TCRs, we discussed five days ago a shift to Alberta by oil-gas explorer producers that were or are active in the lucrative Bakken fields of western North Dakota, eastern Montana and southern Saskatchewan.

Our case in point was Crescent Point Energy CPG, one of three Alberta ‘oilies’ I own as of last week and am expanding (on).

Just in: Crescent Point is buying Alberta’s profitable light-oil explorer-producer Hammerhead Energy for $1.8 billion ($2.5 billion CAD with assumed debt).

See please: https://ir.hhres.com/news-releases/news-release-details/hammerhead-energy-inc-enters-agreement-be-acquired-crescent

[My purchase point for the NYSE-traded CPG came before the transaction and a $500 million equity raise that is skimming CPG shares Tuesday. I am attempting to add more of the 10% cheaper CPG.]

The scrum for Alberta oil fields, in this case the Montney Formation, is on track.

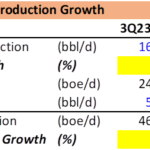

This part is boilerplate a day ago from Hammerhead: “During the third quarter, Hammerhead delivered record production, where the rate of oil growth continued to outpace the rate of corporate production growth.”

That basically means, an oil aficionado in Toronto explains, “that their liquids weighted production (in this case they’re solely talking about oil) outpaced their overall production (which include gas and condensate).”

As seen in the table, oil production grew 80% YoY vs. total corporate production growth of 43% YoY.

Crescent Point Energy CPG several days ago reported sales growth to $1 billion from $970 million a year earlier, albeit an asset-sale-linked loss for the quarter.

TCRs, most of the oil-gas-cos in this report are based in Alberta, in Calgary — a crux of oil and gas services and corporate HQs.

Carbon-based energy, as we know (or think we know), is still the future, at least for another decade worldwide.

[Among my energy-light holdings, I own Baytex, CES, TriCan Well Services and CPG -- they trade in Toronto and in some cases, on NYSE: BTE, CEU CESDF, TCW TOLWF CPG. I am looking at primary nat-gas producer Petrus Resources PRQ PTRUF, one of the tiny ones at $150 million market value.

I also thankfully own DHT Maritime Holdings DHT, a European very-large-crude carrier that just reported splendid shipping rates and profits, sending the shares down for who knows what reason? Avraam Gabrielidis in Greece reports to us: "DHT is trying to get the best possible combination of spot rates and fixed long term rates. Also remember that during the period of November to March, the highest rates are achieved. Past 5-7 days spot rates up to $80,000 USD per day." Read the following -- "I think you will find it interesting: https://www.offshore-energy.biz/aging-vlcc-sector-bracing-f or-a-deficit-of-eco-ships/," Avraam, our TCR contact for all things shipping, says this morning-Tuesday.

Energy services and drillers look expensive when you see the multi-billion-dollar market caps and stock charts of several of these. See chart below please.

Still, most also are reducing debt and-or building cash. Crescent Point‘s net debt came in at $2.9 billion for the just-reported quarter, a drop of $125 million. [I am thinking about buying some CPG for, as stated, a collection of holdings that is energy light when stacked against the metals equities we own here at home.]

All of the Alberta-area producer-explorers are growing BOE/d (barrels of energy-equiv. per day). The leaders in Canada on that score include Cenovus Energy, Canadian Natural Resources, which just reported numbers, and Suncor.

Some are buying other driller-explorers (Baytex’s purchase of Ranger Oil this year) or shedding oil-gas fields that do not “fit” (Crescent Point Energy CPG ditching of a Dakotas property for $500 million this summer).

Once a Bakken oilfields leader Crescent Point‘s strategy of shifting to Alberta-area nat-gas exploration looks like a good case study for this year and next. See image please above.

Most are increasing free cash flow, buying back shares, increasing dividends and-or directing more cash or equity to shareholders. All are booking sales growth as a beneficiary of the steadily higher oil prices.

Earlier at The Calandra Report

Ivanhoe’s Western Foreland Christmas Gift

Ivanhoe’s quarterly headline figures of profits, positive cash flows, copper sales and reducing expenses from Kamoa-Kakula add to fourth largest copper producer’s thus far unbroken string of growth.

As or more importantly to investors and mining professionals are the contextual indicators of coming copper exploration and other capital events in Ivanhoe‘s near future, some likely before year end. IVN IVPAF

For those, you must turn to the 64-minute call the company’s execs staged this Monday morning. By my listening standards, Ivanhoe’s founder and his team engineered what will be remembered as a breakthrough hour for their shareholders, their workers, political leaders, for commodity trading houses and for customers.

As our TCRs are an investing audience, I shall lay low on the embellishment. The purpose of this report is to show ordinary investors, as in you and me, and profoundly NOT bank researchers, large funds and market traders, why the $16 billion Ivanhoe is, I believe, on its way to $35 billion (equity + debt) market worth by 2025.

That will happen with or without further copper price gains, and gains as well for nickel, platinum, palladium, zinc, silver and other metals Ivanhoe produces or is set to produce in Congo Copperbelt and at Platreef in South Africa.

See please the original: Copper Muscles In The Congo

Also: MUSCLES IN NEW YORK

This is a (fictional) short tale with a long tail and illustrations from St. Louis artist-designer Christine Watridge.

Our chef in the story hails from DRC Congo and runs Muscles (Mussels) In New York, a joint in the borough of Brooklyn. This is a story for all of us, a short one with a long tail, we hope, one that will continue in sequels as our Gérald navigates NYC with a Congo flair.

Our broad-chested, well muscled Gérald longs to discover how his nation has changed in the 8 or 10 years since he left. Oh and maybe find his Dad, once a roadside chef among the Congo Copperbelt’s mining camps.

A sample:

In New York City, there is a restaurant: Brooklyn’s greatest mussels joint.

It is called Mussels In New York. This little place serves the biggest mussels anyone had ever seen, plus other types of fish, such as conch and clams and calamari, octopus and squid. With mounds and mounds of fettuccine noodles, or what the Italians call pasta.

Tasty? Sans doute, without a doubt! That’s French.

Senza dubbio. That’s Italian.

The owner of the restaurant is Gérald, only with an accent: GER-ald. Don’t forget the accent; it is just like the chef’s secret-recipe hot sauce on the plate.

Gérald moved to Brooklyn, which is a section of New York City, from Africa when he was a teen-ager. He moved from The Congo, which sounds scary and jungly but these days is a country with 75 million Congolese and a lot of what are called natural resources: not mussels but definitely metals.

— Thom Calandra

PayPal $229 Yearly Non-Recurring The Calandra Report

PayPal $179 Yearly: Recurring The Calandra Report

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.