Golden cross | Alamos, Victoria Gold, Western Copper, Fury Gold Mines

Florian Grummes, European strategist

Regarding gold -- "A similar situation

was last observed around 14 years ago.

After the gold price had been approaching

the USD $1,000 mark for months, the first

monthly closing price above (September 2009)

caused a huge liberation. In the following

three months, gold exploded

and rose by around 25% to $1,225

without any significant setbacks." *

Gold Friday as a futures contract finds itself at a record price high in all currencies at $2,091.

See active futures contract here.

Spot gold’s price (sans dealer premiums) at $2,071 an ounce is about $2 or $3 below its all time high of March 2022. Good luck getting a one-ounce gold coin for that price.

Not much hullabaloo, tabloid headlines, just slowly building goldbug “chatter.” Well, until today’s December start, that is.

Our top gainers among The Calandra Report covered and-or owned miners this week, and today-Friday, number developers such as Osino Resources OSI OSIIF; relatively new gold producers such as Victoria Gold VGCX VITFF st Eagle Gold Mine in Yukon; developer-produer Ivanhoe Mines IVN IVPAF; and a scant few explorers, including James Bay, Québec, operator Fury Gold Mines FURY, whose CEO, Tim Clark, I met the other week in Zürich. Fury owns a slug (25%) of Dolly Varden Silver DV shares.

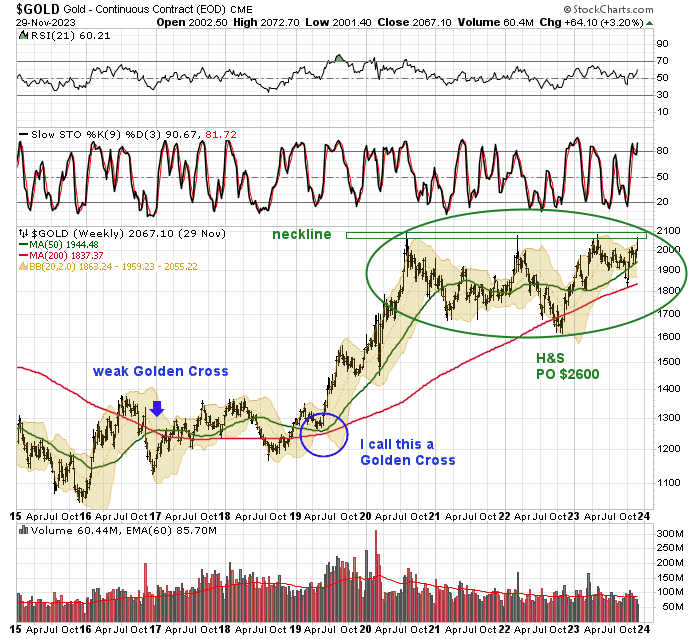

Here is a weekly gold chart, with golden-cross “weak,” genuine, and directional markings, again, courtesy of Al Marden, Las Vegas chartist and longtime The Calandra Report/TCR subscriber.

Silver chart below: in addition to gold, a so-called golden cross for ignored silver’s price appears to be taking place. Or about to, depending on your choice of moving averages. Also, a Fibonacci in here, below. [Plus: how mining equities stack up or down, vs. gold and silver prices.] **

Fakes, death crosses, whimsy all enter a chartist’s equation for a golden cross, which demonstrates a short-term moving average piercing on the upward track a long-term moving average.

Ditto for gold, also in golden cross territory. This close of November 2023 bodes a so-called “breakout†to fresh highs (above $2,100), the technical crowd says.

[Do not forget copper, which I consider precious for global growth; I had rare good timing with my Western Copper & Gold WRN purchase two days ago. In rallies such as this one, it is easier than usual to be on the mark when it comes to value investing.]

“Yet not much market chatter,†says a trusted confidant, a London investment banker and an active bullion investor, Simon Catt at Arlington Capital. Chatter = an outpour of chest-beating by long-subdued bullion believers, and-or front-page New York Post, Daily Mirror GOLD HEADLINES.

*Â Here is a tell-all gold analysis from Munich-born Florian Grummes — covers technicals, sentiment, central banks, supply-demand.

Just out — https://www.midastouch-consulting.com/29112023-gold-monthly-closing-above-usd-2000-triggers-breakout-rally.

Florian, recall, hit it on the bullion head two weeks ago with this discussion, on video here, in Zürich. No nonsense, and tagged Victoria Gold as a leaper VGCX VITFF.

See:Â https://www.gowebcasting.com/events/precious-metals-summit-conferences-llc/2023/11/14/keynote-florian-grummes-technical-update-on-gold/play/stream/37270

See Florian’s blurb above.

Our top gainers among our coverage and-or owned miners this week, and today-Friday, number developers such as Osino Resources OSI OSIIF; relatively new gold producers such as Victoria Gold VGCX VITFF st Eagle Gold Mine in Yukon; developer-produer Ivanhoe Mines IVN IVPAF; and a scant few explorers, including James Bay, Québec, operator Fury Gold Mines FURY, whose CEO, Tim Clark, I met the other week in Zürich. Fury owns a slug (25%) of Dolly Varden Silver DV shares.

In fact, the cross appears to have taken place given the week’s price gains in gold and silver.

Myra Picache at MarketWatch tells us today that catching her attention is “the volatility in gold, how gold and the GLD have managed to head toward a golden cross just a couple months after gold futures reached a death cross.” I include another, more current chart here with 50-day and 100-day moving averages for the active futures contract.

Myra’s latest: https://www.marketwatch.com/story/gold-rallies-toward-golden-cross-after-defying-bearish-signal-a1909dce

**Â “And yet,” Rudi Fronk of British Columbia gold-copper project developer Seabridge Gold SA tells me just now, “Gold stocks are languishing relative to the gold price.”

Rudi, chair and CEO of Seabridge, explains the ratio of the XAU equities gold index to the gold price in late 2015 was 0.035. The March 2020 low ratio was 0.045. “We are now at 0.060. Note the average looking backward. XAU (the mining stocks) could go up 3x and still be below the long-term average, and more than 6X to match historical peaks.” See please Seabridge Gold’s The CASE FOR GOLD.

The most recent major bull market breakout to new highs, in 2009, nearly doubled the gold price by 2011. “Assuming a repeat, gold stocks should be good for a 6-12x run,” he says.

Brien Lundin of Gold Newsletter today: “When gold or any asset gets this close to a big number or a record high, that level often acts like a magnet, drawing the price line to it. That seems to be the situation right now, so the real question is whether we’ll break through this time. Many analysts are saying this rally is overdone and due for a rest, and I recognize that fact. It wouldn’t surprise me to see gold take some time off in this rally, and it may even be doing that today. But as I just posted on X, “One of the key characteristics of this run in gold has been that the Asian investors are in, the central banks are in…but the western investors aren’t.Â

Shorting: This from G2 (Guyana) Goldfields‘ GTWO GUYGF Patrick Sheridan in London.

“Not sure if you’re following the issue, but I think it’s going to get a lot of traction going forward as the computer programs have distorted the markets in many companies,” he says.

That would be so-called bare, or naked short selling of stocks. It is illegal, and a U.S. court case is proceeding. It is Harrington Global Opportunity Fund Ltd. v. CIBC World Markets, Inc. et. al.

Spoofing and other shenanigans also are on the table in the case. Naked short selling usually results in a failure to deliver the shares after the transaction.

Two helpful pieces, one text and one a video with Canada’s Eric Sprott, Save Canadian Mining’s Terry Lynch and others:

– https://www.nasdaq.com/articles/how-three-companies-are-taking-aim-at-alleged-naked-short-sellers [One day old]

– https://savecanadianmining.us4.list-manage.com/track/click?u=1b164dbcbba3b5b3c2388922d&id=4efb1fc2e0&e=017dd61c6f [Five days old]

Alamos Gold

Alamos Gold‘s stock price AGI on NYSE is now above $14.20 and Tuesday yet higher); that looks like the richest price since late 2013 fr the 500,000-ounce-a-year-plus producer.

John McCluskey and team get credit for running a multiple-mine, cash-flowing, profitable and ever dividending Canada/Mexico producer.

Now, let’s see Alamos’ meaningful percentage equity stakes in explorers Orford Mining ORM ORMFF (which I own) and Aztec Minerals AZT AZTMF (which I track) become meaningful money stakes.

The other producer, an emerging one, that is pacing November miner gains is Victoria Gold VGCX VITFF. John McConnell and team have the Yukon Eagle Gold Mine looking to reach 200,000 gold ounces a year.

I own Victoria Gold shares, which, like Alamos Gold shares, have risen about 35% in 2 weeks or so.

Western Copper & Gold WRN: I used to own WRN after seeing the Casino property perhaps 6 years ago with CEO Paul West-Sells and team. I own it again as of today at $1.22 USD.

Active developers of projects (Namibia’s Osino Resources OSI OSIIF a good example) are the stars this week, along with actual and emerging metals producers. WRN at its Casino copper gold project in Yukon notches into that column.

Don’t think I ever have seen WRN shares this cheap. Even after Rio Tinto came up with and people/intel for Paul’s team. That is, Rio Tinto, a 10% WRN owner, is “in the camp tent.”

“The agreement that we signed is similar to that that we had with Rio previously – the big difference is the scope of work,” Paul says. “The new scope of work will focus on developing a green energy solution (already under way with the Yukon-BC connection), securing port access (also already under way), and identifying permitting optimizations. Also, Rio has committed to assisting in all of this work, so moving to a more collaborative relationship, which should benefit everyone.”

Other purchases this week: more Ivanhoe Mines IVN IVPAF — the platinum-nickel-gold developer and accelerating copper (and zinc) producer at two Africa projects is enjoying further rich COPPER discoveries in DRC CONGO; full steam ahead calendar for Platreef in South Africa and active outreach to Angola exploration; IVN shares are outpacing the pack this week — our largest and (since 2003) longest-held nat-resources stake; followed by Ghana’s Xtra-Gold Resources XTG XTGRF, since 2009.

Others: added more DHT Marine Holdings DHT, the very large crude carrier oil shipper in Europe. Investor, ag-equipment seller and shipping aficionado Avraam Gabrielidis in Greece tells me today-Thursday, “I have bought more DHT yesterday at 9.84. Spot rates are down from around $80,000-83,000Â last week to $56,000-60,000 this week, but still higher than 12 months ago and much above $40,000 at the beginning of November. Winter period had already started; if we do not see cuts in the supply of oil, better rates should be the case.”

This week, also, added more Nuclear Fuels NF NFUNF — see previous reporting please for updates, preferred, poised holdings — paying subscribers only.

— THOM CALANDRA The Calandra Report/TCR

Thom Calandra ​is a ​writer and an investor. Research and material are meant as editorial opinion.​ He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.