TARIFFS, BANK RULES CHARGE UP GOLD PRICE

[Updated for subscribers: Monday Feb. 10 2020]

##Trading note: Ivanhoe Mines below

*Uranium notes below

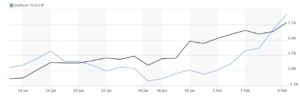

Spot and futures-contract gold (and copper) are seeing a push into fresh, what look like sustained highs.

Gold's continuous futures contract is marking $2,934 an ounce.

Spot gold appears to be on track to notch the day above $2,900 an ounce, first time ever. Why is that?

U.S. President Donald Trump is imposing a round of tariff “penalties” on steel and aluminum imports. [Aluminum, base metal prices here.]

That threat could explain copper’s big gain.

Gold for April delivery rose $47 to $2,934 an ounce, highest-ever settlement AT THIS WRITING for a most-active Comex contract. Asia trading Tuesday extended the futures gain to $2,958.

Copper was rising 2.4%, an astounding daily gain Monday and steady in Asia Tuesday. MarketWatch, Reuters and Bloomberg pointed to moves by traders and commodity houses to move gold and copper to countries with “fewer potential tariff risks.”

Junior gold miners as a group also seeing 3% and greater gains. [See outpacers below +]

Jim Anthony says tariffs are a fraction of the reason. Jim is a consistent strategist and touchstone (see video) on gold trends; he also is a co-founder of gold-copper developer Seabridge SA SEA.

Brien Lundin at Gold Newsletter also reports:

“The World Gold Council just reported that central banks, for the third year running, bought over 1,000 tonnes of gold in 2024, and that’s not counting the massive, unreported purchases from China.”

Says Brien: “There’s what can only be described as turmoil in the London and New York gold markets, as the flood of metal being sent from London to Big Apple vaults to evade potential tariffs is masking cracks spreading in the paper gold edifice.“

The New Orleans Investment Conference operator also cited Ronnie Stoeferle’s note:

“At the time of writing, there are also many rumors about a ‘gold squeeze’ circulating, with physical gold inventories worldwide seemingly running low on physical stock. ... gold deliveries are elevated and something is going on.”

Brien concludes. “All this said, there’s no doubt that the vaults of the London Bullion Market Association and the Bank of England, as well as the Comex, are now being drained. The wait time for gold delivery from the Bank of England has gone from days to weeks, putting the staid institution in technical default on its obligations.”

Jim Anthony also points to banking regulations (Basel III) that make gold a TIER-ONE asset. Full Basel III gold regulation for the U.S. take effect in July of this year.

Physical gold thus is becoming more attractive for central banks to hold, and that increases demand. Here is a succinct explanation of gold’s asset status.

+ The Calandra Report outpacers Monday include Integra Resources ITRG, Ivanhoe Mines IVN and Xtra-Gold Resources XTG. Also Banyan Gold BYN — with thick trading.

[Each of these are personal holdings.]

End of Feb. 10 update

-- CanAlaska Uranium's Cory Belyk: Grooming

An Athabasca Explorer For Mining *

“We currently have $23 million in cash. Enough for all of 2025.” — Cory Belyk

CanAlaska Uranium | SMRs | Ghana Developer | Crude Oil Shipper | Baselode Energy | Nevada Arid Lands Project

Spot uranium’s price this 2025 so far is taking a haircut — in the low $70s.

Still, calloused investors are backing rich Canada discoveries.

The latest of interest for our TCRs: CanAlaska Uranium‘s CVV early winter hits in the Athabasca Basin — unveiled this week. One commentator calls the 12% and 34% “core” hits at 87%-owned West McArthur “monster grades.” See the numbers.

The explorer’s strikes at the eastern end of the sandstone project’s Pike Zone are akin to Cameco/Orano’s McArthur River uranium deposit in the same neighborhood.

Cory Belyk, CEO-geo, has guided us TCRs with his Basin signposts and industry themes for three or four years now. He sees the winter drill program feeding more potent assays to investors.

We’ll see.

When it comes to HOW investors register assay releases, from any explorer of any metal, even superior, rich results can be hit-or-miss. That is: if commodities are having a poor day, odds increase that a singular, rich strike, such as Can Alaska’s 34% core below, produce not a bang, but a whimper.

Fortunately, in CanAlaska’s case, uranium as a clean energy theme continues to attract new investors.

Another Athabasca explorer, Baselode Energy, could provide investors with a positive ooomph when it releases long-delayed assays from the lab. See below.

First, though, regarding big-picture, billionaire hype (Bill Gates’ TerraPower, for one) about small modular (uranium) reactors that will service power-hungry technologies is becoming easier to verify. There are SMR conferences for execs: see this one — and billion-dollar, public companies.

The idea of SMRs has been around at least since 2020, when the Nuclear Regulatory Commission (NRC) approved a design for an SMR from NuScale Power SMR in August 2020.

Boilerplate: In the works are SMRs in Argentina, Canada, China, Russia, South Korea and the U.S.

A few small-mod developers trade in the public market. They each are worth more than $1 billion in market cap, David Kearnes at Haywood in Vancouver, B.C., tells me.

They are:

The three stocks have been on a tear — up, up, up. I do not own them.

CanAlaska is finding it easy to raise cash for West McArthur and other projects it controls and ventures, or options, out. Cory Belyk is keeping as much of West McArthur as he can get. By funding exploration, Cory looks to exceed CanAlaska’s 86% ownership of the project.

Cameco is the partner there, and CanAlaska is the operator.

Marc Henderson of peer Laramide Resources tells us, “Great drill hole and things seem to be shaping up nicely. Interesting time in the U market with term (contracts with uranium users) holding like a rock above $80/lb and spot under pressure and barely holding $70.”

I asked tiny Baselode Energy‘s CEO, James Sykes, like Cory a geo-CEO, what he thought about CanAlaska’s latest strikes.

“Fantastic results. That’s what the Athabasca Basin is known for. Grades and widths such as those mentioned build tonnage very quickly. I’ve been an investor in CVV since 2021 and I look forward to keeping my long-term position with them.”

CanAlaska has $23 million of cash, which can evaporate in 9 months with a project (three drill rigs) such as West McArthur.

Cory Belyk says the cash will go a long way in developing West McArthur into a world-class, mineable uranium deposit. He’s in the right place. Let’s pray investors agree, (and solid assays are released on up-uranium days?)

I also asked James Sykes at Baselode FIND BSENF what it will take to get young investors turning to uranium.

“Baselode Cryptocurrency,” he joked. “I think that spot price is what everyone watches , and it’s currently below some of the contract prices I’ve seen in news releases.”

Result: “Investors have fled the U space, most notably the juniors, because the sector hasn’t gone nuclear (pun intended) like it did in 2006.”

“We basically need the price of uranium to start climbing above $90 – $100 again for investors, young and old, to come rushing back in.” — Baselode Energy

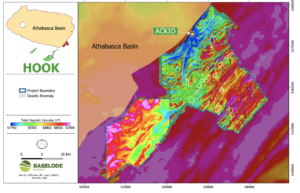

TCRs, Baselode has a $15 million CAD market value and $5 million in the treasury. The company has been waiting for assays from the lab since October 2024. This was its last release: what it called high-grade uranium at its ACKIO prospect in northern Saskatchewan.

Its Hook project features shallow uranium deposits.

“Baselode can’t compare Hook project’s shallow uranium deposits to CVV’s Pike Zone because of the grades,” James Sykes says.

“We’re exploring for deposits like CVV’s Pike Zone but closer to surface. We continue to explore for is a near-surface Arrow (NexGen NXE). Even if we could define something that is 25 M lbs. U3O8 and open pit, you’ve got a mine and very high chance as a take-over target from the majors, especially with our projects being so close to a mill.”

Baselode says assays from the completed ACKIO and Hook drill programs are pending. Any hint of continuity and grade evidenced in that release from October, and the 10-cent CAD stock could double.

My uranium ownership list, aside from CVV, is down to enCore Energy EU (Texas producer-explorer); and F3 Uranium FUU (4.5 meters of 50.1% U3O8 at Patterson Lake North property in Saskatchewan).

At some point I will buy into Laramide Resources LAM again (New Mexico and Kazakhstan and Australia).

I do not own Baselode, which is connected to Stephen Stewart‘s Ore Group cooperative of metals explorers.

Gold: yet more new highs, with silver starting to kick in. Keep an eye on Xtra-Gold Resources XTG XTGRF — Ghana exploration and production. The perpetually rising stock still shows a market cap of just $85 million. More Kibi Gold Belt assays, as I understand it, are on the way.

Newcore Gold NCAU, which I bought into for a second time last week, also operates in Ghana.

Luke Alexander, CEO, cites NCAU’s Enchi gold project illion with an after-tax net present value of $848 million at $2,750 gold. “We will be close to $1billion at $2,900.” Technical report here.

** DHT Maritime: The owner-operator of very large crude oil carriers is out with Q4 figures and its traditional take on oil, shipping and pricing.

“The start of the year suggests the coming year to be filled with geopolitical volatility, including announcements of tariffs that could disrupt trade and result in inflation. We however expect changes in trade flows to be constructive with the VLCC sector looking to be an asset class in high demand.“

“… freight volatility so far this year demonstrates how the market balance is shifting in the favour of the ship owning community.“

DHT, based in Bermuda for tax reasons and operating in the North Sea, the Middle East and Europe, sees “economic sanctions and fiscal issues impacting operations of teapot refineries, likely gradually shifting refinery runs to state owned refineries (and) thus changing imports to non-sanctioned crude oil with the use of compliant ships from companies such as DHT. “

Teapot (smaller, independent) petroleum refineries in China and elsewhere are shutting down or reducing their activity for a slew of reasons — Reuters article. That shifts the advantage to large, state-owned refineries that rely on fully legal, regulation compliant ships.

Refinery margins in Asia are strengthening — suggesting improved economic activity, the shipper said.

## Trading: I intend to sell 2,000 profitable shares of Ivanhoe Mines IVN IVPAF for tax purposes and for at-home expenses, and to continue funding a living family trust. I have a good-til-cancel order to sell at $17.25 CAD/$13.06 USD.

We have about 78,000 shares of IVPAF at the present time in taxable and retirement accounts. Some of those shares go back to 2003, when Ivanplats South Africa was private and about 6 years into developing its platinum-metals complex on the Platreef.

Ivanhoe says the Platreef PHM-nickel mine will become “one of the world’s largest and lowest-cost producers of palladium, platinum, rhodium, nickel, copper and gold.”

PRO-BONO: Revegetating Nevada’s Arid Land

This week, Sandy McVey of Nevada gold developer West Vault Mining WVM distributed this:

“The University of Nevada Reno’s world-class team of range ecologists are going into the fourth year of a five-year research program targeting using nutrient-rich seed coatings to solve hard-to-revegetate mining disturbance. Results to date are very promising.”

Sandy McVey, P.Eng, PMP, MSc.

Thank you, Sandy. I own shares of WVM.

— Thom Calandra [Still voice to text — at least one more week in a cast; then 3 more in a brace.]

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities. The Calandra Report, in its 13th year, offers a one-price, $139 yearly fee for all newcomers. Earlier subscribers keep their original cost. Sob stories listened to. No refunds after three weeks of service. Exceptions:

groceries, mistaken ambitions.