** Trading Note | Coming from The Calandra Report below

Financial markets are (choose one): lunatic; schizoid; paranoid; bipolar; neurotic.

You already knew that, TCRs.

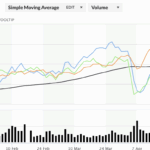

Of note this month: copper‘s consistent price rise, in market spans antithetical — one day ‘risk-on,’ gold friendly and pro global industrial growth, and the next? Headlines about the U.S. White House’s threatened and actual tariffs, and about its threats against the Federal Reserve; and about China growth pullbacks and trade war rattling — all leading investors to abandon most everything they own.

But not copper. (See chart — it levitates.)

If you awaken one morning to headlines that London or Chicago or Shanghai speculators (and-or commodities trading house intermediaries) are forced to deliver copper they cannot find, because they don’t own it, or a copper trader has committed harakiri when his or her derivatives swap trade has dissolved, you will be glad you own copper producers and developers*.

NAI 500, a news service that says it “bridges the gap between North America markets and Chinese investors,” examines copper’s policy and geopolitical angles. Such as: copper import tariffs in the United States; production cuts at Chinese smelters; mine strikes; other factors that boost market volatility.

It’s that “other” that could see copper climb to new highs from its $4.84-per-pound price.

Paul West-Sells, a PhD. in metallurgy and former CEO of Western Copper & Gold WRN, tells me, “Consider that the U.S. is a major copper concentrate producer, but there is not sufficient capacity to smelt all the copper concentrate produced, thus it needs to export, often to China; and then you have China with an insatiable appetite for copper and limited supply in country. Throwing tariffs into this situation blows the whole thing up.”

*My own copper stakes, as you know, are Ivanhoe Mines, Ivanhoe Electric, C3 Metals, Ore Cap Investment (see latest below), EMX Royalty, Elemental-Altus Royalties and Koryx Copper. IVN IE CCCM OCI EMX ELE KRY

Others worth considering, according to three of my trusted sources, are Lundin Mining, Surge Copper and Pan Global. All of these, and my own stakes, trade in Canada and-or the United States.

“I’ve decided that Canadian oil and gas is just too cheap.” Rick Rule says in a new video

TCRs, strategist Rick Rule talks with Canada’s Michael Campbell in this fresh video.

You have to take in the 29-minute discussion (briefer at 1.5x playback speed) — if only as a tutorial on how to explain gold, currency debasement, Canada oil & gas, North America politics and the world economy to your Canadian and American family and friends.

Outtakes:

— “The Canadian companies (energy) are substantially cheaper than their U.S. counterparts, who are also cheap.”

— “We’re becoming 3% poorer every year.”

Rick’s latest, or Michael’s latest, is required viewing for all of us. Topics include cheap Canada energy, currencies, gold, inflation, politics and the “CP-lie.”

My own Canada energy stakes (oil and gas, does not include uranium): Cenovus Energy; Peyto Exploration; Petrus Resources and Baytex Energy.

GOLD: a Reuters brief update that tracks this week's dollar, China tariffs and Fed chief firing scares: article.

Tiny transaction that might grow rapidly: Orecap Investment Corp.‘s clever 19.9% purchase of Québec gold explorer Kintavar Exploration KTR, using its XXIX Metal shares (formerly QC Copper & Gold).

Orecap OCI is a Toronto-based holding company ($16 million CAD market value) for a range of small-cap metals equities (Awalé, American Eagle Gold, Baselode Energy, others), and actual land packages (Kirkland Lake area, others).

Stephen Stewart, one of my 10 or so trusted metals sources, runs the operation.

I traded queries and responses with Stephen. His “color” regarding the transaction also illustrates how OCI uses its tiny market cap and equities portfolio to expand.

Stephen Stewart: “We’ve structured the deal so that XXIX won’t issue any new shares. Instead, it will vend its current 50% interest in Roger (a project in Abitibi’s Chibougamau mining district) and exercise its option to acquire the remaining 50%, funded using XXIX shares held in treasury by Orecap, which owns 40 million XXIX shares.

“As a result, both Orecap and XXIX will each hold 20% of New Kintavar, which will own 100% of the Roger Project, along with Kintavar’s existing 10 Québec copper/gold assets. The company has $4 million in cash, and we’ll take control of the management and board to reposition it accordingly.”

Stephen explains that bringing in OCI avoids dilution. Neither OCI nor XXIX issues shares in shuffle. OCI, he says, benefits by diversifying its holdings, reducing its XXIX concentration and gaining exposure to New Kintavar.

“Old Kintavar was broken, but it had cash and solid ground in good postcodes. New Kintavar will be a clean vehicle for Roger. We’ll rebuild it with a new CEO already in mind.” — Stephen Stewart

Post transaction Orecap will still own approximately 25 million shares of XXIX – which represents about 10% of XXIX.

Stephen does video, too. Here he discusses some of OCI’s physical land packages.

Coming: The Calandra Report updates from the operators who run C3 Metals, a Peru and Jamaica gold and copper explorer-developer; Vista Gold, whose Australia gold mine project seeks a buyer or strategic investor; and Maple Gold, whose efforts in the Abitibi Greenstone Gold Belt of Québec are ignored by most investors.

I own shares of C3 Metals and, above, Baselode Energy — and those already tagged above as stakes here at home.

**As for trading this week, my recent purchases include adding more Avino Silver & Gold and more EMX Royalty. Also, Orecap Investment. I intend to add to what is now a small amount of C3 Metals shares.

I intend, as stated numerous times here, to divest some of the 78,000 shares of Ivanhoe Mines we have here at home — for both family trust allocation and diversification. I am, I hope not paradoxically, expecting Ivanhoe in early May to state potent copper (and zinc) production figures from Kamoa-Kakula in DRC Congo.

Ivanhoe will issue its Q1 2025 financial results April 30 — next Wednesday.

Co-Executive Chairman and founder Robert Friedland will address the Bank of America Metals, Mining & Steel Conference in Barcelona Spain May 13-14.

See: Reciprocating With Fury [Gold & Bitcoin]

— Thom Calandra

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities. The Calandra Report, in its 13th year, offers a one-price, $139 yearly fee for all newcomers. Earlier subscribers keep their original cost. Sob stories listened to. No refunds after three weeks of service. Exceptions: groceries, mistaken ambitions.