Plus: Ivanhoe Mines’ Congo & Angola | Collective Mining| Silver, Gold Crosses

TCRs, gold, silver, copper, uranium. Big week thus far: See GOLD PRICE CONTINUOUS FUTURES CONTRACT.

A golden cross for silver (and gold) is in place.

Another promising week for precious metals.

Gold ($2,010 an ounce Monday and $2,040 Tuesday; $2,060 Wednesday) at a record price high in most currencies, just not USD yet — another $35 or so for that.

Wednesday morning in Asia, gold now $2,060. See futures here.

Updating this with Colombia (and Spain) explorers

at the close of this report.

Previous The Calandra Report here please:

Uranium Run | Zürich Material | Contango OreSilver chart here: a so-called golden cross for silver’s price (and gold) IS TAKING PLACE. Fakes, death crosses, whimsy all enter a chartist’s equation for a golden cross, which demonstrates a short-term moving average piercing on the upward track a long-term moving average.

That bodes a so-called “breakout” to fresh highs (above $2,100), the technical crowd says.

“Yet not much market chatter,” says a trusted confidant, a London investment banker and an active bullion investor, Simon Catt at Arlington Capital.

Uranium: Completed a call with Wyoming uranium explorer

Nuclear Fuels. NF NFUNF has a fresh U.S. listing

that is boosting trade of the hard-to-get stock. See below please.In fact, the cross appears to have taken place given the week’s price gains in gold and silver.

Myra Picache at MarketWatch tells us today that catching her attention is “the volatility in gold, how gold and the GLD have managed to head toward a golden cross just a couple months after gold futures reached a death cross.” I include another, more current chart here with 50-day and 100-day moving averages for the active futures contract.

Myra’s latest: https://www.marketwatch.com/story/gold-rallies-toward-golden-cross-after-defying-bearish-signal-a1909dce

Alamos Gold

Alamos Gold‘s stock price AGI on NYSE is now above $14.20 and Tuesday yet higher); that looks like the richest price since late 2013. John McCluskey and team get credit for running a multiple-mine, cash-flowing, profitable and ever dividending Canada/Mexico producer.

Now, let’s see Alamos’ meaningful percentage equity stakes in explorers Orford Mining ORM ORMFF (which I own) and Aztec Minerals AZT AZTMF (which I track) become meaningful money stakes.

Nuclear Fuels NF NFUNF: Just wrapped a Zoom from Wyoming with CEO Mike Collins and enCore Energy CEO Bill Sheriff, who chairs tiny NF. [I own NF shares.]

In a short take (more to come), NF NFUNF, a 2-day-old OTCQX listing, is probably the cheapest priced genuine U.S. uranium explorer and definitely the cheapest in-situ one (deep drilling of wells — fluid-based, alkaline-leach mining) that I know. Nuclear Fuels now controls 33 miles of claims across the western side of Wyoming’s potent Powder River Basin. Peninsula Energy, a larger, Aussie explorer, is also in the area with its Lance Project.

Mike and Bill say Nuclear Fuels, already having achieved 0.3 grams per metric ton uranium in just-released drilling, looks to notch the 0.42 grade plus that Peninsula sports in a 53-million pound resource (albeit from 2012 drilling). Expect more drill assays this week or next — the two execs are on site, and results come in fast for gamma-downhole wireline probes, I understand.

This is all super-spec, as I call it; a tiny market cap explorer with $7 million for more drilling. Bill and Mike note that enCore, about to press release actual production at its Rosita Project in southern Texas, owns 20% of NF.

Bill, a successful uranium and gold company starter, considers NF the exploration arm of enCore, which can if exercised via clawbacks, one day own 49% NF. The stock, hard to buy, is showing life at 50 cents USD.

“I think we are going to see a spike to $100 a pound (from $80 spot uranium price), and then it will settle down for a while,” Bill Sheriff says. NF shares are showing life at 60 cents CAD, just remember, TCRs, this is a $20 million market cap.

I continue to purchase NF NFUNF (and I also own CanAlaska Uranium and Laramide Resources, and am looking at Skyharbour Resources, Cosa Resources.)

Uranium forward price curve from Numerco here please: https://numerco.com/NSet/aCNSet.html

Getting zero love: Jamaica copper, gold explorer C3 Metals CCCM CUAUF.

C3 just out with more from a porphyry target at its Bellas Gate project there in th4 Caribbean. The hole intersected pierced 281 meters at 0.37% copper and 0.21 g/t gold. The idea, says CEO Dan Symons, is to achieve higher grade, deeper mineralization from a bornite core “that is typical of these systems.”

We’ll see; I own it after having visited Bellas Gate with Dan and team. C3 Metals shares are showing a scant bit of life this month of November after a year of torpor. CCCM is a $50 million market cap. Approx. 650 million shares outstanding at 8 cents CAD.

Other still shunned explorers even as gold, silver, platinum, even copper today, add to their November gains: too many, several owned here at home.

Those not owned here at home but reboundable at these pitiful prices include: Western Copper & Gold WRN — just getting $6 million more Rio Tinto investment money; Maple Gold Mines MGM MGMLF in Québec’s Abitibi Gold Belt — just talked with new CEO Kiran Patankar, a geo-engineer and former CFO there about a continuing Agnico-Eagle joint venture; Denarius Metals DSLV — see below; Québec’s Radisson Mining Resources RDS; Aztec Minerals AZT — in Arizona and Mexico.

Maple shares Tuesday rose 25%, still, just 2 cents CAD.

Too many to tag here, but rest assured, all of those at these prices likely will activate with any developments.

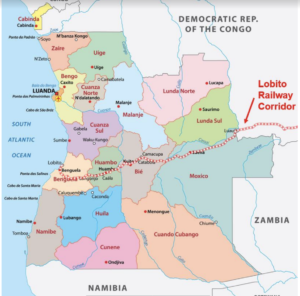

Ivanhoe Mines: it’s off to Congo-bordering and Namibia-bordering Angola to see if it can extend the rich-rich-rich Central African Copper Belt. See map above. See release here please.

IVN IVPAF already has proven and extreme-high grade properties, with sedimentary spread Kamoa-Kakula producing prolific amounts of copper in Democratic Republic of Congo. Ivanhoe just released (yet another) exploration copper hole of 5.19 meters grading 11.64% copper. The new Kitoko hole is world-class grade.

Re Angola, I asked Heye Daun of Namibia gold mine developer Osino Mining OSI OSIIF (which I own) what he thought. Heye hails from Namibia.

“Very tough place to operate. Namibia is the perfect jumping off point for Angola,” he said.

Ivanhoe’s 100 percent-owned license package in Angola is half the size of Switzerland, the company says.

IVN IVPAF is our largest natural resources holding here at home and our longest-held one. Next in line, Xtra-Gold XTGRF XTG, which we have held, bought, sold, bought more, since 2009 — it is Ghana’s Kibi Gold Belt centered, with alluvial gold income that pays all exploration freight for the company.

- * Colombia: As our TCRs know, through last year, my tours of gold, silver, copper projects, and nat-gas/oil, number about 25.

After a sit-down with Collective Mining’s Aris Sussman in a Zürich setting the other day, I have to pinprick the worry bubble over (probably) lame-duck President Gustavo Petro, a guerrilla fighter who came into office a couple of years ago dissing all mining and exploration.

As Ari points out, new permits were issued to South 32 for Cerro Matoso, significantly by the federal government. Other exploration and production permits across much of the country continue to make their way through local, provincial and federal pathways — albeit mostly for underground mining in that lush, scenic nation.

Collective Mining, next to historic and rich Aris Mining ARMN project El Marmato, is CNL in Toronto. Ari co-founded Continental Gold, the Colombia gold and silevr developer at Buriticá owned by a China giant.

“Based on the information from drilling we have presently, we envisage a modest size pit followed by an underground mining scenario,” he says.

The junior miner leader right now in Colombia is probably Aris Mining, which is producing at underground Segovia. I have been to all of these projects numerous times. ARMN ARIS is showing heady gains this month.

Investor and CEO in his own right (British Columbia’s Stuhini Exploration STU) David O’Brien points to the Aris A& B 2025 stock warrants that trade publicly. The B’s and the A’s have about doubled in the past two weeks, and the B’s, David says, have no premium above strike price right now. The B’s are rising anotHer 4% today. See B warrants here please.

Neil Woodyer, Aris CEO — I saw him in Zürich, and he followed up with a 75% increase in gold reserves at underground Segovia to 1.3 million ounces of gold at 11.63 grams per ton. I remember when Gran Colombia Gold, then run by Serafino Iacono, ventured into the former Frontino Gold Mine some 7 or 8 years ago and observers said the wildcat mercury-using miners there would rip ’em off blind.

Neil notes the mineral increase guaranteed at least a 7-year mine life for Aris.

Finally, one that I have been to at least three times, Zancudo at Titiribi in Colombia, is on its way to Denarius Metals DSLV DNRSF production, Serafino is CEO of Denarius, which is active there and in Spain’s Iberian Pyrite Belt.

Zancudo has a 10-year underground mine life and according to an engineering-economic study, will start producing gold, and silver, at the site not far from large city Medellín next year.

The Denarius Spain project, Lomero, also is fast-tracked for production of a grab bag of metals — 147,000 metric tons of copper equivalent in 7.73 million tons of ore at 1.91% per ton copper equivalent in indicated and 50,000 tons of copper equivalent at 1.46% copper equivalent inferred. Boilerplate here please.

More to come for The Calandra Report/TCR subscribers.

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.