Platreef To Develop Into A ‘Godzilla,’ Friedland says

Forgive me the ‘hustle’ here: Ivanhoe Mines‘ Platreef volley is fresh on the wires. See the ‘super-giant’ release.

South Africa’s Platreef platinum (gold, nickel, copper, etc.) complex, via Robert Friedland‘s Ivanplats in 2003, was my second introduction to Ivanhoe. Mongolia’s Oyu Tolgoi copper-gold project in the Gobi was my first.

Oh, and on that broiling South Africa day, I was late to the party: Platreef’s Ivanplats property was in the miner’s portfolio bag six years before I got there.

Granted, MAGNIFIED language, such as “Godzilla of a mine,” is order of the day for the Ivanhoe Mines chief.

Being fair, I point out that Robert Friedland has always stayed true to his school with this property on the Northern Limb of the rich Bushveld complex.

“Biggest … lowest-cost … most technologically advanced … richest … generations of output, jobs, mineral supply chains” — all consistently stated for the thick layers of platinum-group metals beneath the Northern Limb.

He was “consistent” in 2003, when he — in black tie and like all of us pale folks, sweating rivers of salt out of our bodies — introduced me to the sprawling property at Mokopane.

The release just out is an expansion study of Platreef timelines, costs, accelerated phase developments and billion-dollar NPVs (net present values). Ivanhoe pledges on a global scale to be:

“The lowest cost platinum, palladium, rhodium, and gold producer; with significant nickel and copper.”

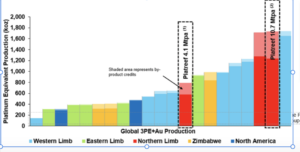

Early phases, starting toward the close of this year of 2025, will show an annualized pace of 450,000 ounces (so-called 3(P)E platinum group metals + gold, if I understand the terminology correctly). Two or so years on from that: a yearly pace of 1 million ounces of platinum, palladium, rhodium and gold, plus 25,000 metric tons of nickel and 15,000 tons of copper — a metal, along with zinc, that Ivanhoe mines in size in the Congo Copper Belt.

I must not magnify further Ivanhoe Mines‘ already magnified text, graphics and direct quotes. It is all here. The company in its several iterations, going back to 1996, has always made investors money.

I bought into Ivanplats when it was private in 2003 and still hold many of those now-public IVN IVPAF shares. (Approx, 78,000 shares owned, and one hour or so ahead of Ivanhoe Mines’ Q4 financials, which will tick off DRC Congo’s profitable Kamoa-Kakula copper and Kipushi zinc mine, I added $3,100 worth at the current, what I see as well-below-fair-value price of $11.25 USD.)

That is enough for now. Except to say that when I last emailed with Robert Friedland three days ago, I told him I expected an all-time high for the IVN stock this week. Premature?

As for the independent studies that detail three phases of Platreef mine, once again: ’tis all here.

Platreef is probably on track (I am not including outer-space mining) to rank as a Top 3 undeveloped precious metals deposit: 56 million ounces of platinum-equivalent indicated (category) mineral resource and another 74 million inferred. That is with a 2.0 grams per ton and a 3(P)E+gold cut-off.

Gotta go. Ivanhoe Q4 numbers coming from the company in a few.[Wed Feb 19 12:35 p.m. Pacific]

Entire The Calandra Report here.

— Thom Calandra

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities. The Calandra Report, in its 13th year, offers a one-price, $139 yearly fee for all newcomers. Earlier subscribers keep their original cost. Sob stories listened to. No refunds after three weeks of service. Exceptions: