimut patiently endured earlier this year from activist shareholders. See: https://www.northernminer.com/news/azimut-rio-tintos-quebec-lithium-exploration-deal-a-benchmark-says-lulin/1003856619/

Thank you, again, Henry.

My interest is and always has been the gold resource that is ahead for Azimut’s Elmer Gold Project. That is in James Bay, near the lithium targets with Rio Tinto.

* Azimut Exploration’s Jean-Marc Lulin assured us Elmer Gold Project‘s Patwon Zone and a 600-meter strike length would have a ‘maiden’ resource estimate by end of June 2023.

Azimut published this drilling update 2 weeks ago; so we wait.

A regulator compliant resource by an independent engineering firm in Val-d’Or, also Québec, “is the next milestone for the project,” AMZ AZMTF says. We have been waiting three-plus years for this; anything around 2 million ounces of gold across all national-instrument categories probably will bump up the shares’ $97 million USD value ($7 million cash in that figure) by 15%. That is approx. a $45 gold-in-the ground value, admittedly on the high side. That is my take.

I have seen West Vault Mining in Nevada and Azimut-Exploration in Québec.

Dollar-gold view: Drama — finally

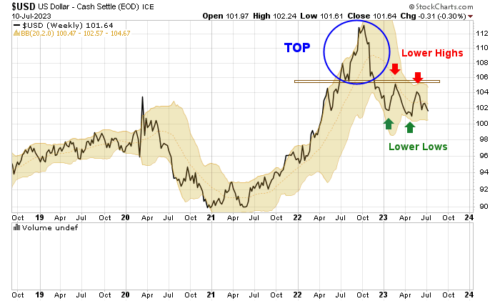

This chart at left comes from Al Marden, 5-decade chart examiner in Las Vegas Nevada; and a dear friend and a longtime subscriber.

Al sent the chart, labeled lower highs-lower lows, before Wednesday’s USD drop to near-100 against the DXY basket of currencies. That dollar decline, finally, fortified by a tame U.S. inflation report, is boosting gold’s price by $25 today.

The math: dollar down 1.1 % right now vs. DXY basket of currencies; gold up 1.3%.

The Swiss franc just notched its richest level vs. USD in 8 years, according to Bloomberg. Â

Dollar weakness for USD-denominated commodities such as gold, silver, copper, and so on, eventually correspond with rising metals prices. Dramatically so today.

Nice job, Al.

There are many explainers (interest rates, mining supply, investor demand, geo-drama, central bank buying-selling, a lack of econ clarity, crises …) for the inverse link between dollars and gold:

Another DXY chart from today-Wednesday, June 12, 2023 — at right.

— Thom Calandra

thomcalandra.com