Interactions with principals of Banyan Gold & QC Copper & Gold.

And more ... Uranium Rush | Amex Exploration | Newcore Gold ... Contango Ore

Update

A Ferocious Precious Metals Rebound

The latest [Nov. 18-19, 2024] — to say gold and other precious metals, silver, platinum, and their miner equities, are shaking off last week’s crushing losses.

Gold futures: here — a rousing rebound

Uranium? That’s moving up sharply — the equities that is — as Russia threatens to restrict exports to the West.

“But if the spot uranium price doesn’t follow through, it (a uranium miners’ rally) may be short lived,” says Bill Sheriff of enCore Energy EU, a Texas uranium producer.

Spot and longer ‘term’ prices for the nuclear fuel are edging higher this week. [More below. ***]

“Few details on the Russia hold-back but with the U.S. allowing missiles, it is not likely to lessen Russia’s resolve on uranium.”

Spot uranium rebounded from a one-year low of $76.50 the other day and at last look was in the low-$80s a pound.

At any rate, I’ll let the metals numbers do the talking. [I use MarketWatch for miners and for metals futures prices. Here is copper, for instance — attempting its own rebound.]

More uranium comments below. ***

Previously On The Calandra Report Nov. 16, 2025

Select miners with strong PEAs or drill results are gaining in a devastating week for precious metals: for example, Amex Exploration AMX — its Perron in Québec with average gold grade at 5.26 grams per ton and a payback less than 2 years. PEA here.

Banyan Gold BYN and QC Copper & Gold QCCU are stuck in watch-the-paint-dry market neutral. Each of them might present an opportunity for those willing to purchase on the cheap as losing shareholders sell for tax–loss purposes or flee the metals carnage.

TCRs, there are scores of miners with worthy metals projects fitting this misery bill. Strong, developing miners with little market love — Newcore Gold NCAU is yet another example: regular reports of high-grade sulphide gold at its Enchi in Ghana yet little appreciation this month of November. Latest results.

Sure-footed miner-explorers that suffer meandering market malaise. Where to now? Not helping: tax-loss selling of losers as year-end nears.

I do not own Newcore, nor AMEX, yet I did once (or twice) and made money each time.

Before we do the quick scans of QC Copper & Gold and Banyan Gold: a bigger picture of precious metals.

TCRs, if it is any consolation this awful week for precious metals, copper, and miners, there is a barn-burning sale going on. Trading note at close of this report.**

Banyan Gold BYN and QC Copper & Gold QCCU are stuck in watch-the-paint-dry market neutral. Each of them might present an opportunity for those willing to purchase on the cheap — as losing shareholders sell for tax loss purposes or just flee the metals carnage.

I own each of these explorers.

I reached out to Avi Gilburt, a technical chartist who leads the team at Elliott Wave Trader. Avi’s readings are sharp, and he has been anticipating a metals pullback.

“As the market is pulling back into the support zones we had outlined a while back, we expect that the next bull market move will likely carry us into early 2025 before we see a much longer multi-month pullback/consolidation. That larger pullback/consolidation will likely set up the final parabolic rally in the metals complex that I believe will conclude the bull market phase which began in early 2016.” — Avi Gilburt

Avi will be one of five panelists I will (attempt to) moderate next week at the opening Precious Metals Panel in New Orleans. Details above.*

Also heard from Rick Van Nieuwenhuyse at Contango Ore CTGO, which I own and which is benefiting on its cash-flows sheet (but like most, not in the market) from its share of the Kinross Gold joint venture in Alaska — Fort Knox processing Manh Choh gold ore.

Banyan Gold

Banyan, set in central Yukon and run by Tara Christie, has a 3-minute animation of the explorer’s gold intrusive at its AurMac project.

It is worth a view in a regional setting that is propelling one of the best small-cap exploration stocks of the past two years: Snowline Gold SGD to the Yukon east.

Both explorers’ properties host intrusion-related gold mineralization. Boilerplate: their gold deposits each are spatially linked to granitic intrusions — formed from fluids and metals and posing the possibility of large tracts of recoverable gold ore.

Here is the Banyan animation. (Link here.)

Tara is grooming a portion of Banyan’s AurMac for higher-grade, milled ore.

“One day the paint will be dry and the market will realize the value proposition, particularly as we continue to put out drill results and advance to our PEA next year.” — Tara Christie, Banyan Gold

Richard Gray at Cormark Securities has been tracking Banyan Gold for quite some time. I rarely rely on brokerage reports for perspective, but in this case, Richard’s 3-page summary of Banyan’s “definition drilling” for a mining plan of the Powerline deposit at AurMac says it in a nutshell:

“The company is targeting the higher grade areas of the 7 million-ounce resource that has an average grade of 0.63 g/t … and the company believes that will drive a smaller but higher grade resource of 2 million ounces (for) a standalone, mill-only (mine).”

Banyan is a $70 million CAD market value, so less than 10% of $800 million-plus Snowline Gold AGD and that explorer-developer’s fast-growing, extremely high-grade Rogue property holdings.

QC Copper & Gold

Stephen Stewart runs several explorers through a holding company, Ore Group. and directly as an executive and as a large shareholder.

One of those companies, American Eagle Gold AE, this week said Australia’s South32 Ltd. AU: S32 will buy $29 million of the Canada explorer-developer’s shares for investment purposes. See release.

American Eagle is developing a copper-gold project, NAK, in British Columbis.

Another in Stephen’s Ore Group fold that could get active in coming weeks, QC Copper & Gold, is adding to its copper holdings in eastern Canada. It has shareholder approval to buy Cuprum and the 90% of its Thierry Resource in Quebec that QC does not already own.

The idea, says Stephen, a serial company creator, is to develop copper projects in the Chapais-Chibougamau area that resemble QC’s past-producing Opemiska Copper Mine Complex.

“I’d recommend that smart money should take a closer look at QC Copper, especially with the upcoming acquisition of Cuprum, which is set to close in December. The newly combined company, to be named XXIX, will be well-capitalized with nearly 5 billion pounds of copper, making it the largest copper endowment in eastern Canada,” he says.

QC is a $23 million CAD market value; miniscule for a company that eventually could be viewed as a copper midweight at a time of (one hopes) rising copper prices.

New investors, I think, might be nervous about the addition of 82 million shares to the already large count. Stephen Stewart tells me there are zero plans for a combining of shares in a “reverse split” that more often than not rattles investors.

For the approved Cuprum purchase, the share addition to existing shareholders on a total 255 million shares will be approx. 25% at current stock prices.

“If you want to acquire an asset, property or cash, you must issue shares. But this isn’t dilutive, it’s accretive. Very much so,” he says.

He concludes,

“If I can buy future dollars for a dime, I’ll make that trade every day.”

**Trading note: I have been adding to our Banyan here at home; it is owned and accumulated over 4 years. I hope to add more QC Copper & Gold, a recent purchase, if it declines as most sub-$50 million miner-explorers are this week.

I have been adding to our Sprott Physical Gold & Silver Trust CEF at lower, and lower prices.

Today-Wednesday, raising capital, I sold a total of $1,300 USD worth of Canalaska Uranium CVV and Alamos Gold AGI at profitable prices. I have owned both for years and years, and both are still in our holdings.

Uranium ***

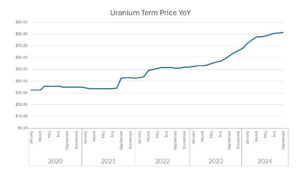

Marc Henderson of Laramide Resources LAM (New Mexico, Australia uranium developer): “Virtually every data point in uranium in 2024 (both on the supply and demand side) has been bullish. The spot price moves around a bit and occupies too much of investors’ thinking – especially short-term investors. The ‘term’ price though is a thing of beauty and we included this chart (here) in our Q3 MD&A. The only people who don’t like this chart are those that HAVE to buy uranium, the utilities.”

Jordan Trimble of Skyharbour Resources SYH (Canada uranium explorer-developer):

“I expect Russia‘s move will boost both prices (spot and term) over the coming months. There may be some volatility but given that Russia accounted for 27% of enriched uranium supplied to the U.S. last year, I can’t see how this doesn’t have a meaningful impact. The enrichment and conversion prices have been squeezed higher recently and this will eventually spill over into the U3O8 market.”

— Thom Calandra [TCRs, no reports for two weeks. Feel free to ping me.]

Gold’s Big Fail As Cryptos, Blue Chips Ascend — online here]

[Elections Cyclone — online here]

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.