This is year 12 of TCR.

We are looking to simplify the service.

Nothing is set in granite yet, or in gold doré. You all will be second to know.

Investing: please see Canada Space Idea at close of this report.* Also: an outer-space janitorial service?**

TCRs, reporting and delivering The Calandra Report are tough tasks. There are many subscribers, some loyal and others in and out, and all with different motives.

We serve you, or try to, in real time.

As in, reporting in real time from Brien Lundin in New Orleans:

“As a typical gold bug/investor who has been repeatedly beaten down by Mr. Market whenever I get my hopes up, I’m hesitant to get too excited over gold’s latest move higher. But it sure looks like this could be the turn-around we’ve been waiting for.” Brien Lundin from his Gold Newsletter

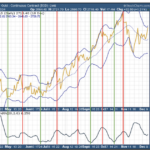

[That was mid-week from Brien. Gold and metals equities closed the week with a turn south ($2,665 an ounce), alas, as the metal lost its geopolitical-etc. gains from earlier in the week. Par for the course, these choppy prices, as gold slowly makes its way into the portfolios of non-owners in the western hemisphere.]

Brien has fresh New Orleans Investment Conference video links below

Folks, all of our subscribers are enjoying a fixed TCR price at the time of their signing on, if they chose the recurring mode.

I am happy to say that we still have $25 subscribers from 12 years ago. Many subscribers, recurring ones, are well below $179 a year, and for many, below $100 USD. This is pretty cut rate by newsletter standards, I think.

[FYI, we have zero plans to raise prices.]

Making money (in mining, in real estate, in shipping and in special situations) is tough and rough. Managing a newsletter? Ditto.

As you know, I often invest alongside The Calandra Report coverage. I tend to hold for long, l-o-n-g spans. Back to 2003, to 2008, to 2013, to 2016 with some holdings.

Against a worldwide backdrop of satellite systems, semiconductors, quantum computing, defense, EVs, aerospace, crypto, drone delivery, entertainment media and other spectacular gainers whose market values total many trillions of dollars, euros, yen, pounds, CAD, etc., our resource-cos, and their hard assets as they are called, are small-fry.

The market value of one of the most popular exchange-traded funds for miners, VanEck Gold Miners GDXJ, at last look is a ‘forlorn’ $15 billion USD.

Even copper giant Ivanhoe Mines at $26 billion Canadian seems tiny to some (pas moi) stacked up against a Nvidia, an Eli Lilly, a Broadcom, a Tesla.

At The Calandra Report, we have had our investment winners — Ivanhoe Mines, Alamos Gold, Golden Valley Mines, Abitibi Royalties, DHT Maritime, Osino Resources, Kenorland Minerals, Xtra-Gold Resources, others — all meeting their own stated ground goals or having been consumed by other companies. (Or soon shall be? Consumed, that is.)

Gold and silver and uranium prices are having a sturdy run that suggests a continued commodities boom for this world. Copper, too, is teasing investors, albeit still at measly levels based on supply-demand. Platinum (I believe) is poised for $1,000 and greater per-ounce prices.

We have enjoyed our 1-year and 2-year solid winners from oversold conditions — Ghana developer Newcore Gold NCAU for one largely holding its two-year steady gains.

Then, ones that rebounded from battered levels, but gave up part of the ship in 2024, floundered in stock price, then, (we believe), entered or are entering recovery mode: Banyan Gold, Contango Ore, Avino Silver & Gold Mines recently. Others, naturally. I own Banyan and Contango, just not as much as I once did.

If you had firm price entrance, exit and re-entry strictures, your track record mostly would be paved in green. I, on the other hand, often buy cheap as a value-pointed investor and usually trek the peaks (nice views) and valleys like a nordic skier hoping to climb the next peak.

Our spectacular market losers: IMV Inc. is the biotech disaster thast by far killed us here at home to the tune of $500,000 USD, and it hurt some of you, too. Also: Victoria Gold, once a big winner and now, due to the Eagle Gold Mine collapse in Yukon, in receivership.

The Eagle Mine, I believe, will be revived as the mine is too valuable to the community of Yukon miners to abandon. The loss to shareholders? Probably not retrievable.

Other damaged metals explorers? GoviEx Uranium, battered by the Niger stripping of its Madaouela mining license, is hurting and looking to Zambia, and to courts and-or arbitration, for a recovery. Azimut-Exploration in Québec, whose shares I still own, albeit reduced greatly, has yet to live up to its promises of gold bonanzas, lithium lodes, copper coups and so on.

Our watching-paint-dry names — even as they continued to fire their businesses in mining or exploration or royalties or special situations — are too many to name. The most recent one that trades on NYSE, Integra Resources ITRG, owns the Florida Canyon Mine in Nevada and looks (to me) undervalued. I own it (as I do some of the companies in this report).

Among those, as you probably know, my favorite, having seen its Nevada shovel-ready gold project three times, is West Vault Mining. WVM just sits there, waiting for a buyer.

Our tried-and-trues: namely, the gold and silver Sprott physical trust, CEF CEF.A; Aberdeen Platinum Trust. The profitable gold trust, CEF on NYSE, is what I use as a money market holding tank that I tap for funds or shuttle cash into. Probably owned it off and on since the early 2000s, when gold was $300 and $400 USD.

Of others in The Calandra Report‘s corner that are faithful to their biz-models, EMX Royalty stands out for the breadth of its know-how and net smelter returns from gold, silver, copper, etc., but has yet to catch fire with investors.

Our outpacing uranium-cos: led by CanAlaska Uranium in Canada’s Athabasca Basin, Laramide Resources in New Mexico and Australia (and Kazakhstan), and enCore Energy in southern Texas.

Of course, and the ones I never have enough space nor time to mention, yet that seem to be making headway with their projects but not their shares. Delta Resources comes to mind recently: here is the latest video from the Ontario developer.

I can continue with the titles. But 12 years of ups and downs take their toll on memory. It’s all there somewhere at thomcalandra.com or in your emailed reports.

The mistake that I often make is not selling, theoretically or in reality, when the title or our portfolio, our holdings here at home, drop for more than two weeks or fall a certain percentage. Bad-bad.

I also have seen many of the tiny-cos I so much adore for their pioneering spirits fall victim to investor ennui, or to ‘lifestyle mode’ expenses, or to disastrous reverse-splits (share consolidations), to dilution of existing shareholders or to bad fortune, to poor timing or simply to a lack of vision, a lack of funds in a challenging financing arena for resources or bad luck (if there is such a thing).

Fund managers — I am not in that crowd — sometimes say they operate in a cone of silence, hearing from clients only when prices are going south. That is much the same with newsletter writers, I tend to think.

That is stress inducing. Especially a drag for writers who deliver reports frequently, which can be a plus and a minus for you, the audience, and for me here at home.

Atop it all, as I have shared, I am (still) working through stress, weight, memory, energy and other physical challenges.

TCRs, I vow to update you with a game-plan for all of us. I am always at your service.

I hope more of you will weigh in with your investment ideas.

In the meantime, as stated here frequently, our four largest individual resources holdings here at home are Ivanhoe Mines (81,000 shares), Xtra-Gold Resources (110,000 shares), Alamos Gold and EMX Royalty.

The Sprott gold-silver trust and the Aberdeen platinum trust combined-total probably rank No.4 in there, I believe. Add in actual gold, silver and platinum coins, mini-bars, jewelry and a nugget or two, and that No. 4 is probably a No. 3.

* I won’t let you go without an idea, this one a space-age thruster from Cormark Securities, fed to me not by the analyst but by a Cormark believer.

It is MDA Space Ltd. MDA, a $3.4 billion geo-intelligence and earth observation systems operator.

The idea comes on the heels of the $350 billion private value of SpaceX, based on a secondary share buyback by the company. See SpaceX report.

“… demand for space-based industries and businesses is accelerating, driven by satellite cellular service, satellite internet service, mission to the moon, mission to Mars, new space stations, space tourism and demand for space infrastructure and commercial services from defense and intelligence organizations.” — David McFadgen, analyst, Cormark

MDA, with a facility in Montreal, is Canada’s largest space technology service provider, developer and manufacturer. Cormark report here. I do not own the shares.

** An outer-space janitorial service?

I’ll have our Casper, Wyoming, frostbitten investor, subscriber, crypto aficionado and, during COVID, a waste manager for the landfill there, give us his take on outer-space garbage.

“The lessons learned from dealing with automatic equipment handling tons of garbage a day , sometimes handling spills from the same with a shovel in my hand, conducting public traffic to the dump zones and so much more have fully changed my outlook on rubbish.”

- The New Orleans Precious Metals Panel — here for free courtesy for The Calandra Report subscribers

— Thom Calandra

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.