Kazatomprom Confirms Sulphuric Acid Shortages

Uranium prices and their attendant equities are surging, yet again, Thursday.

Sulphuric acid shortages, higher costs for the agricultural fertilizer ingredient and new mine delays caused Kazatomprom KZAP on LSE, a major Kazakhstan uranium producer, to tick off guidance risks for 2024 and probably 2025. See KZAP report.

“The news out of Kazatomprom has sparked yet another breakout,” said Jordan Trimble of Canada uranium explorer/project spawner Skyharbour Resources SYBH SYHBF, one of five preferred uranium companies here at The Calandra Report. *

In here: CCJ KZAP CVV NF LAM

SYH SASK SUU NXE, WVM, others

Tight uranium oxide supplies look baked in the yellow cake, globally. See reports back to mid- 2023 at The Calandra Report please.

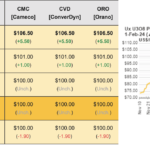

Spot uranium’s price rose to $105 per pound Thursday from approximately $95 after the report, then appears to have reached $106.50. [See graph here.] Contract prices for 5-year pacts from utilities and other buyers are the more meaningful indicator, and they are hard to pin down.

“Cameco (CCJ) is next up a week from today and they have started to guide expectations lower as well, but their reasons were a lot more plausible than ‘we can’t seem to secure sulfuric acid,’ ” says Marc Henderson of Laramide Resources LAM, one of my holdings and a preferred uranium explorers. Please see: Runaway Uranium report here please.

Sulphuric acid is used for leach-extracting uranium from the ground. The price is up about 30% from a year ago.

Many of uranium’s explorers, developers and producers, and the uranium physical trusts, continue to see sharp stock-market ascents.

Uranium trusts (Yellow Cake Plc YLLKF; Sprott Physical Uranium Trust U.UT SRUUF) that accumulate the nuclear fuel fortify what has been an almost 95% rise in U308’s price since the start of 2023 a year ago.

Cory Belyk again at CanAlaska Uranium: “We are early to the bull run, yourself included, and this is going to be multi-decade as the infrastructure is built, supply lines developed (fabrication and enrichment/conversion), and fuel is sourced. Uranium is abundant but economics and geopolitics needto be factored in.”

Nations are attempting to lock in uranium supplies and hasten new mines for their electricity and defense needs.

Uranium supplies worldwide are strained. Governments are looking to lock in suppliers for non-carbon power, for weapons, for research. Production cutbacks regularly at the few producing mines in the world. Restrictions or taboos on Russia’s so-called enriched uranium.

More so-called Tier 1 assets (“anywhere,” says Cory) are required.

“This will take some time. We aren’t talking about building a gold or silver mine in a few years, either.For perspective, outside of NexGen’s Arrow deposit in Athabasca Basin NXE, another Tier 1 asset is not known on a global scale,” Cory says.

NXE’s Arrow is the superstar of uranium developers this decade.

I am fortunate to have heeded advice (Cory Belyk; Marc Henderson of Laramide Resources; Bill Sheriff of Nuclear Fuels/enCore Energy; Daniel Major of GoviEx Uranium; Jordan Trimble of Skyharbour Resources) in late summer 2023 to re-enter 4 of my preferred uranium-cos.

Make that 5. I finally added Skyharbour shares to the fold.

I also track, or try to track, other small uranium explorers or holding-cos, including Mega Uranium MGA. One I came across in Zürich in November, Atha Energy SASK (Athabasca Basin and Sudbury Basin), SASK, has grown about 25% in market value since then to $150 million CAD.

Unknown or obscure (for now?) uranium-cos include Nuclear Fuels NF, whose shares I own; NF NFUNF is in Wyoming, drilling the east side of the Powder Basin. Michael Collins, CEO at Nuclear Fuels, an exploration arm for Bill Sheriff‘s south Texas producer, enCore Energy EU, says, “We traded almost 800,000 shares today in Canada (and 100,000 over-the-counter U.S.) So, much better visibility in the market.”

Another in Wyoming is Strathmore Plus Uranium SUU.

In Canada, Cosa Resources COSA COSAF, a relative newcomer with a hot stock and a $25 million market value. It is centered on Saskatchewan’s rich Athabasca Basin. Geologist and financier Craig Parry, perennial company starter at Canada’s Inventa Capital, co-founded mightily successful NexGen Energy NXE and Isoenergy ISO.

As for the Athabasca, F3 Uranium FUU FUUUF, formerly Fission 3.0, points to a section of Patterson Lake North sporting grades of 59% uranium at 150 meters depth — shallow and high grade.

CEO-Chairman Dev Randhawa points out to me that Athabasca’s Denison Mines DNN in October invested $15 million. F3 with a $226 million market value is cashed up and will spend $16 million this year on further drilling at its Patterson Lake North camp. A Fission 4.0 new-co with 14 Athabasca properties will be distributed to shareholders — see release please.

Many of these titles trade in the United States and Canada stock markets, some in London; Australia-listed uranium companies ASX are numerous.

Video Interview: Nevada Gold ‘Vault’ CEO Sandy McVey took questions from mining newsletter writer John Kaiser the other day. West Vault Mining WVM WVMDF, owned here for several years and visited at Tonopah in central Nevada three times, gets little press.

In the video here, Sandy explains WVM’s hands-off vault-in-the-ground approach at its Hasbrouck camp, which is fully permitted and “shovel ready.” John Kaiser says the shares, below $1, easily could travel to the $5 to $10 range with a $2,300 gold price.

“It’s pretty straightforward,” Sandy said. “We look to put this into the hands of an experienced mine building team.”

*Ownership: Laramide; Nuclear Fuels; GoviEx; CanAlaska; Skyharbour.

— Thom Calandra

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.