“Today is a day of total chaos as the market loses its general and its leadership.” — Rudi Fronk of Seabridge Gold SA SEA [Monday Jan. 27 2025]

BITCOIN BRAWL | COPPER | GOLD | & SHROOMS

Don’t mind the DIGITAL typo: this is an eye-opener re: cryptos, gold and investors; it’s free.

* TRADING NOTE BELOW.

If you have some green on your screen, you’re a wizard, a true star.

Light China factory usage Monday sent copper, gauge of most industrial growth, down 2%. IVANHOE MINES and other copper miners lost ground.

Oil fell Monday. NASDAQ was battered. The broad stock market dropped 1.5 % and more.

Ditto gold, down sharply: see active (continuous) futures contract.

U.S. gov’t bond prices held steady and some gained a few ticks in price as investors seeking solace bought ’em.

Bitcoin? Held steady Monday after a decline to $101,00.

Signs of investors’ greater risk tendency surfaced last week with crypto-currency products getting a $1.9 billion “inflow.”

Still, this follows the previous week’s “outflow” — see graph below. Wacky, indecisive investors?

More from Rudi Fronk in Toronto. The longtime Seabridge Gold chief executive and his SA SEA co-founder, Jim Anthony, are (in my book) master big-pic strategists.

“In one day the stock market has gone from a risk-on what can possibly go wrong mindset to one of risk off, as investors flee to Treasury bonds. But the dollar is down when it should be a safe haven.”

Rudi figures that when Donald Trump took across the board tariffs off the table and attacked the Fed, “telling them rates have to fall and suggesting he was confident they were going to listen to him, the markets figured out the dollar trend had changed.”

Risk off with a lower dollar? Positive for gold and “we will see that very soon when the panic subsides. This should be good for western investors who buy gold stocks,” Rudi says.

Gold stocks, the miners, lost 2% as a group — GDX. Bargain prices — but let’s see Tuesday.

I see a sharp rebound in all so-called “real” assets.

Andrew Kaplan at Avino Gold & Silver ASM just now:

TCRs, the shipping stocks rose Monday, too: SHIP DHT USEA GNK.

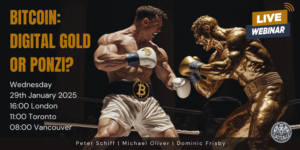

Simon Catt is hosting a Bitcoin brawl

London banker Simon Catt’s’ MicroStrategy put options are finally working — with MSTR hammered Monday and last Friday.

I joined Simon in the “bitcoin” MSTR short via put options, which are rising as much as 40% today.

I am still down about $900 on a $1,700 stake (February out of the money put contracts.)

|

|

I asked Avi Gilburt for his one-sentence technical scan. Avi is at Elliott Wave Trader.

“It’s (Bitcoin) setting up for one more rally to 120-130k . . . and then likely a long bear market.”

Peter Schiff, Dominic Frisby and Michael Oliver are the panelists for Simon Catt’s brawl; it’s free. Info here.

TCRs, I remain voice to text with broken, hopefully mending hand.

* TRADING NOTE: This week closing JAN 31, 2025, I sold some DHT Maritime from a long-held stake at a profit. As noted in our private missive to TCRs, I added more Integra Gold ITRG. I also added more Banyan Gold BYN to a long-held stake.

I started a small stake Newcore Gold.

We toured with a mycologist wizard this weekend. Not a word about financial markets was spoken.

Patrick Hamilton told our group of 30 this weekend: “Many mushrooms are edible. Some you would not want to taste twice.” TCRs, mushrooms in the wild have nothing to do with investing. Thank goodness. Our group of 30 found a trunk load (see below) on our own after Patrick set us loose among the oak, elm, redwood and bay trees. This was a 3-hour tour at Pt. Reyes (Bear Valley). It’s mostly been a January drought month across California, and it still is. Yet we all managed to score fungi, which thrive in misty, damp times. We all had to throw ourselves into the bramble, the thorns, via lots of climbing, hiking and digging. Our hauls included tasty chanterelle, the California state shroom; black trumpets (Patrick gifted some to us and Maura and I scrambled them with eggs and tofu for dinner; candy caps (maple syrupy); “artist” conch mushrooms (large and suitable as a “canvas” for painting or drawing). I could go on.  The Deceiver’s cap here looks psychedelic but is not. Of the many things learned from Patrick: — you can touch and smell any mushroom without harm — even so-called death caps; — shrooms absorb fat — they’re fat soluble — but not water soluble. Thus, you can chew to taste a poison mushroom and spit it all out (please) and suffer no harm because the shroom will not break down in your saliva; — psilocybin mushrooms can be found in very wet piles of wood chips and are abundant in the U.S. Pacific Northwest; — so called toadstools are usually poisonous; — mycologists such as Patrick identify most mushrooms by looking at their spores.  For more, please see somamushrooms.org. Thanks Patrick. Some videos here via link: https://www.icloud.com/photos/#0e0QK9Z1FmUu57bLtxNvqAyJA and here: https://thomcalandra.com/video-library/

I shot 5 or 6 videos for those who might be as entranced as we were; merely ping me, as usual.

Patrick is a wizard, a true star.

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities. The Calandra Report, in its 13th year, offers a one-price, $139 yearly fee for all newcomers. Earlier subscribers keep their original cost. Sob stories listened to. No refunds after three weeks of service. Exceptions: |