Family Offices Must Show Their Hands In Mining Investments

[Private Note At Close Of Report]

TCRs, here is a historical scan via Denver Gold Group: mining investors continue to add private equity firms to the mix — 2011 vs. 2024.

The current figure, based on those miners that will attend the September Americas Forum: $463 billion, with copper miners starting to show in the mix.

Still, the 2011 tally adjusted for inflation is far more: $587 billion. So, today, even with a much better current gold price, which powers the bulk of miners who belong to the DGG trade group, the current total is down, down, down.

Nowhere to go but up for miners’ market caps? I think so. But so do other diehard natural resources investors.

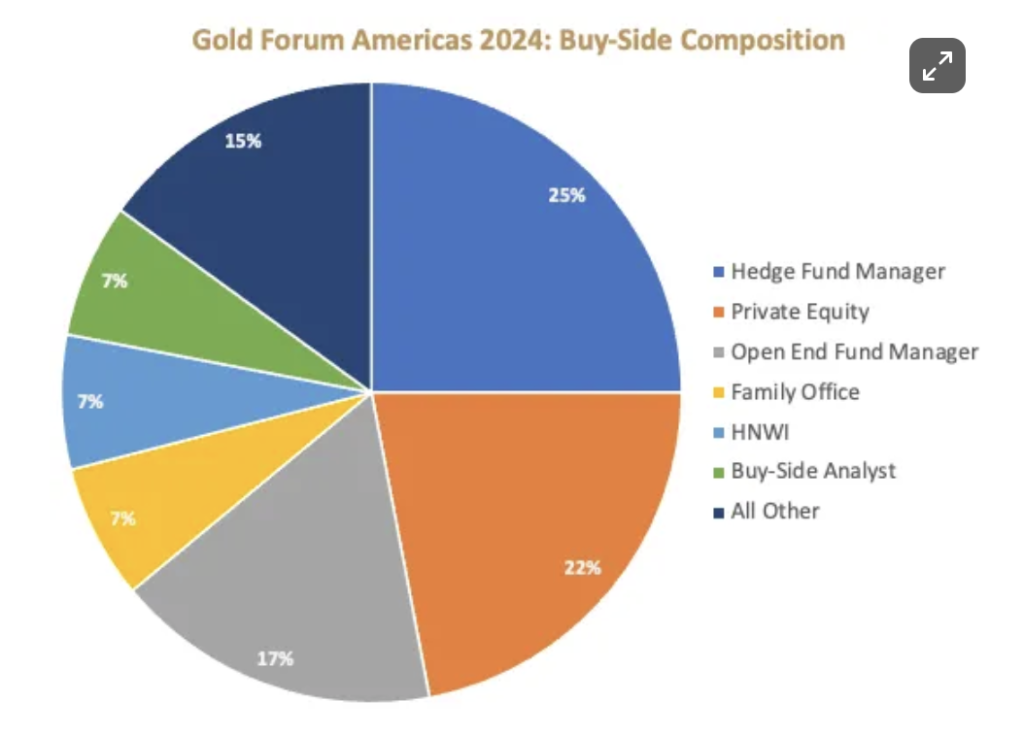

As you see in the buy-side pie chart, the family office mix is 7%; family offices are a good measure of individual investors (known also as retail investors). That 7% percentage needs to grow, grow, grow, if we are to see broader buying of lazy mining stocks, I believe.

Private equity firms are now 22% and growing, all well and good. Yet as we know, private equity firms show up at the table when there are valuable mining properties in distress or are underpriced and in need of cash.

Translation: private equity does not accelerate the momentum of mining stocks. Individuals (including hedge funds –25%) and HNWI (rich folks — 7% of the pie) do.

The 15% OTHER slice of the pie, I gather, includes endowments, royalty buyers and streamers (including possibly off-take metals buyers) and sovereign entities such as JOGMEC in Japan.

Anyway, take a look: https://www.miningforum.live/

Denver Gold Group‘s September 15 to 18 Americas Forum in Colorado Springs takes place the week following the equally popular Precious Metals Summit at Beaver Creek in Colorado.

See also my take on then — Denver venue — and now — Colorado Springs venue: https://www.

You can subscribe to DGG’s Mining Forum for free.

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.