TCRs, put this in your portfolio.

The term HODL, I learned, “HOLD ON FOR DEAR LIFE,” originates from the crypto world and can be applied to any topsy turvy market, including gold.

This amalgamated straight from the Internet:HODL originated from a typo in a 2013 Bitcoin forum post. The term is retroactively redefined as an acronym for “Hold On For Dear Life,” a strategy during volatile market conditions.

— Ivanhoe Mines unveiled A resource upgrade for its Western Forelands in DRC Congo. Straight from the wire:Makoko District Indicated Mineral Resources 27.7 million tonnes at 2.79% copper plus Inferred Mineral Resources of 493.7 million tonnes of ore at 1.70% copper, using a 1% copper cut-off. Release here. I own shares of IVN.

As you know, the pub-co galaxy has far too many small miner wanna-bes.

I will be limiting coverage of companies I have not kept abreast of. Our The Calandra Report will try to tag companies when there is a value proposition. Please excuse me if some fall through the cracks.

Contango reminds me that its Johnson Tract technical assessment recently published shows a 30% IRR and a seven-year mine life (at $2,200 gold) with a one-year payback after mining commences. Post-tax net present value: $225 million. Details here.

Someone was paying attention. Thursday, after publishing Q1 $19.3 million of operational income from Contango’s share of Manh Choh gold production in Alaska, the company saw its stock rise 16% to $15 USD. Quote here.

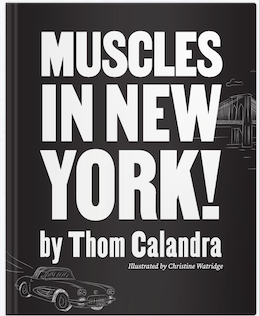

It’s just out: “Muscles In New York.” Mussels, fettuccine, The Congo, Brooklyn New York and our hero, Gérald, and zee hot zos.

Need a smile? “Muscles In New York” follows a Congo seafood chef transplanted to Brooklyn, New York. It’s free and for all ages.

Also as a free flip-book here.

Reading this will not enrich your investment accounts. I guarantee it will make you laugh and leave you hungry for mussels and zee hot zos. PDFs for printing on request, and also free.

[Un]Finished Business

TCRs,

Note from Peter. A in southern California: “Mining stocks are in the toilet. They should be triple what they are now. Gold goes up $91 and juniors go up 6 cents. Silver stocks suck.”

My response: “Peter, the producers are doing well … royalty cos coming on, too. Some silver stocks are doing well — Avino ASM for one.”

Peter: “The mining sector is in the soup with every 100-dollar daily rise in gold. Silver is not participating in the rally. Physical has been a far superior investment then wretched mining stocks trading at levels when the gold price was $1,200. CEF (Sprott physical gold and silver trust) is the clear winner.”

Response: “Give it time. When we have another day like this one, maybe those desperate for a position will chase juniors, which I own in force. Peter, meantime, one thing to look at is discount/premiums on trusts that hold gold — closed end funds such as PHYS Sprott and as you know, CEF Sprott.

When they move to a premium from a discount, the desperate buying will have begun.”

— James Turk of Goldmoney.com just published “Money & Liberty.” James and I go back to 1999 in London. His new one links freedom and sound, or natural money.

James’ takeaway intro: “In the 1950s my parents would drive the family car to the local gas station and fill it for two silver dollars. Today $2 does not even buy a gallon of gas, but the value of the silver in two silver dollars will still fill the family car.”

The book is at Amazon.

“Your book has a section that sounds like a question I get all the time ‘What price will gold go to?’

My answer is usually, ‘Well, there might be a better question. In dollar terms forecasting a gold price is fuzzy at best, You have to measure it in what you will be able to buy with gold against what you will be able to buy with paper.”

James: “The page you’ve chosen hits upon a key theme: how language today is being misused by demagogues. For example, gold is not an investment because it does not create wealth. When gold rises, existent purchasing power moves from holders of dollars to holders of gold. But calling gold an investment serves a purpose for those who benefit from the current monetary system. It takes attention away from the real cause of rising gold: the debasement of the dollar’s purchasing power.”

He adds, “Misusing words is particularly harmful when the original intent of the framers of the Constitution is ignored, as you will find as you get further into the book.”

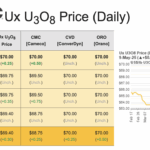

– Uranium: “Are we onto a trend now that we passed $70? I think so,” says Cory Belyk at CanAlaska Uranium.

— Comstock‘s Q1 conference call on Youtube. LODE’s several solar-panel recycling, biofuels and clean-energy businesses are starting to look like they’re in the segment for the duration, even if they are losing money and Comstock is indebted with an approx. $4 million note.

The silver miner in the Comstock Lode is getting state government grants (Oklahoma) and other, corporate money commitments and biofuel recycling facilities for a range of metals-to-energy and recycling systems. See con-call.

The stock has a history of boom and bust, and when it booms, as it appears to be doing now, albeit gradually, the stock, on NYSE American, changes hands furiously.

— Finally, an independent review of one of the biggies’ Q1s, Barrick Mining.

Thank you, Kristie Batten at Mining Forum Live via Denver Gold Group.

Let’s see if Mark Bristow can continue to mend cost-increasing patches of Nevada, Papua New Guinea and Tanzania.

— Thom Calandra [I do not own Barrick, Newmont, Hecla or Endeavour Silver.]

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities. The Calandra Report, in its 13th year, offers a one-price, $139 yearly fee for all newcomers. Earlier subscribers keep their original cost. Sob stories listened to. No refunds after three weeks of service. Exceptions: