Inside: European Shipper As Commodities Indicator Plus: alluvial cash funding exploration, equipment, salaries at Ghana's Xtra-Gold. Mourning for Victor Nkansa -- below.

The inclusion of copper in the DOE report s a first.

Of great interest, Ivanhoe, amid power interruptions, managed to report spot-on mined ore and hefty profits and low cost of copper production. The company says it likely will raise its projected copper output for 2023.

As for Western Foreland in DRC, “We don’t need a partner but there sure are a hell of a lot of partners interested,” Robert said. Western Foreland is likely to report the first resource statement for its exploration there.

The MDA MANAGEMENT DISCUSSION has it all: Kamoa-Kakula copper, Kipushi copper and zinc, those both in DRC Congo; Western Foreland copper exploration in DRC — “my favorite subject,” Robert, co-exec chairman, said today; Platreef nickel-platinum-palladium-gold-rhodium project in South Africa. Also, risk factors, valuation projections, currency calculations; road improvements; accelerating on-time deliveries; optimizing copper tailings recovery; accelerating time lines for delivery via flash smelting. See please Ivanhoe’s Flash.

Quarterly update release here.

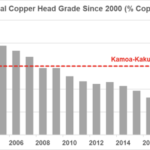

As stated: “Kamoa-Kakula‘s Phase 1 and 2 concentrators milled a record 2.2 million tonnes of ore during the second quarter at an average feed grade of 5.2% copper. This included high-grade, run-of-mine ore from the Kakula Mine, supplemented with ore from the surface stockpiles to achieve throughput over original design capacity. Strong copper recoveries continued for the quarter averaging 87.2%. For July, Kamoa-Kakula’s Phase 1 and 2 concentrators milled 0.6 million tonnes of ore at an average feed grade of 5.8% copper and recoveries of 88.0%, producing 35,636 tonnes, just short of a monthly record. The record second-quarter production at Kamoa-Kakula was achieved despite maintenance shutdowns in June and intermittent (power) grid instability. “

Snowline Gold‘s 553.8 meters of 2.5 GRAMS PER TONNE GOLD at Yukon’s Rogue Project. SGF SNWGF Results here. Snowline and Ivanhoe are our best performing stocks this year and last. SNWGF shares rose 12% today to firmly above $4 USD.; Thursday August 3, 2023. We own the shares here at home.

DHT Maritime Holdings: DHT shares touched $10 USD amid terrific volatility for spot and contract contracts for very large crude carrier shipping rates this year. Results later this month, and the quarterly dividend from the European shipper of nat-gas and crude oil could be a doozy.

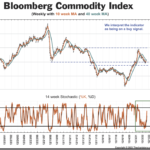

The stock notched $10 a share USD Friday (updated). Likely an indicator of gaining commodities prices. https://lnkd.in/gWeS2Ekp. See Bloomberg Commodities Index please, with notations courtesy of Brien Lundin of New Orleans Investment Conference (November 1-14, 2023). We own the shares.

Xtra-Gold Resources‘ alluvial cash is funding all exploration, equipment, salaries at all of the Ghana properties. I have owned XTG XTGRF since first touring the company’s projects in the alluvial cash funding all exploration, equipment, salaries at Ghana’s Xtra-Gold. We have owned XTG (main TSX board) and XTGRF since 2009, when I first toured the properties in Ghana’s Kibi Gold Belt.

I just added more shares again, for probably the 15th time in 14 years. In that time, I have visited Xtra-Gold’s self-funded camps 5 times.

I am as you know, TCRs, searching for another company that buys back and cancels its shares once or twice a week; funds everything, and I mean everything, with its own cash — probably $11 million right now, approx. 25 cents a share of its 63-cent USD stock price, in steady alluvial Kibi cash, some $1.5 million USD and more a year, for many years.

That includes a couple of insightful energy-producer stocks in Alberta, Canada. Xtra-Gold also sports a limited and selective choice of private placements in gold-cos, including, Jim and his Toronto brokers hope, an obscure Canadian copper explorer with outsized trading activity of late.

Numbers for the quarter out next week; further assays likely for Boomerang East targets at the Kibi in August or early September. Drill rigs, company owned and operated, are looking to score core that will boost a 750,000-plus ounce resource to 1.3 million ounces. Market cap: $38 million CAD at 80 cents CAD.

I speak with founder CEO James Longshore twice a month. Jim and XTG just lost its chief financial officer, No. 1 employee, controller and secretary Victor Nkansa in a horrific rural Ghana car crash. Jim tells me, “Very sad to lose our first employee and a business friend.” See release please.

Victor was on his way to a family reunion in northern Ghana. Head-on vehicle accidents are one of the leading causes of death and injury in Ghana and in many nations on the Africa continent. Unmarked gravel two-way roads; poor lighting; trucks and more trucks; oil slicks. Victor, a Ghana-educated MBA, was 65.

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.