‘When financial asset returns are zero or close to zero, the return on (the physical asset) gold is 20 percent on average yearly. Compound that.’ — Sun Valley Gold fund manager

“Liquidity is a coward; it disappears at the first sign of trouble.” — the late strategist Barton Biggs

Also: Friday update -- gold and miners surge. See indexes. Gold new highs -- $3,251. Ivanhoe Mines Platreef update below.*

Back to the reciprocal gold thesis that Idaho strategist Peter G. Palmedo pioneered with the now-deceased global markets analyst Barton Biggs at least 22 years ago; ’tis a long time coming.

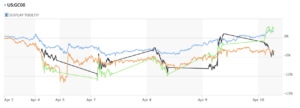

Today-Thursday April 10 2025 is a reciprocal gold day. Put simply and shown in the chart here: gold (and mining stocks) rise, reciprocating 3-plus decades of Fortune 1000 gains (and bond market gains, too).

Thursday’s gold futures contract (continuous) is gaining $98 USD, or 3.4%, to an all-time high. The broad Russell 3000 Index of company stocks is down 4.8%. The Dow Jones Total Stock Market Index is down 5.6%.

Everything paper is down — The Dow 30 losing 1,800 points; government bond prices down; the U.S. dollar down dramatically against most currencies. Even Bitcoin, for which we make the case that investors will start gauging BTC as digital “sound currency” vs. the papered alternatives, is pounded today.

Gold, and silver, platinum, globe-building copper, are all rising smartly. Gold, and silver, platinum, globe-building copper, are all rising smartly. Mining stocks, the largest of the producers, are rising 5% as a group — GDX ETF.

Days like this the algorithmic program traders do not allow often.

Background at The Calandra Report here: 30 Years Making Case For Patient Gold

Let’s hope that western investors see the headline — GOLD AT NEW HIGH AS STOCKS PLUMMET — call their advisers and tell ’em to add physical gold, or ETF gold, or closed-end gold and silver (CEF on NYSE), or riskier mining stocks

Peter Palmedo, for background, runs a gold fund out of Sun Valley, Idaho, and he is the 44% owner of West Vault Mining WVM WMVDF. (I own WVM shares and have for years now.) The vault theme = the Nevada permitted and shovel-ready mine at West Vault’s Tonopah concession = figuratively the same as owning gold in the ground, just far cheaper than buying bullion.

Peter, a so-called quant, also chairs West Vault; another large stake the 68-year-old strategist has in the Sun Valley Gold Fund is Vista Gold VGZ.

This is just a reminder, TCRs. Gold’s legacy as a sound currency in paupering paper times, as we seem to be suffering regarding money printing worldwide, is I believe secure.

* Note: Copper miner Ivanhoe Mines’ profitable investors see that its copper, tariff free, has freedom to travel the world. A plus: IVN’s DRC Congo anode-producing blister smelter kicks in this summer at Kamoa-Kakula.

Aside from the Kamoa-Kakula copper (and its Kipushi Mine zinc), my takeaway on why IVN is my largest stake and has been since 2010 or so: Platreef in South Africa.

The stock leaped higher earlier in the week and Thursday is giving up half those gains. I own it and Ivanhoe Mines.

— Xtra-Gold Resources XTG, the Ghana profitable producer and explorer that is our second-largest mining holding, is trading in the USA as XTGRF and paused this week by Canadian regulators who are ascertaining the company’s domicile: Canada or foreign issuer (British Virgin Islands).

I expect (but cannot guarantee) the administrative matter will be settled by next week. XTGRF shares are rising this week to 14-year highs — albeit with light volume.

EMX Royalty — The company just received a property payment and is reducing long-term debt. It is making a $10 million principal payment toward its senior secured term loan facility due to Franco-Nevada. “Following this early principal payment, EMX’s total long-term debt outstanding will be reduced from US$35 million to US$25 million,” EMX reports. See release.

Outpacing mining shares today-Thursday: EMX Royalty EMX | Integra Gold ITRG | Vista Gold VGZ | West Vault Mining WVM | Avino Silver Mines ASM | Others

Added: Saturday April 12:

— Compounding Gold at The Calandra Report: 30 Years Making Case For Patient Gold

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities. The Calandra Report, in its 13th year, offers a one-price, $139 yearly fee for all newcomers. Earlier subscribers keep their original cost. Sob stories listened to. No refunds after three weeks of service. Exceptions: