DHT Maritime Holdings shares surpass $12 USD for the first time since 2012.* Xtra-Gold's XTG quarter shows after-tax Ghana gold profits of $510,000. GoviEx Uranium GXU saw a Niger mining minister visit its Madaouela site in the coup-dazed nation; the stock gained 20%. -- Thom Calandra

DHT Maritime | Xtra-Gold Ghana | GoviEx Uranium Niger

A Swiss family friend sends me a ‘cautious’ UBS report from its Singapore office’s visit to China.

China, we are told, is powering the gold rally going on this spring 2024. (So are Russia, BRIC nations, select central banks such as Turkey).

This visit resulted in a pragmatic takeaway from the UBS team. As a value-driven (read: like cheap) writer and investor, I find high-placed skeptics refreshing. UBS Group AG is often seen as “too big to fail” with a $1.7 trillion balance sheet.

“Plenty of questions about the global macroeconomic outlook and what it

means for gold. Many of our conversations included discussions on the potential

impact of the U.S. elections on gold and the implications of fiscal policy.” — UBS team

The team’s visit to China officials and gold professionals, among others, registered beliefs that small gold buyers, jewelry-driven buyers, are laying off the purchase button at $2,350 gold. Banks, funds and mega investors will step in — that is the thinking here.

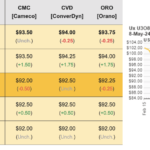

The team’s choice of charts for this report, which you likely will not find online and which I cannot forward, indicate slackening demand for Shanghai Gold Exchange spot gold and a lull in turnover of other, paper-linked gold contracts in Shanghai, Chicago and New York. (See insert please.)

Gold “continues to act as an alternative asset for onshore investors Admittedly,

recent sparks of optimism on Chinese equities could also be acting as bit of competition

currently, especially as gold’s upward momentum stalls. However, we think gold can

stand its ground as an attractive alternative long-term asset for investors in China that

offers diversification.” That is UBS Singapore.

* DHT Maritime Holdings: the European very large crude carrier, active in the Middle East, Asia and Europe, is a godsend-stock; I have owned it for three years, I believe. A fresh $12 mark for the NYSE-DHT shares. The quarter with a dividend will come out next week. Boilerplate here please.

DHT is closing in on a $2 billion market value. Spot shipping rates for supertankers in the strafed Red Sea and across the Middle East are all over the place and consistently rising to levels not seen in 5 years; some short spans are above $100,000 a day, a price seen briefly in spring 2023. See Fearnleys’ FearnPluse report.

Most cargo carriers (Tsakos, Navios, Scorpio, Mitsui, Teekay) are benefiting from clients who want to lock in multi-year contracts. Fleet replacement worldwide (new ships, refurbished ones) is in a 3-year funk.

Teekay Tankers TNK, about the same market value as DHT at $2 billion, just turned in a quarter that handily

beat all projections at $145 million net profit. TNK shares are rising 8%. [Thursday update.] I do not own TNK.

[Thursday May 9, 2024, outpacers for The Calandra Report titles include Alamos Gold AGI; Ivanhoe Electric IE; tiny Ridgeline Minerals RDG. Plus, platinum, gold, silver, copper.]

Xtra-Gold Resources: Our Ghana explorer’s decade-plus of alluvial gold profits is accelerating.

Net profit (after tax) of $510,987. The cash goes into the kitty, which with withhheld gold to be sold later, select investments (oil-gas mostly in Alberta), is now $12.7 million — this for an explorer with a $42 million USD market value.

The Kibi Gold Belt alluvial harvest is one I have seen many times now. XTG XTGRF is our second longest resource holding (Ivanhoe Mines is first). See boilerplate please. And MDA management discussion here.

This is the kicker, for me, anyway, as an investor hoodwinked too many times by cash-needy minerals explorers: “We covered all of our exploration drilling and operating costs,” James Longshore, CEO-founder, tells me. Not just this quarter; for the past 14 years.

That includes the outlay for 3 drill rigs, concession costs (five licenses across the Kibi Gold Belt); and 106,000 meters of drilling over the years: 584 holes. Stated and filed resource right now is 800,000n easily mined ounces from Kibi, on its way, hopefully later this year, to 1,3 million.

Jim and the only exploration manager and VP he ever has had, Yves Clement, practice inch-by-inch. Maybe not this year, but at some point, Newmont or a lesser miner will buy the Xtra-Gold kit-and-caboodle for $100 an ounce in the ground. Maybe more depending on gold prices. That will be three times XTG’s current market value.

Govi-Ex Uranium: not a lot to say except what is above — the visit a few days ago to the Madaouela uranium project by Niger’s mines minister, Commissaire Colonel Ousmane Abarchi. Niger, working through a military coup, owns 20% of the vast project.

The stock price give GXU, 18-years in the making and in the Ivanhoe Capital family of companies, a sub-$100 million CAD value. Deserves another 35% gain, if you ask me.

Daniel Major, CEO, tells me he is hopeful about Niger yet still performing all of the legal work to ensure that any Niger usurping of Madaouela and its measured-indicated resource of approx. 100 million pounds of uranium will be litigated.

GaviEx also has a permit-read uranium project in Zambia called Mutanga.

I added shares after the minister’s appearance earlier this week. I also own Laramide Resources LAM; CanAlaska Uranium CVV; enCore Energy EU; Nuclear Fuels NF; F3 Uranium FUU; Skyharbour Resources SYH.

— Thom Calandra

The Calandra Report

PayPal $179 Yearly: Recurring The Calandra Report

PayPal $229 Yearly Non-Recurring The Calandra Report

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.