“When financial asset returns are close to zero, the return on gold is 20 percent on average yearly. Compound that.” — Peter Palmedo, quantitative theorist and Idaho-based money manager

A “broad” dollar slide is doing the trick in Monday’s $100-plus gold gain to the $3,430 USD level. See: DXY Dollar Index and gold futures contract

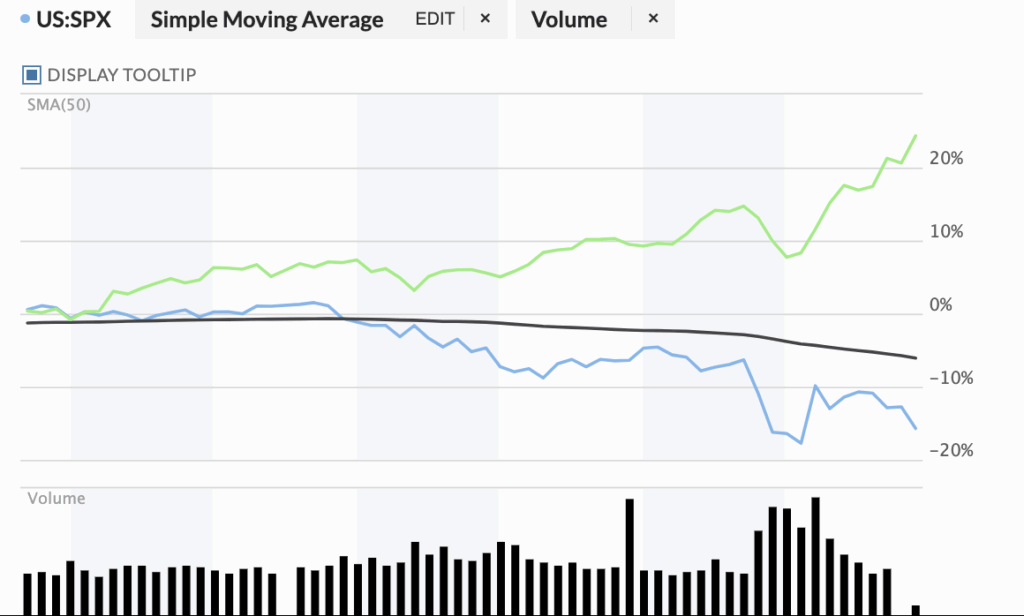

Our subscribers know, I think, that today’s significant bullion gains vs. yet again dramatic blue-chip losses of 3% across all stock indexes, and 1% dollar drop, are part-and-parcel of reciprocal gold theory*. That is, investors largely abandoning Fortune 1000 equities in search of an appreciating asset. GOLD vs. S&P 500 Index charted below

* See: 30 Years Making Case For Patient Gold

The depreciating dollar essentially means investors have to come up with more dollars (yet fewer, say, yen or euro) to buy gold.

- CAD trading at a six-month high, with USD/CAD slipping to around 1.3835 as the greenback weakens broadly. Dollar falls against most major currencies (especially against safe haven JPY) on fears of full trade war/recession risks. The Dollar Index has dropped 1.25% to 98.131, hitting a three-year low.

Among miners, it is the project generators, developers and royalty companies based in Canada and the United States (and the U.K. and Australia) that look to be outpacing large bullion producers right now.

Silver, lagging, has yet to play catch-up with gold. It is half industrial and half sound money. Below, the green is gold and silver is blue in a three-month chart.

Avino Silver & Gold ASM sent me this Barron’s podcast and it is outstanding. It examines gold, mentions Bitcoin (up sharply Monday in the dollar slide –– as investors weigh the crypto as a digital version of gold) and zeroes in on silver as a bargain metal:

It now takes more than 100 ounces of silver to buy an ounce of gold — a historic low for silver’s buying power vs. gold.

Also, check out this pro-silver report from a former colleague at MarketWatch — covers all the bases:

Commodities Corner: Silver may be better investment than gold

Our The Calandra Report outpacers Monday: Kenorland Minerals, Vista Gold, Banyan Gold,

Elemental-Altus Royalties, EMX Royalty, Snowline Gold, Integra Resources, Sprott Physical Gold (& Silver) Trusts, others — all of them functional gold mine developers, roy-cos and a physical metals repository. (I own each but for Vista and Snowline.)

Copper’s price, while up, is not assisting Ivanhoe Mines and select copper producers in share price today.

Investors are sensing a global industrial slog in coming months. Same reason why silver miners are lagging. Fortune 1000 companies that are not part of the metals complex are again suffering in share price, and that is a win for reciprocal gold theory: gold up, blue-chips down.

My one speculative purchase — late last week — is Baselode Energy, an Athabasca Basin uranium explorer waiting many months for a number of drill-hole assays. It is as ignored and obscure as the most forlorn of resource-cos. By the way, Stephen Stewart’s OreCap Investment ORFDF, owns stakes in Baselode, Awale Resources, American Eagle Gold and one or two other obscure developers.

“Waiting to release all of the ACKIO assays together, and the same for the regional drill holes assays. We’re still patiently waiting (31 weeks and counting),” says Baselode geo-CEO James Skyles. Uranium shares as a group are falling Monday.

Finally, Avi Gilburt of Elliott Wave Trader, on the gold gains — he uses the GLD ETF (315 on NYSE right now) in examining wave patterns:

“In my last update to you, I was looking for a pullback from the 290 region to 268-273 to set up one more rally, and we topped at 292 and got a pullback to 273. This rally now seems to be a blow off top, which when complete, can begin a larger degree correction pointing us back down towards the 255 region.”

Needless to say, I am on the other end of that gold spectrum and, while not forecasting, do see gold reflecting or anticipating the dollar debasement (in the basement) and maybe a looming fiscal meltdown driven by derivatives and possible interest-rate and-or currency swap trades.

“I own gold,” to paraphrase a well known gold mining strategist, “because I’m afraid it will go to $5,000 … and to $7,000.”

I will be looking to add some silver to my attention list.

— Thom Calandra

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities. The Calandra Report, in its 13th year, offers a one-price, $139 yearly fee for all newcomers. Earlier subscribers keep their original cost. Sob stories listened to. No refunds after three weeks of service. Exceptions: groceries, mistaken ambitions.

|