Kazakhs’ Uranium | Cheap Gold Case | Radisson Mining | Dynasty Gold

Pesky interest rates and the strongest USD vs. nearly all currencies (excepting export-star Mexico’s peso) are still bruising most commodity prices. [See Gold Case outtake below please.]

Their attendant equities also are in hurt mode, notably copper, gold, silver, nickel-etc. miners. [Please see rate/USD-DXY/gold chart here.]

“Yes, ugly times to be an explorer or a producer, or a developer, or a royalty company,” Chad Peters tells us today-Monday October 2, 2023. Chad’s Ridgeline Minerals has a partnered drill going deep in Nevada at Carlin East.

Rudi Fronk & his Seabridge Gold SA strategists CASE FOR GOLD today: "We think a recent warning by economist Peter Boockvar will prove to be prescient: 'When you see U.S interest rates rising in addition to the US dollar falling, that is when we're in real trouble.'" Also: this 'Wild Bunch' examining of radical U.S. Treasuries trading is worth a view. It is from my former colleague Barbara Kollmeyer in Madrid.

Ridgeline’s Carlin-East gold project is on trend with Nevada Gold Mines’ Fallon discovery. If NGM’s ultra-deep drilling hits, RDG’s forlorn shares, $14 million USD of stock, will do what tightly held Lavras Gold‘s shares LGC LGCFF did 5 weeks ago after a considerable Brazil gold find — which is, go to $1.20 from 20 cents USD.

TCRs, I used to own Ridgeline shares and look to re-enter.

On that matter, I continue to accumulate sliding mining stocks, most of them the ones we know here at The Calandra Report/TCR. See previous reports please, September.

Biggest risk, besides loan-sharks, is that miners, the smallest of them damaged by dwindling cash and few financing avenues, get hit hardest in coming weeks: tax-loss selling.

My most recent buying, aside from perennial and copper-tarnished, for now anyway, Ivanhoe Mines IVN IVPAF, from last week, all of September and today-Monday, are the three uraniums I have been discussing with you: CanAlaska Uranium CVV CVVUF; enCore Uranium‘s Wyoming explorer proxy Nuclear Fuels NF — it’s cantily traded; and Laramide Resources LAM LMRXF. CVV is Athabasca Basin, Canada; NF, EU, LAM are southern and southwestern U.S.

Briefly, in that regard — uranium, that is. The U-stocks, fortified by a 3-year climb of spot prices (I use Yellow Cake Plc YCA in London, as an international gaugue) and utility contract prices, are cooling this week and last Thursday and Friday. (Spot looks to be approx. $73 a pound, I understand today.)

“Look, Yellow Cake is raising cash to buy another 1.5 million pounds. Sprott’s physical trust (another holder of uranium — U.UT SRUUF) is trading at its first premium to NAV since the start of this year,” says Jordan Trimble of Athabasca Basin uranium staker Skyharbour Resources SYH SYHBF.

“This rally we are having is overdue and looks centered on power-utility buying for their depleting plants,” he says. Investment buying from non-uranium funds will follow, Jordan says.

Jordan is one of my top uranium-ados, as in aficionados in a short list (Marc Henderson of Laramide; Cory Belyk of CanAlaska; Bill Sheriff of enCore and Nuclear Fuels). Jordan attended, along with my other fonts, the World Nuclear Association annual meeting in London.

Worth direct-quoting: “I think you can argue this rally has been forming for a decade: structural deficits, nuclear community is growing, tactical and large; and on our side of the world (he is Canadian,) the east and west division as most uranium demand is still in western Europe.”

As we know, the west (includes U.S., Canada, Australia) is not producing nearly enough — maybe a third of primary mine supply is here, Jordan Trimble says. “The Athabasca (Saskatchewan, Canada) is one of the only places in the west that can help fill the gap and deliver large mines to market.”

By the way, the Kazakhs, enormous producers, have a physical uranium trust to support their publicly traded National Atomic Co. Kazatomprom KZAP. ” To get the U-prices higher in Kazakh exports — like an OPEC trade group. It is called ANU Energy OEIC.

Kazataprom, the leading uranium producer worldwide and an outperforming stock (KZAP, the ADR, has tripled in three years), says it will unwind production reductions, resuming full production in 2025. See WNA article please.

Bill Sheriff of enCore Uranium (and Nuclear Fuels NF) tells me just now, “They had already announced half of this some time ago.”

Bill sees shipping of uranium to the west increasing, “So this will definitely put a small dent in world demand … but won’t affect north American demand too much if at all due to shipping issues through St. Petersburg (Russia).”

By the way, spot uranium’s price (approx. $73) “didn’t flinch with the news,” he says.

Back to cheap gold

TCRs, two tiny-gold-cos I have sidestepped or ignored this year and last can get cheaper, but then their stocks would disappear. I was updated at length in September and this week by the two: Radisson Mining (Québec). RDS RMRDF; and Dynasty Gold DYG DGDCF.

I do not own shares of those two. Private investor Michael Gentile of Montreál owns a sizeable Radisson stake.

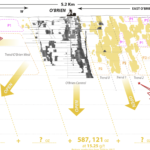

The idea with Radisson, as it revives the old O’Brien Gold Mine in the Abitibi Gold Belt’s Cadillac Break in Québec, is to have a feed of ore that can go to one of several active gold mills in the area.

“Operators (Agnico-Eagle, others) will be looking for additional sources of feed via a corporate deal or a toll-milling scenario,” Radisson CFO Hubert Bouchard says today.

Possible flow-chart here?

Ammar Al-Joundi of Agnico-Eagle AEM is on record that gold juniors with Abitibi deposits could use the miner’s spare capacity for milling their ore. He mentions in interviews the possibility of toll milling arrangements, takeovers or joint ventures.

Radisson’s acting CEO, soon to yield to a capital markets executive if the board has its way, is Denis V. Lachance. Denis is also chairman.

“O’Brien is surrounded by Agnico-Eagle (Laronde, Canadian-Malartic complex), IamGold (Westwood), Wesdome (Kiena) and Eldorado (Lamaque complex); they are consistently looking for additional sources of feed to leverage and extend the life of their mills and infrastructure,” Denis says.

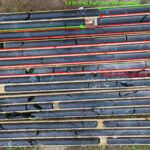

As for Dynasty Gold, Ivy Chong has been on me about Thundercloud in NW Ontario for two years. The CEO just published intercepts in its greenstone-hosted property that I thought deserved attention (fat chance in this sad-sack metals market): 130 meters of 1.17 gram gold.

That was from 6 holes drilled. “Our hit rate is 100%,” Ivy says from Toronto. “The next batch of results will have even better numbers, I think.” Resuming drilling in two weeks for another 3,000 meters, she says.

In fact, Tuesday-October 3, Dynasty published further assays. One of them, on the company’s Pelham hydrothermal target, 43 meters of 5 gram gold from 108 meters. See image please.

Finally, that video primer I promised — from one of three Québec explorers whose shares I own, and the one with the most projects (Ontario, t00) farmed out to larger-miners: Val-d’Or Mining VZZ VDOMF. I own more than 200,000 shares and yes, Glenn Mullan is the founder and CEO and this VZZ is tiny.

This is the video; the dynamic is the same that turned Glenn’s Golden Valley Mines, also Val-d’Or and the Abitibi Gold Belt, into a successful takeover target two years ago. Video here — worth a go.

Namely, Eldorado Gold‘s sprawling earn-ins of VZZ properties.

Glenn notes in the 50-minute VZZ primer, “The ELD JV is a stealth transaction for us, as there are 4 agreements, collectively providing for up to $34.5 million to earn 70% of 11 properties (all gold, 2 in Québec and 9 in Ontario). ”

Reminder: in NYC October 5 to 10. Midtown Manhattan. Mostly personal but please ping me.

The Calandra Report/TCR subscribers: rough notes, direct quotes via Beaver Creek Precious Metals Summit. Earlier TCR caches here. And here please.

See also: BEAVER CREEK’S Executive verbatim here please

— Thom Calandra

PayPal $229 Yearly Non-Recurring The Calandra Report

PayPal $179 Yearly: Recurring The Calandra Report

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.