$6,000 Gold | Alamos Gold | Brien Lundin | Integra Resources

TCRs, it looks like the gold-double cycle discussed by the New Orleans conference creator is igniting.

“The thing I’m more interested in is, ‘Where do we go from here; the ultimate end-game of the cycle.” — Brien Lundin, Gold Newsletter & New Orleans Investment Conference

Brien’s headline is $6k gold to $8k gold.

Some of the gold-burst price chatter here we have heard time and again since 2011’s PRECIOUS METALS HEYDAY and ensuing burnout.

Yet the 7 bullet points in the discussion are stated clearly, with no hubris and with cyclical price levels that appear to support Brien’s $6,000 to $8,000 price target. Take note that the forecast, if it is a forecast, is for the “end of the cycle.”

Investors (and their children) would love to get a handle on the time element for this AU element. (My own on-the-record shot at predictive fame and misfortune is $3,000 an ounce by the close of 2024 — here.)

FRIDAY UPDATE: “It’s too early to call it for sure, but it certainly looks like the correction in gold is now behind us, and the next rally has begun,” Brien reports today October 11, 2024.

His bullet points led me to purchase, this week, yet more Alamos Gold AGI, my favorite cash-flow dragon producer; yet more of a physical gold and silver trust — the Sprott CEF one; and yes, more platinum via Aberdeen Physical Platinum Trust PPLT. (All of these Monday at falling prices, which I value as a buyer.)

Not that I need a reason to keep adding to the 26-year mound of precious metals assets here at home. (Or to the copper-zinc pile, as represented by our longest and largest holding, Ivanhoe Mines IVN IVPAF — I added yet more today at falling prices after viewing the latest Kipushi and Kamoa-Kakula copper and zinc production reports this morning. Electricity outages might be rattling investors who own IVN at near-record high prices? Pas moi. *)

The first gold bullet point mirrors our Reciprocating Gold theme, one that The Calandra Report has been tracking for almost four years now.

That is:

“There is a gradual but impactful reallocation of portfolios toward hard assets like gold and silver, commodities and real estate. This reallocation, though small in percentage terms, is significant for the smaller precious metals markets and has the potential to push prices higher.”

The “reciprocal” shift likely will allow western investors who have enjoyed the riches of Fortune 1000 stocks and bulging bond prices since the early 2000s (at least) to think twice before confronting the prospect of both record-rich (and expensive) stock markets worldwide and “negative real interest rates” (falling rates, rising inflation) going forward.

So: Feeling Left Out? Reciprocate … here at The Calandra Report

* Ivanhoe Mines: And yes, even with the IVPAF purchases (approx. 400 shares) earlier this week at $14.53 USD a share of IVPAF, I have kept in place the sale order for 2,000 shares IVPAF at a higher price as we fund a family trust. We own approx 83,000 IVN IVPAF shares.

Friday: I also purchased more Xtra-Gold Resources XTG XTGRF, a Ghana explorer and self-funding producer. More platinum via PPLT, the Aberdeen trust.

I just spoke with exec chair George Salamis of merging Great Basin (Nevada, Idaho) mine developer Integra Resources ITRG (NYSE). Integra and Nevada gold producer Florida Canyon Gold are hooking up in a transaction that pending shareholder approvals will close in November.

The 60-40 combination, a stock for stock transaction, will give Integra approx. 70,000 ounces a year of gold from the also-named Florida Canyon Mine.

“We want to avoid equity raises for our Integra flagship, DeLaMar in Idaho, until project financing for that mine in about three years,” George says. Alamos Gold AGI will own about 10% of Integra after the combining of the two companies. [I do not own Integra shares.]

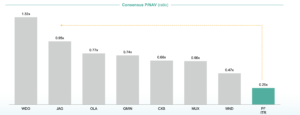

More to come on this front; Integra shares pro-forma, with the Florida Canyon Gold addition, sell for about a quarter of their net asset value; that’s the cheap end of the spectrum — see graphic here please.

George is also on the board of Newcore Gold NCAU, a Ghana developer that showed sturdy, lengthy gold intercepts at its West Africa flagship camp this week.

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.