CanAlaska Uranium | Victoria Gold | Ridgeline Minerals

URANIUM miners’ June-July stasis (equilibrium) comes after a three-year rebound in spot uranium prices.

June and July 2024 were (and are) mostly like watching grass grow. This week, thus far, it’s fast-shooting bamboo stalks were watching.

The nuclear fuel, you know from many The Calandra Report missives, is in a renaissance — one that now is we hope gaining steam again.

The U.S. Nuclear Fuel Security Act‘s $2.7 billion paycheck from Congress this year is probably the best example of the element’s grudging acceptance as a de-carb savior.

“There has been strong bipartisan support for nuclear energy in the U.S. as playing a crucial role in achieving decarbonization goals as well as strengthening our national energy security.” — Bill Sheriff, enCore Energy EU

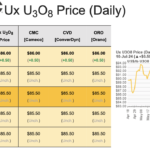

Uranium stocks are showing life and greater trading this week. See one-month ETF CHART please.

You know my preferred uraniums and sources.

Companies owned here at home: enCore Energy, which just joined a Texas nuclear alliance; CanAlaska Uranium CVV, whose Cory Belyk is talking the West McArthur venture with Cameco CCJ in the Athabasca Basin; F3 Uranium, which has four projects in the active northeastern Athabasca Basin; Laramide Resources LAM, whose reach includes New Mexico and Australia; Skyharbour Resources SYH, which is seeding a host of Athabasca Basin ventures; GoviEx Uranium GXU — hard hit by loss of Niger project.

I’m here to point to probable and mostly sub-$1 billion investments whose field work, properties and execs I know and trust. So far, those are the ones. I also continue to look at Baselode Energy FIND, whose shares I own via Stephen Stewart’s Ore Group/Orecap OCI portfolio.

“The move today in uranium stocks was about a new tax in the Kazakhs, which is over 40% of the (uranium) market.” — Dev Randhawa, F3 Uranium

Cory of CVV on the activity this week:

“I think we are getting a taste of just how wound up the uranium market is at the moment. It really feels like a spring that is coiled and ready to release its energy.”

“The dramatic swings we are currently seeing is just a sniff of what is to come in my view…the day to day swings we are seeing are leading indicators of pent up energy.” — Cory Belyk

Cory’s CanAlaska, see below, released its first drillhole of the summer at Pike Zone. Cory says the new drill result represents “the best new discovery on a global scale.”

Those are mighty words from a usually reserved Cory.

The eastern Athabasca Basin for CanAlaska has reserve depletion issues for Cameco and other producers or potential producers.

CanAlaska’s West McArthur is 15 km from Cameco’s McArthur River. Pike Zone drilling, I am told, is ongoing at a “feverish pace.”

Preciously (and previously) at TCR:

I add C3 Metals CCCM to the summer injured list. Hurricane Beryl in Jamaica cut off most road access and other “infrastructure” at the Bellas Gate, Arthurs Seat and Super Block gold, copper porphyry and epithermal sites. See statement.

“Currently, the vast majority of roads are inaccessible, and our project areas are without power.” Dan Symons, CEO

Dan says C3 will go into big-brother-sister mode, delivering water and food, clearing landslides and repairing damaged homes where it can. No injuries reported among C3 team members.

“Mid to long-term,” Dan told me this morning, “this event only strengthens our community relations. Short term, it delays our ability to conduct exploration and get results.”

CCCM CUAUF shares already are crushed this year. I own CUAUF and am down about 50% in the now-$15 million CAD company. I will monitor and for now, hold my shares.

Gold mine operator Victoria Gold VGCX and Niger-stripped GoviEx Uranium GXU also are on our summer injury list — the first suffering after the Eagle Gold Mine disaster and the second trying to withstand the Niger military coup’s seizure of its flagship project.

I continue to average down my VCGX VITFF shares. (Bought more at 0.52 CAD just now.) The stock is hit again this week yet recovering now –just above an all-time low and a $54 million CAD value. See %$#*! Dot Dot Dot for more.

I know four individual miners buying more shares. Victoria promised an update this week about Eagle.

The consensus: “Where do you buy into a gold mine these days for $50 million?” Still, a ton of risk is possible from further fallout: Yukon and Canada-wide regulatory, environmental and financial.

I asked Matt Geiger, SF fund manager, whether Eagle Gold Mine is coming up for discussion at the Boca Raton metals symposium this week.

I have been to Eagle three times.

Matt, who does not own Victoria Gold shares, says nothing yet about Eagle on Rick Rule’s stage. Matt, who does not own Victoria Gold shares, says nothing yet about Eagle on Rick Rule’s stage. Another attendee, Robert Sinn, known as CEO Technician, concurs.

As to the matter of restructuring debt in the event the mine returns to production, there are many possibilities. A royalty company, Osisko Gold Royalties, put down $98 million CAD for Eagle in exchange for a 5% NSR in March 2018.

This week, a good dozen subscribers, most miners or investment professionals, tell me I am way too early speculating on VGCX.

Too many unknowns still? For us here at home, it is an easy decision to average down on the gaping mark-to-market loss we have in our shares.

Ridgeline Minerals RDG: I have high hopes for the Nevada silver-lead-zinc-gold multi-property explorer.

I just read Matt Geiger‘s exhaustive survey of RDG. Matt just released his first-half review for his small fund, MJG Capital. It’s in there. (Matt and I visited Selena, the silver-etc., project, and other RDG properties.)

If you want a chance to snag what could be a low-priced ($16 million CAD) explorer with several diverse drilling irons in the fire, I suggest a look-see at Matt’s report. Young Chad Peters is CEO.

From Matt:

Milestones expected from Ridgeline over the next 28 months.

• Plan of Operations Permit Received from BLM at Selena Project by end Q3 2024

• Drill results (4-5 holes) from Phase III program at Swift funded by NGM by end 2024

• Decision on whether to drill on 100% basis or bring in earn-in partner at Selena by end 2024

• Decision on whether to drill on 100% basis or bring in earn-in partner at Big Blue by end 2024

• Drill results (1-3 holes) from Phase I Program at Black Ridge funded by NGM by end 2025.

Thanks Matt — his report here at top of the page.

Good News Bear(ers): CanAlaska Uranium CVV CVVUF is reporting continued high grades of the nuclear element at its West McArthur venture with Cameco CCJ.

The hit — first drill hole in the Pike Zone there in Athabasca Basin — intersected 3.44% eU3O8 over 21.6 metres. Tuesday looks like a rebound day for recently hard-pressed uranium stocks, which have been twiddling their thumbs eyeing a static spot uranium price this month of July 2024.

I scanned this review of uranium-cos from Financial News Media via Morningstar — a worthy, succinct summary.

https://www.miningforum.live/p/17c8914f-a6e2-4b2e-8456-938bbf6c2176?postPreview=paid&updated=2024-07-10T21%3A43%3A22.621Z&audience=everyone&free_preview=false&freemail=true

Intrepid Metals: Shares of the Arizona copper and gold explorer are rising smartly after what look like potent grades.

Deborah Honig at Adelaide Capital put this on my radar screen 9 months ago; we were at a conference at the time — October 2023. At the time, INTR shares were a $12 million CAD market value.

Today: $20 million CAD.

Intrepid Metals‘ Arizona headline: 20.20% copper, 8.51 grams per ton gold and 250 grams per ton silver (23.85% copper equivalent at Corral Copper Property.

Deborah, a marketing executive, at the time told me,

“This is essentially a brand-new story with a large recently consolidated land package in southern Arizona with excellent historic drill results, strong technical management team, tight share structure and excellent shareholder base. The first Intrepid drill program planned for later this year should have decent hits as will be a combo of twinning and exploratory holes.”

Again, that was in October 2023. Ken Brophy is CEO. I hope to chat with Ken soon. I do not own the shares; my exposure to Arizona is Ivanhoe Electric IE.

— Thom Calandra

PayPal $179 Yearly: Recurring The Calandra Report

PayPal $229 Yearly Non-Recurring The Calandra Report

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.