Plus: Consumer Prices Wednesday

John C. McCluskey of Alamos Gold, a four-mine producer (Canada and Mexico), stuck to his seek-cheap knitting in the awful gold market of circa 2015 onward.

That’s when he bought AuRico in a $1.5 billion transaction, then spent bucks on AuRico’s Young-Davidson Ontario mine and its Mulatos mine in Sonora, Mexico.

His shareholders were nervous, to say the least. “Off cycle, investors hate it,” he said — telling a small audience at Denver Gold Group’s European Forum in Zurich.

[Consumer Inflation Levels Out Wednesday -- Earlier The Calandra Report/TCR | Tracking Copper & Platinum As Industrial/Precious Metals Price Gauges Of Goods (And Services ... And Energy ... And Wages) -- Worldwide | Platinum, Silver, Gold, Silver Accelerating Ahead of Wednesday's CPI figures for March in the U.S.]

I own AGI shares — the stock is one of the very top gainers of any gold producer this year — I own it for the positive cash flow that John (pictured here) has achieved 8 years on. Some $100 million right now, and who knows, as gold continues its run higher, maybe three or four times that free cash flow in three years, John says.

In 2015, when Alamos was looking at potential M&A, “we were usually the only company in the data room.”

Now, in 2023, “Everyone is talking about M&A in an up market. We’re done.”

View: John McCluskey video at Zürich Forum.

Takeaways for me: precious metals mining is a lousy business when prices are falling, as they did for years not long ago.

Mining is a terrific business, and a worthy investment, when prices are rising — as long as CEO and board completed their company-building in lean years.

More later this week from Zürich, where attendees and 40-plus companies are keeping an eagle eye on the gold, silver, platinum and palladium price feeds on hotel screens.

[Today, after presentations I helped moderate, and a few one-on-ones, I added to shares of Contango Ore CTGO (Alaska) and I-80 Gold (Nevada). Also on the copper and platinum side of the equation, I added to a long-held stake in Ivanhoe Mines IVN IVPAF (Africa). And as I have every week for probably the past 15 weeks, to Aberdeen Platinum Trust PPLT on NYSE] *

Please see: Miners, explorers, developers look for legs in their metals shares.

Speaking of M&A and eagle-eyes

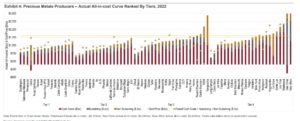

CIBC is ranking mines that are possible “acquisition targets.” It looks at producing gold mines NEM, GOLD, AEM, NCM, KGC, EDV, BTG, EQX, AUY, IAG, CG,

NGD, VGCX (Eagle Gold Mine), KRR, TXG, OLA and LUG, “which combined represent 80 assets and 22% of global gold output.”

Here is the graph: Classifying Assets – The Quality Roadmap

The bank in its report this week says that to identify potential acquisition targets, and mines “that could become Tier 1 or 2 with some help, and assets that may be better off rationalized,” it ranked the properties by production size, mine life on reserves/size of orebody, and position on the cost curve (using all-in costs) for 2022 — and flexed for what they

would be at reserve grade if the current cost structure persists.” [Ping me if you cannot read the chart; or click the link.]

Victoria Gold’s Eagle Mine in Yukon (Tier 3 at approx. $1,490 cost for producing an ounce), is one we track and whose shares I own, profitably; it’s in the middle of the graphic. VGCX VITFF shares this week and last are outpacing the stocks of most mid-tier producer cousins.

* Reconnected here in Zürich after many years with Platinum Group Metals PLG PTM, South Africa developer at Waterberg.

— Thom Calandra

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.